It was three ago last week when LendingClub closed its acquisition of Radius Bank. At that time LendingClub entered into an operating agreement with the OCC that imposed capital restraints and growth limits on the fintech pioneer.

Last week that agreement expired and LendingClub will now be less constrained and will pursue options to take advantage of its capital position. Of course, it is still a regulated bank, so there are standard constraints that apply to all banks.

An analyst noted that LendingClub has about $400 million in excess capital, money it can now use to buy back stock or for other initiatives. One example could be an expansion of its structured certificate program, a securitization program that LendingClub introduced last year.

LendingClub has come a long way from its start as a peer-to-peer lending platform and is now one of the largest personal loan providers in the country.

This year will mark the 10-year anniversary of its IPO but its valuation is still a fraction of its IPO price. The company is not expected to regain that valuation any time soon but at least it will have fewer constraints on its growth now.

P.S. Today is your last day to get tickets to Fintech Meetup so you can take part in its famous meetings program. Use code NXGA2995 to get $500 off.

Featured

LendingClub exits OCC agreement, sees path for faster growth

By Catherine Leffert

The San Francisco company entered into a pact with its regulator when it acquired Radius Bank three years ago. “The operating agreement, by design, in some ways slows you down,” said CEO Scott Sanborn.

From Fintech Nexus

> Rental contracts in crypto: Milei’s agenda sparks sector optimism in Argentina

By David Feliba

Javier Milei’s deregulation agenda raises hopes in the sector, with rental contracts settled in crypto. But the economy remains in dire shape.

Podcast

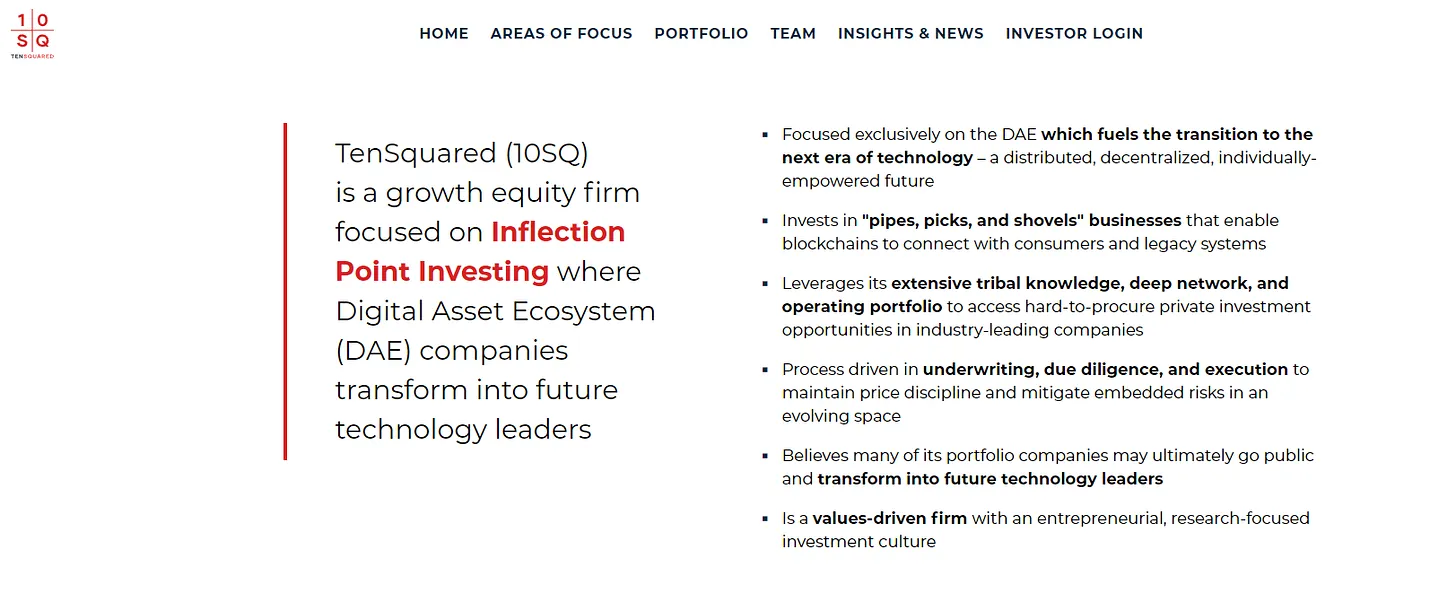

Investing in frontier capital markets, from Eastern Europe to ICOs, and tokenized securities, with TenSquared Capital Managing Partner, Stan Miroshnik

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Also Making News

- USA: ProducePay raises $38M to tackle produce supply chain waste

Food waste is a major problem. In the U.S. alone, roughly 30% to 40% of the supply ends up in landfills. A United Nations report estimated that around one-third of the world’s food is wasted every year, adding up to 1.3 billion tons — worth almost $1 trillion.

- USA: A startup’s plan to disrupt the fuel card industry

Taking aim at a market dominated by decades-old private-network fuel card players, the San Francisco-based firm AtoB is teaming with Mastercard to launch an open-loop payments platform for trucking firms and fleet operators.

- USA: Vast Bank discontinues crypto mobile app

The Tulsa, Oklahoma-based lender told customers their digital assets would be liquidated and accounts would be closed. Customers will receive stranded assets via cashier’s check, the bank said.

- Global: Iran used Lloyds and Santander accounts to evade sanctions

Tehran-backed Petrochemical Commercial Company operated from office near Buckingham Palace.

- UK: HSBC installs first of ten ‘Cash Pods’ in town with no bank branches

HSBC UK has introduced its first standalone ‘Cash Pod’, which will provide improved access to cash in the Crown Glass Shopping Centre in Nailsea, North Somerset, in advance of the closure of the last bank in town.

- India: India’s probe of Paytm widens; $2.5 bln wiped off shares in 3 sessions

India’s probe into digital payments firm Paytm has widened with the country’s federal anti-fraud agency investigating violations of foreign exchange laws, days after the central bank asked the platform’s banking unit to halt business.

- USA: AI FinTech Lendbuzz closes $219m asset-backed securitisation

Lendbuzz, the AI-based fintech company, has announced that it has closed a $219 million securitization collateralized by a pool of auto loans secured by new and used automobiles, light-duty trucks, and vans.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.