This year has not started well for loanDepot.

We first heard the news two weeks ago that the mortgage lender had suffered a cyber attack that shut down critical systems.

The incident is still ongoing and this morning we learned that, in addition to many of their systems being down, the personal information of 16.6 million people has been compromised.

Many customers were unable to process loan payments or begin a loan application. Some systems still appear to be down but the loan application process was working again this morning.

The mortgage lending industry has had a rough time in the past 18 months with rising interest rates leading to a dramatic decline in refinancing and new home loans.

This is the last thing one of the leading players needs right now.

Featured

LoanDepot says 16.6 million customers had ‘sensitive personal’ information stolen in cyberattack

By Zack Whittaker

About 16.6 million LoanDepot customers had their “sensitive personal” information” stolen in a cyberattack earlier this month, which the loan and mortgage giant has described as ransomware. The loan company said in a filing with federal regulators on Monday that it would notify the affected customers of the data breach.

From Fintech Nexus

> Real-Time Pay-to-Card: Insights from the Visa Direct-Checkout.com webinar

By Fintech Nexus Staff

The webinar with Visa Direct and Checkout.com discussed the rise of real time payments and how pay-to-card solves the pain points for many different verticals.

> Protect the house from fraud, not just the front door

By Tony Zerucha

While many security companies can make a strong lock for your front door, DataVisor co-founder and CEO Yinglian Xie said focusing on every area of the house is a much more effective strategy.

Podcast

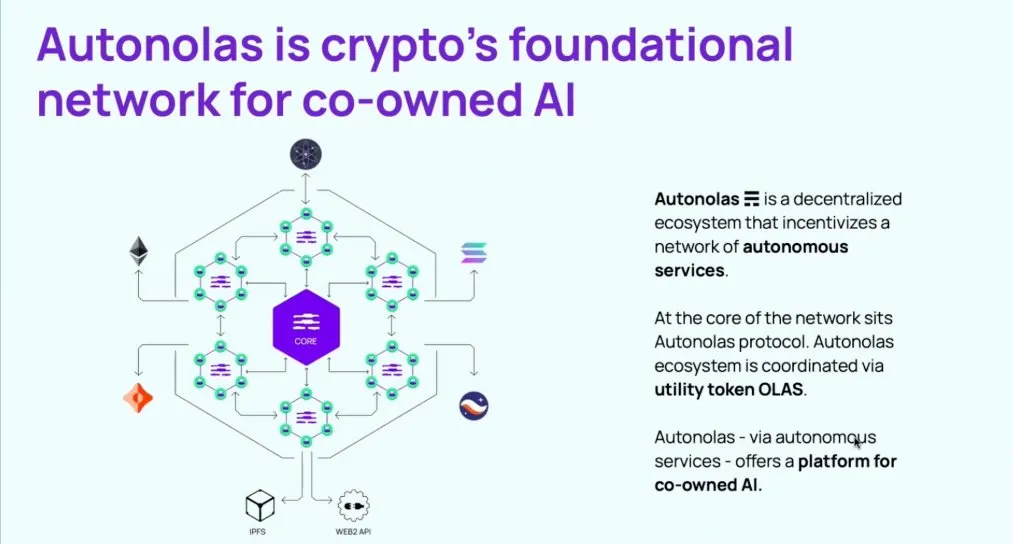

Podcast: Understanding Autonolas, the $2B autonomous agent network running on blockchain, with Valory CEO David Minarsch

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Listen Now

Webinar

Building Trust: Scalable Strategies for Consumer and Business Onboarding

Jan 23, 2pm EST

Identity verification is a key part of financial institutions’ and banks’ customer journeys. However, with ongoing compliance…

Also Making News

- USA: The buy now, pay later holiday debt hangover has arrived, as consumers wonder how they’ll pay bills

Buy now, pay later helped fuel record holiday spending online in 2023, but now that those bills are coming due, consumers aren’t sure how they’ll pay them.

- USA: How Apple’s new payment fees portend more legal fights

The technology company will allow outside processors, but plans to charge a commission. Epic Games vows to challenge the move in court.

- USA: Citi in Talks With Analytics Startup to Expand Lending

Citigroup is in discussions with cash flow analytics startup Prism Data about incorporating the firm’s technology in its consumer credit underwriting, according to people close to the discussions between the two firms.

- USA: Nearly 40% of Consumers Say No to Pay-by-Bank Payments Even With Incentives

Pay-by-bank payments, also known as account-to-account (A2A) payments, allow consumers to transfer funds between bank accounts in real time. These payments bypass traditional card networks and utilize intermediaries like peer-to-peer (P2P) service providers such as Venmo or PayPal.

- Global: Terraform Labs files for Chapter 11 bankruptcy

Singapore-based Terraform Labs (TFL), the company behind digital assets TerraUSD (UST) and Luna, filed for Chapter 11 bankruptcy in Delaware following the collapse of its cryptocurrencies in 2022.

- UK: Revolut hires lobbyist in bid to end banking licence limbo

Revolut is beefing up its lobbying team in its marathon effort to obtain a British banking licence.

- Global: Addressing Two Common Fintech Issues With AI: Exploring Solutions

The emergence of new companies brings potential challenges, both typical and novel.

- UK: 11:FS to launch fintech VC fund led by Fronted founder Jamie Campbell

11:FS is planning to launch its own venture firm and accelerator programme under the banner of 11:FS VC. It’s a bold move to take the challenger consultancy beyond just building technology and towards investing and supporting the next generation of fintechs.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.