Today, Google has announced a pilot program with Affirm and Zip to bring BNPL natively into the Google Pay wallet.

Consumers continue to choose BNPL as a payment option and its popularity continues to grow, particularly during the holiday shopping season.

Consumers shopping at merchants that offer Google Pay at checkout will receive multiple BNPL options powered by both Affirm and Zip. If the consumer has an account of either of the firms they will be able to link their accounts or they will have to go through the onboarding process.

Merchants are signing up for the program hoping to see an increase in average order size with Affirm noting that its merchants average a 60% increase in order size.

It is worth noting that Apple announced Apple Pay Later, their native BNPL option, earlier this year and it rolled out to all U.S. users in October.

The Google pilot will begin in Q1 and Google will be looking to add more merchants before a full launch.

Featured

Google Pay Pilots BNPL as Consumers Want Choice at Checkout

Consumers and select merchants that use Google Pay for online checkout in the United States will see Affirm and Zip offered through a pilot program next year.

From Fintech Nexus

> Pinwheel, OSV partnership brings payroll into fintech age

By Tony Zerucha

Pinwheel’s partnership with payroll provider Workday company One Source Virtual (OSV) ushers payroll into the same convenience levels as other areas of finance. It will also help banks achieve primacy with their customers.

> Fintech Clara launches payment accounts in Brazil, aims for $1B in transactions

By David Feliba

Fintech Clara launched a high-yield payment account in Brazil as it aims to double down on the South American market.

Podcast

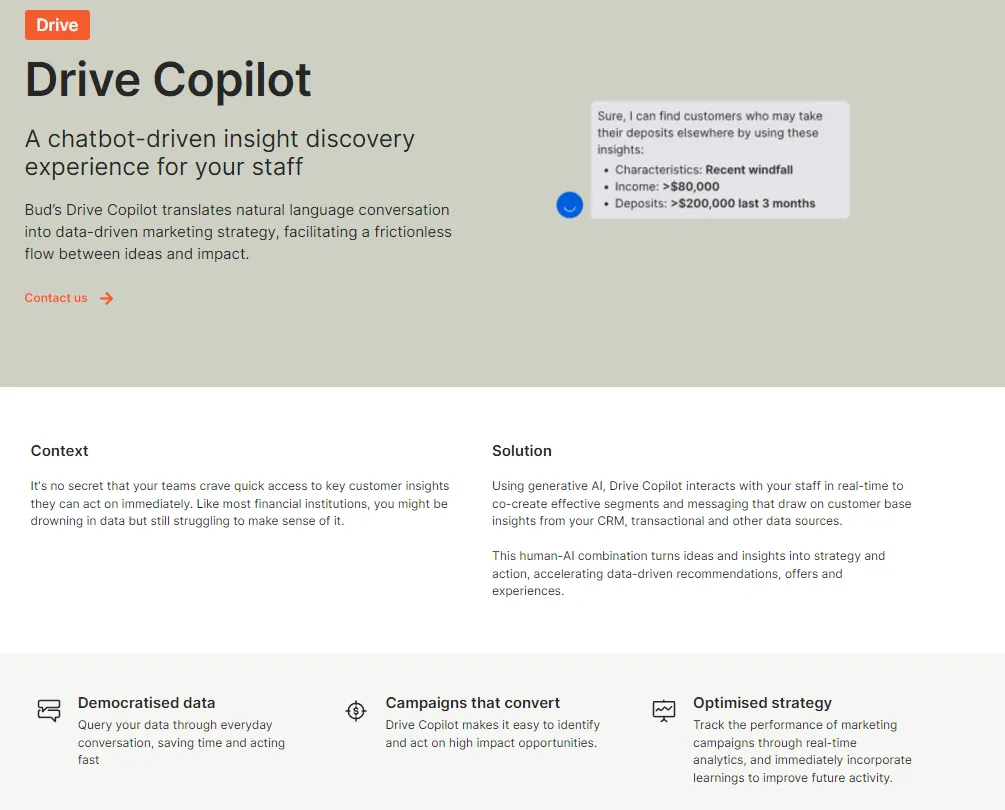

Can open banking power AI-based finance? with Bud CEO Ed Maslaveckas

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

> Listen Now

Webinar

Payments Innovation is Hot: What to Expect in 2024

Dec 14, 12pm EST

Global payments revenue grew double digits in 2023 – wondering what the near future of the burgeoning payments space might… Learn More

Also Making News

- USA: Hyperplane wants to bring AI to banks

Hyperplane, a San Francisco-based startup that is building foundation models to help banks predict customer behavior, is coming out of stealth today by announcing a $6 million funding round. - USA: Major fintech layoffs in 2023

LendingClub, SoFi and Upstart were among those that wielded the ax. - UK: UK payments regulator proposes cap on Mastercard, Visa cross-border fees

Britain’s payments regulator on Wednesday provisionally proposed a cap on cross-border interchange fees on retailers and other businesses charged by Mastercard and Visa on transactions made between the UK and European single market. - USA: Latino market offers a $155 billion opportunity for U.S. banks: Report

If banks reached the same market penetration among U.S. customers of Latin American descent that they have among white Americans, they could tap an additional $155 billion in annual revenue, according to new research from the consulting giant McKinsey. - Global: Sam Altman’s Retina-Scanning Orb to Become More Useful with World ID 2.0

Shopify, Minecraft, and Reddit will begin using World ID to identify some users. - Global: Cash Down Under: Australia And Argentina

While the use of cash is declining, there seems to be more of it about than ever. In Australia, it’s Aussie Dollars. In Argentina, it’s Dollars. They could be digital. - USA: What’s brewing in SMB finance in 2024?

As we bid farewell to 2023, senior executives from prominent banks and sector-specific companies provide their perspectives on what developments they anticipate will shape the SMB landscape in 2024.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.