There is never a dull moment in the Banking-as-a-Service space. Treasury Prime is the latest company to make news in the space.

While Jason Mikula broke the story on LinkedIn it was confirmed by CEO Chris Dean on the company blog yesterday. Treasury Prime has laid off about half the company and is pivoting to a more direct approach with banks.

While Treasury Prime had established itself as a major player in the BaaS space by selling to fintechs, going forward it will be focused on selling software to banks.

The company announced a new Bank-Direct product that will help banks work directly with fintechs and brands. So rather than be a type of matchmaking service between banks and fintechs they will work with banks to establish direct relationships with fintechs and other non-banks.

Dean also acknowledged the increased regulatory scrutiny that has brought a lot of uncertainty to the BaaS space. And regulators want banks to have direct oversight of their fintech partners and not use an intermediary.

I have an interview scheduled with Chris Dean at Fintech Meetup on Tuesday to record a podcast episode, it suddenly got a whole lot more interesting. Look for that in late March.

Featured

> Treasury Prime Cuts Staff Amid Shift to ‘Bank-Direct’ Offering

Embedded banking firm Treasury Prime is cutting staff amid a new shift in strategy as CEO Chris Dean made clear in a blog post yesterday.

From Fintech Nexus

> Orum launches direct access to the Fed with Deliver API

By Peter Renton

With Orum’s new Deliver API small banks and fintechs will now have direct access to the Fed’s payments rails.

> Mercado Libre hits 50 million fintech users in Latin America

By David Feliba

Mercado Pago, the fintech arm of Latin America e-commerce giant Mercado Libre, reported a significant milestone in its fintech business.

Podcast

Ana Mahony, Founder & CEO of Addition Wealth on the digital plus human approach to financial health

Digital tools are essential for delivering financial health products that can make a difference. But many lack the human…

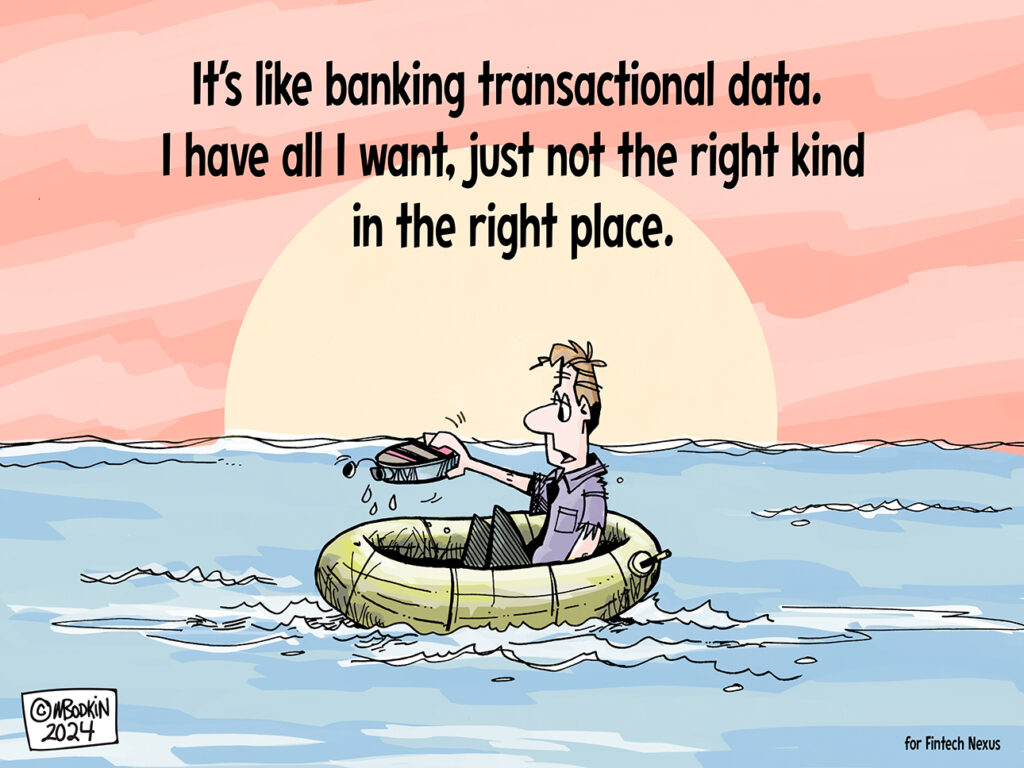

Editorial Cartoon

Also Making News

- Global: The budding promise of tokenization in banking

Large global banks are experimenting with tokenization to make complex transactions faster, efficient and more auditable.

- USA: How Discover’s Network Helps Capital One Take On Card and Banking Giants

Becoming the next Visa or Mastercard is a tall order, but isn’t necessary for Discover’s network to pay off.

- USA: How credit unions can improve consumer loan repayment performance

Approximately 2.53% of consumer loans held by commercial banks in the US were reported as delinquent in the third quarter of 2023. While this delinquency rate had previously declined from its peak of 2.47% in the first quarter of 2020, it has since resumed an upward trend beginning in 2021.

- USA: Gemini to Return $1.1 Billion to Earn Customers, Pay $37 Million Fine In New York Settlement

Gemini says the resolution for crypto lender Genesis means full digital asset returns for Earn program participants—market gains included.

- USA: Mastercard to Launch New Open Banking-Powered Digital Account Opening Experience

Mastercard is preparing to launch a new digital account opening experience for select U.S. debit and prepaid products.

- USA: Alloy for Embedded Finance launches for banks and fintechs to collaboratively manage identity and compliance risk

Alloy, the identity risk management company behind nearly 600 leading banks and fintech companies, today announced Alloy for Embedded Finance…

- USA: Checkbook and Visa partner to enhance instant payment access

Checkbook, a payments platform, has announced a collaboration with Visa aimed at improving the availability of instant payments for businesses, institutions and individuals across the country.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.