In the kickoff to the Holiday shopping season, consumers are spending, with retail sales up 1.1% and e-commerce sales up 8.5% according to Mastercard SpendingPulse.

But you want to know what is really up? Buy now pay later. BNPL generated a staggering 42.5% more online spending on Cyber Monday this year than last year. And it was not like last year was a down year.

Mobile wallet usage was also way up with a 54% increase, led by Apple Pay according to Salesforce.

While credit cards are not in danger of being replaced any time soon this data does show that consumers like using these new payment methods. When these bills come due in January we will see whether they have the capacity to pay for their holiday spending.

For now, though, it is party time for BNPL and other alternative payment methods.

Featured

Digital Payments Are Having a Jolly Holiday

By Telis Demos

Investors might be warming again to the growth potential of alternative ways to pay.

From Fintech Nexus

> APIs: The silent fintech security concern

By Tony Zerucha

A quarterly report published by integrated app and security platform Wallarm gives granular attention to a little-discussed but critical security concern for fintechs – their APIs.

> Fintech: Why is Goldman Sachs leaving the Apple credit card partnership?

By Farhad Huseynli

Goldman’s consumer banking business has lost approximately $4B since 2020.

Podcast

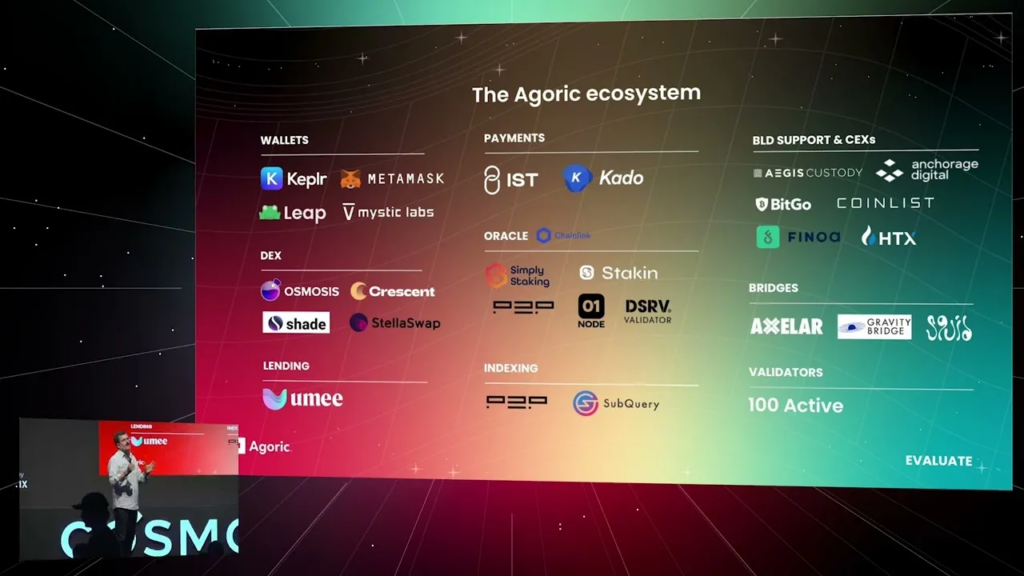

The Fintech Blueprint: Bringing MetaMask to the next billion users, with Agoric CEO Dean Tribble and MetaMask Co-Founder Daniel Finlay.

Webinar

Payments Innovation is Hot: What to Expect in 2024

Dec 14, 12pm EST

Global payments revenue grew double digits in 2023 – wondering what the near future of the burgeoning payments space might…Learn More

Also Making News

- USA: House votes to nullify CFPB small-business data rule

Republicans and a handful of Democrats in the House and Senate, which already had passed an identical bill, say the data-collection rule would be too onerous for lenders and small-business borrowers. President Biden is expected to veto the legislation. - USA: Breaking down capital requirements

For this primer, think of capital requirements performing a similar function for a bank that an airbag has in a car. - USA: Binance Copped a $4 Billion Plea but Is Still Fighting the SEC

Prosecutors and the Treasury Department had more leverage to get a settlement with the cryptocurrency exchange. - USA: 2024: The Beginning Of The End Of Bank-Fintech ‘Partnerships’

Many bank-fintech partnerships aren’t really “partnerships”—they’re client-vendor relationships. - USA: Digital Identity Fintech Solutions Could Save the U.S. Billions of Dollars

Underpinning this challenge is the willingness of the U.S. Government to make significant dollar investments and innovative companies and regions to rise to the challe… - Europe: European Digital Bank N26 Releases Profitability Expectations, Announces Upcoming Trading Product

N26 Group shared an overview of its business and product strategy through to the year 2024.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.