The SEC has not had a great track record in court cases against crypto firms in the last few months. And another important case is playing out right now in a New York federal courtroom.

Back in June of last year the SEC sued Coinbase arguing that it was operating illegally and that it should register as an exchange and be overseen by the SEC.

In comments yesterday, the presiding Federal judge in the case questioned the SEC that their argument is too broad and would sweep in collectibles and commodities as having to treat them as securities.

This gets to the heart of the legal disputes over whether or not cryptocurrencies are securities. Coinbase argues most are commodities, the SEC argues most are securities.

Without any action from Congress (unlikely in an election year) the outcome of this case will in large part determine the legal standing for cryptocurrencies in the short and medium term.

Featured

Coinbase Asks Judge to Deny SEC’s Claim to Regulate Crypto

The crypto exchange is seeking the dismissal of a lawsuit at the center of the agency’s oversight strategy.

From Fintech Nexus

> Beware of the crypto/blockchain patent troll

By Tony Zerucha

As the cryptocurrency and blockchain industries mature, they must prepare for a downside to their success – patent trolls. As technology charts clear routes and more money is at stake, Dykema patent attorney Michael Word said cryptocurrency will be the next patent battlefield.

> Artificial Intelligence: Broadridge deploys OpsGPT to improve trade lifecycle support

lex.substack.com

Generative AI applied to the trade processing and operations

Editorial Cartoon

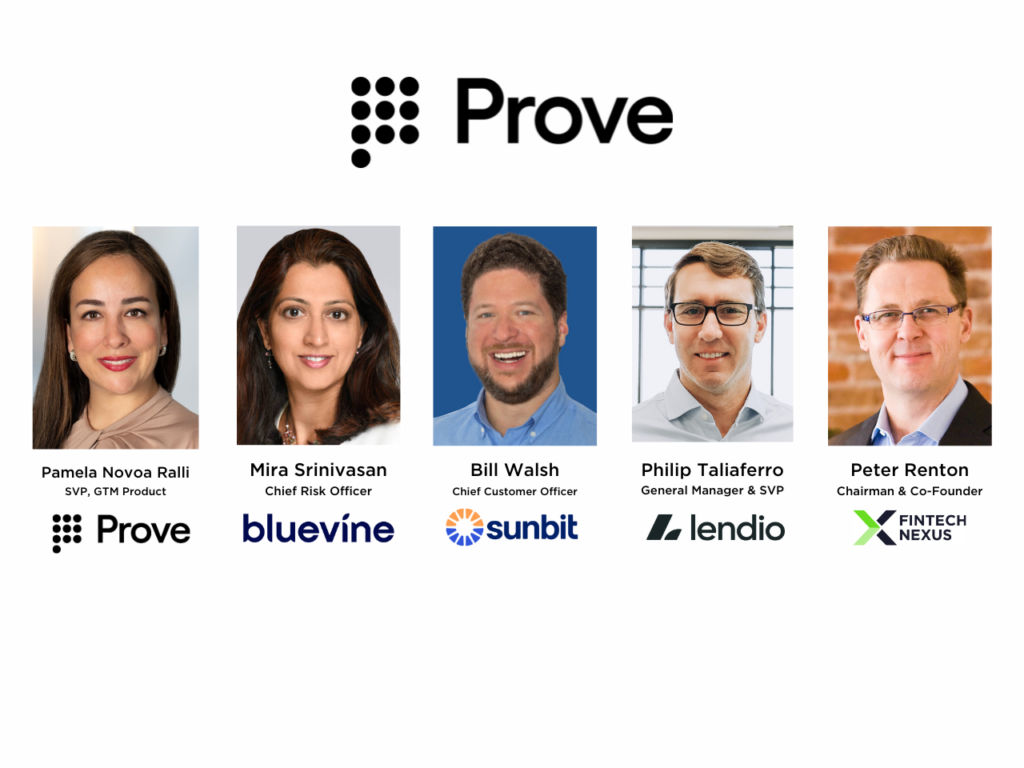

Webinar

Building Trust: Scalable Strategies for Consumer and Business Onboarding

Jan 23, 2pm EST

Identity verification is a key part of financial institutions’ and banks’ customer journeys. However, with ongoing compliance…

Also Making News

- Global: Nova Credit helps Ukrainians in U.S., U.K., Canada get credit

Ukraine is the latest of more than a dozen countries where the fintech is partnering with credit bureaus to help immigrants make a fresh start in their new homes.

- USA: Digital Onboarding grabs $58M to help banks with profitable customer engagement

Financial institutions spend hundreds of dollars in marketing and awareness to get a customer to open an account that often doesn’t get used. Digital Onboarding wants to help.

- USA: Briq, a startup that uses AI to automate finances in construction, brings in $8M extension at a $150M valuation

At a time where many startups are struggling to raise funding, or are raising – but at lower valuations, it’s notable when companies raise at flat or higher valuations. Especially when their last raise took place in 2021.

- USA: Varo rolls out free tax prep and filing tool with Column Tax

All Varo Bank customers can access the tax filing service, which uses pre-filled data based on user information and helps to file taxes in less than 15 minutes, the lender said.

- USA: How Walmart’s Financial Services Became a Fraud Magnet

Scammers have duped consumers out of more than $1 billion by exploiting Walmart’s lax security. The company has resisted taking responsibility while breaking promises to regulators and skimping on training - USA: BlackRock’s Bitcoin ETF Hits $1B AUM in One Week

IBIT’s holdings consist of 99% bitcoin, and nearly $60,000 in fiat, data shows. - Europe: Varengold Bank invests in Dutch BNPL firm Billink

Germany’s Varengold Bank has invested €29.5 million in Dutch buy now pay later fintech Billink. - USA: How technology may be able to do some heavy lifting for banks in 2024

A confluence of macroeconomic factors and technological innovations may lead to some important changes in the world of banking. Endangered bottom lines, regulators, and the promise of AI may put banks closer to achieving goals that have been on their list for a long time.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.