You could say Banking as a Service is under siege.

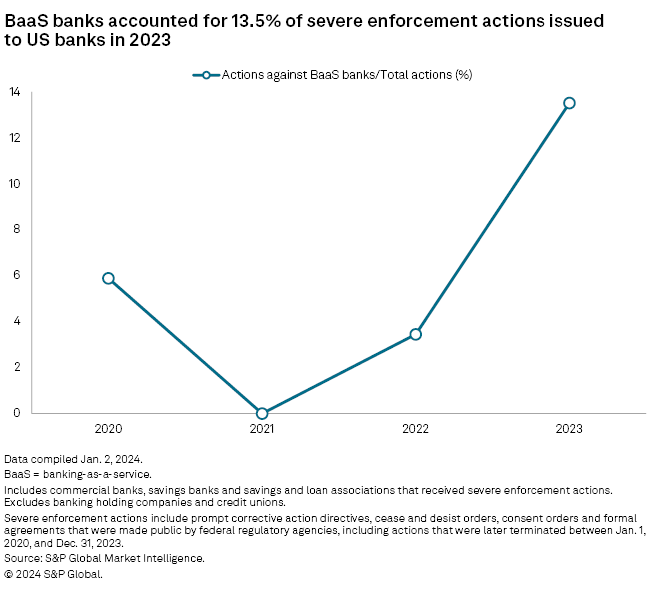

The number of severe enforcement actions BaaS banks received skyrocketed in 2023 to 13.5% of the total. When you consider there are probably only around 100 banks out of 4,800 that are involved in banking as a service, you can see why this number is disturbing.

And this is only those enforcement actions that have been made public, there are likely many more that we do not know about.

There has never been a more challenging environment for those banks looking to provide banking services to fintechs and other non-banks.

Here is what Phil Goldfeder, CEO of the American Fintech Council had to say:

“Responsible innovative banks are increasingly frustrated with the nature of treatment by their supervisors, examiners and regulators who refuse to engage in pragmatic or meaningful dialogue.”

This is the reality that banks and fintech operate in today. There is regulation by enforcement with no clear guidelines on how to operate within the law.

That has to change. Or we risk financial innovation being severely stifled as no one wants to try anything new.

Featured

Small group of banking-as-a-service banks logs big number of enforcement actions

US banks that provide banking as a service to fintech partners accounted for more than 10% of severe enforcement actions issued by federal bank regulators in 2023, an outsized share given that the number of banks partnering with fintechs is small.

From Fintech Nexus

> Navigating the current fintech M&A environment: Top strategies for success

By James Lichau & Craig Hamm

Interest rates remain high, valuations have fallen and overall deal volume is down across sectors — including fintech M&A activity. But deals are still getting done, albeit slowly and with more caution from investors. BPM Partners James Lichau and Craig Hamm outline their top strategies for navigating the current fintech M&A environment.

> Nubank ramps up LatAm strategy with remittances in Mexico, license in Colombia

By David Feliba

Nubank steps up its game in Latin America by offering remittances in Mexico and securing a new license in Colombia.

> DeFi: Frax Finance rolls out on-chain bonds. Will it impact USDT and USDC?

By Farhad Huseynli

The Total Value Locked (TVL) in tokenized securities with U.S. Treasury exposure has grown 6x, reaching around $790MM in 2023.

Editorial Cartoon

Also Making News

- USA: A new era of bank runs demands a new regulatory approach (Part 1)

A former comptroller of the currency assesses last year’s turmoil in the industry and charts a path forward including advancements in regulation.

- Europe: Sygnum defies Crypto Winter and grows valuation on $40 million fund raise

Swiss digital asset bank Sygnum has raised $40 million in an over-subscribed growth financing round.

- USA: Carlyle expands its reach on student loans as banks back out

The private-equity firm bought a $415 million portfolio, reportedly from Truist, and invested in student loan specialist Monogram.

- USA: Figure eyes SEC approval for interest-bearing stablecoin

The company’s token would be redeemable at 1 cent per certificate, rather than $1, and interest would accrue daily and be paid monthly to the user, according to paperwork filed with the agency.

- UK: Zopa, ClearScore Initiative Pledge2025 Tops 10 Million “Actions Campaign Goal”

Digital bank Zopa and ClearScore report they have surpassed 10 million consumer actions that aim to boost the financial resilience of UK consumers as part of the 2025 Fintech Pledge.

- Europe: Tink launches Risk Signals to unlock instant payment experiences

Open Banking platform Tink has launched Risk Signals, a rules-based risk engine that unlocks payment experiences across Europe while minimising risk.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.