European core banking provider Temenos is the latest victim of a Hindenburg Short Report. The detailed report cites interviews with 25 former employees that allegedly uncovered manipulated earnings and accounting regularities.

Hindenburg is a financial research firm that places bets against publicly traded companies when it finds evidence of wrongdoing. It has taken on many high profile companies since its founding in 2017.

You may remember it was almost a year ago that Hindenburg attacked Block with a similar report. Block’s shares tumbled the day that report was released but had fully recovered by the summer.

Predictably, shares of Temenos are down substantially today but the company has reacted quickly and already issued a press release refuting the claims in the report.

While these short sellers can provide valuable insights into the wrongdoing of public companies, we should keep in mind they are not always right.

Featured

> Temenos Sinks Most in 21 Years on Hindenburg Short Report

The Swiss banking software firm has lost $2.4 billion in market cap. The Hindenburg Report cites accounting irregularities, earnings manipulation.

From Fintech Nexus

> Lendbuzz uses AI to disrupt assessments, earns $219M AAA securitization

By Tony Zerucha

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

By David Finch

Fintechs looking to achieve or maintain stability in 2024 need to focus of three key areas: cost discipline, measured growth and regulatory compliance.

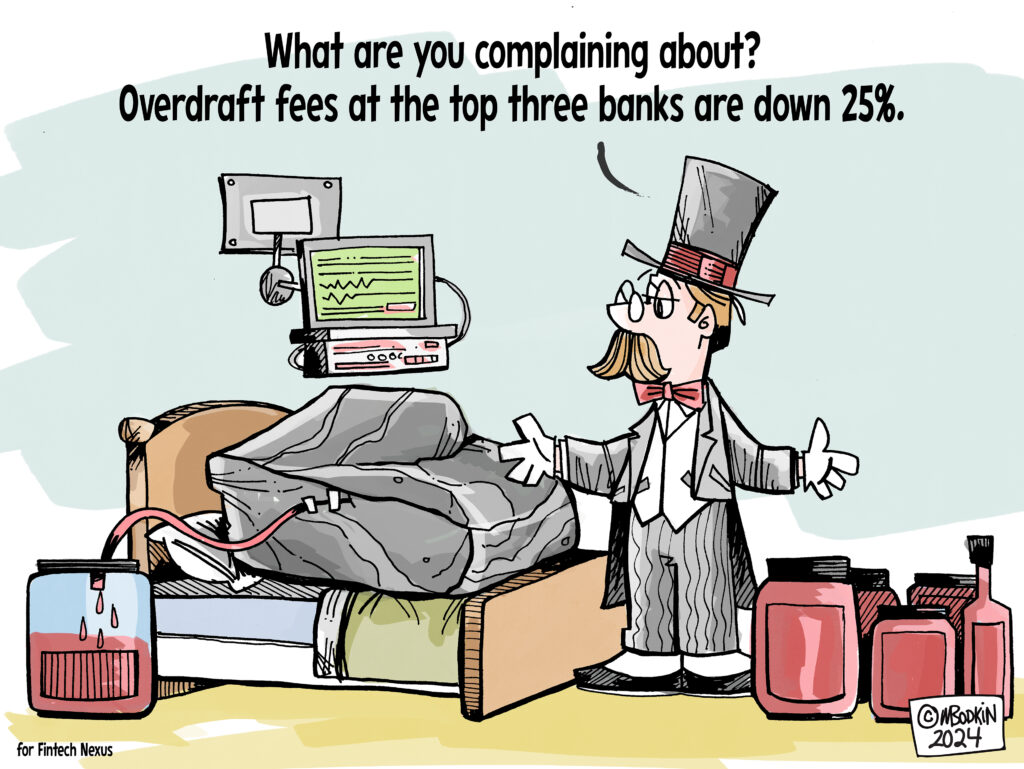

Editorial Cartoon

Also Making News

- Global: 20 fintech and payments M&A deals with the largest volume in 2023

The top five fintech and payments M&A deals had a combined dollar volume of more than $23 billion.

- USA: What Do New & Recent Data Tell Us About Small Business Fortunes?

New small business data from OnDeck and Ocrolus provide insight and echo other small business surveys.

- USA: SoLo Funds nears 2M users

The peer-to-peer lending platform has faced some regulatory backlash, but a study from London’s Centre for Economics and Business Research shows it’s cheaper than many other subprime options.

- Global: Crypto Money Laundering Dropped 30% Last Year, Chainalysis Says

Illicit addresses sent $22.2 billion in cryptocurrency to services in 2023, a decrease from $31.5 billion in 2022, and centralized exchanges remain the primary destination.

- Global: One app to rule them all? New survey finds banking apps are more than just a home for transactions

Until recently, it seemed that consumers were more than happy with unbundled financial products, creating their own versions of a “personal finance tech stack”. But that trend may be reversing as consumers turn back to their banks with growing expectations for their digital banking app to be a one-stop shop solution.

- USA: Upstart’s stock slumps again amid funding questions

The lending fintech is increasing its reliance on third-party funding arrangements as its revenue slides. Analysts are wondering how much risk is embedded in the deals.

- Europe: Viva Wallet acquisition turns sour for JPMorgan as lawsuits filed

Lawsuits are flying between JPMorgan and Viva Wallet, the European cross-border payments platform in which the US bank acquired a 49% stake last year.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.