It was only Thursday of last week when our lead story was about the challenges banks were facing in the Banking-as-a-Service space.

Then Friday we learned that Blue Ridge Bank was hit with its second regulatory action in less than 18 months and is now deemed to be in a “troubled condition”.

Kudos to our unofficial fintech regulatory watchdog, Jason Mikula, for breaking this story. American Banker also picked it up on Friday.

Blue Ridge Bank is a $3.3 billion-asset bank based in Virginia and was an early mover in the BaaS space. The consent order came out of the OCC’s June exam and Blue Ridge claims to have made significant progress since then.

The banks needs to ramp up its AML controls, capital position and third party management.

It is interesting that industry expert Jonah Crane said “every bank with a large BaaS program will see some type of regulatory action over the next year.”

For the fintech companies that rely on these banks for banking services, this is bad news. Building redundancy into your banking partnerships is now essential.

Featured

OCC says Blue Ridge in ‘troubled condition’ over BaaS

By Catherine Leffert

The Virginia bank is one of three that have been publicly admonished by regulators this week due to problems related to their banking-as-a-service programs.

From Fintech Nexus

> What your B2B customer really wants

By Tony Zerucha

As B2B payment technology catches up to other areas of fintech, TreviPay CEO Brandon Spear said exciting trends are emerging. In late 2023, TreviPay released the B2B Buyers Payments Preference Study. It updates similar research conducted in 2019.

> The Evolution of Payments Rails: Shaping the Future of Financial Services

By Sameer Danave

The payments landscape is undergoing a significant shift right way with new payments rails gaining more market share. And we have only just begun.

Podcast

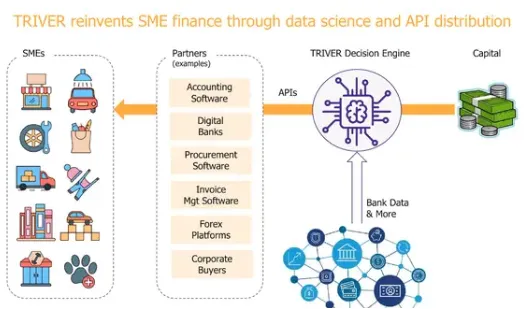

Podcast: Building modern digital lending across Capital One, Barclaycard, Funding Circle, and TRIVER, with TRIVER CEO Jerome Le Luel

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Listen Now

Also Making News

- USA: Fintechs contend with banking-as-a-service fallout

Fintechs that jump ship to more stable sponsor banks need to prove they have a solid business and take compliance seriously.

- USA: US falling behind peers on CBDC progress, warns think tank

The United States’ slow progress on central bank digital currencies is seeing it fall behind the likes of China, India and the European Union on the future of money, warns think tank The Atlantic Council.

- USA: Fintech Funding Freeze May Thaw in 2024. But Failures May Multiply, Too

Venture capital for fintech companies may see a comeback in the second half of 2024, but the heady days of crazy valuations and wide-open wallets won’t return.

- USA: Top Goldman Sachs Executive to Depart

Jim Esposito’s exit removes a potential contender for president or CEO.

- UK: YouLend secures deal with J.P. Morgan to extend £4 billion in additional financing to SMEs

YouLend has announced the completion of a private securitisation transaction with global financial services firm J.P. Morgan as a senior lender and Castlelake, L.P. providing subordinate debt.

- India: How Google’s helping take India’s payments tech global

Google Pay’s collaboration with the country’s digital transaction network is the latest example of Indian tech informing strategy elsewhere in the world, including the U.S. - LAC: Fintech Islands – a great experience for both business and pleasure!

Over the past few years, I’ve been to many fintech events around the world, from London to Las Vegas; Sydney to Singapore; Kigali to Karachi; but last week was a first, for me, Fintech Islands in Barbados. Well yes, someone had to go I guess and so, when asked, how could I resist?

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.