Stripe has, for some time, been one of the leading fintech companies globally when it comes to scale.

But the numbers it revealed today in its annual letter are truly staggering. It processed $1 trillion, around 1% of global GDP, through its platform in 2023. It crossed that milestone just 15 years after it was founded.

Founders Patrick and John Collison penned the 12-page letter where they opined on the state of Stripe, tweaks they have made to the checkout process, their automation efforts, VC funding, clean energy, robotics and more.

They also commented on the record number of startups that are using Stripe today and the fact that startups founded in 2022 are generating revenue at a faster pace than those founded in 2019.

Despite the challenges in the fintech ecosystem Stripe continues to be a bright spot. They are still growing at a rapid pace while being “robustly cash flow positive in 2023”.

This is a bullish sign for all of fintech.

Featured

> Stripe reveals it passed $1 trillion in total payment volume in 2023

By Jacqueline Corba

Fintech giant Stripe revealed in its annual letter published Wednesday that it surpassed $1 trillion in total payment volume in 2023.

From Fintech Nexus

> Capstack Technologies has the cure for SVB ills

By Tony Zerucha

Capstack Technologies’ founder and CEO Michal Cieplinski believes he has the antidote to the Silicon Valley Bank meltdown, and Citi Ventures agrees.

Podcast

Adam Famularo, CEO of WorkFusion on using AI digital workers to fight financial crime

The CEO of WorkFusion discusses the role of AI digital workers in detecting financial crime and how they can augment a human…

Webinar

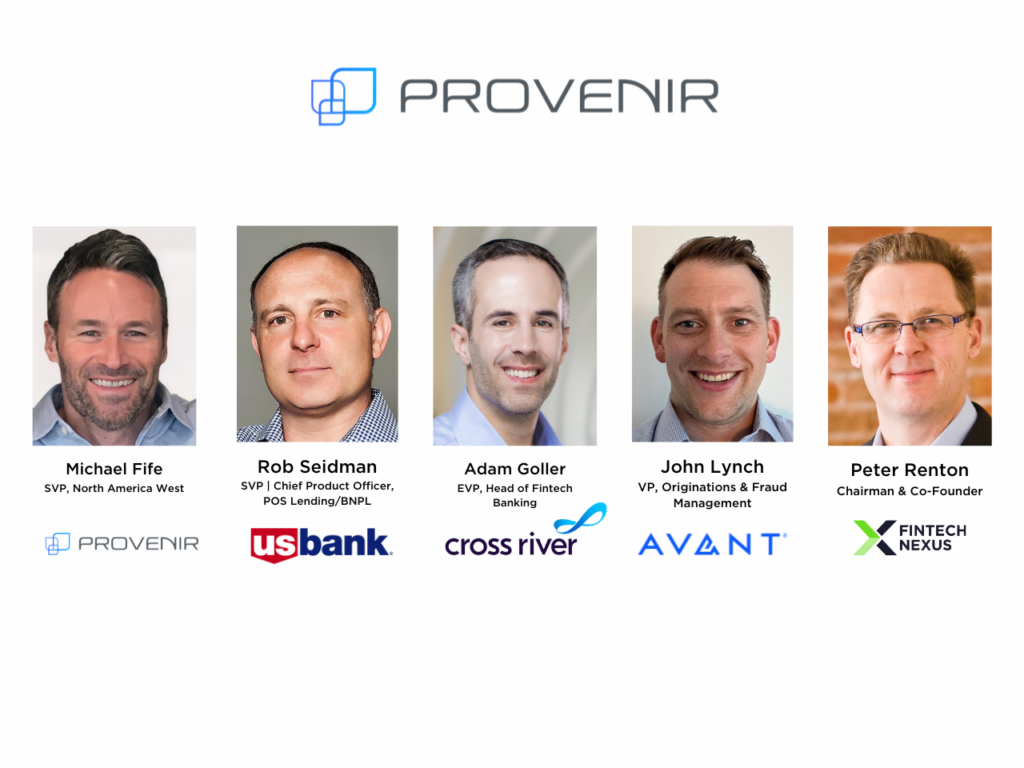

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- USA: The tech partnership helping credit unions finance Teslas

Through its integration with the auto manufacturer, Origence and its indirect lending subsidiary FI Connect aim to match buyers in need of auto loans to eligible credit unions.

- USA: LoanDepot Invests in Technology to Prepare for Mortgage Industry Rebound

LoanDepot is investing in technology as it prepares for a rebound in industrywide mortgage origination volumes. While the provider of home lending solutions reduced its expenses by 36% in 2023, right-sizing itself for today’s lower market volumes, it also invested in platforms and systems to boost productivity.

- Europe: How the Wirecard story unravelled: an interview with Dan McCrum who broke the truth

I’ve been following Dan McCrum, the investigative journalist with The Financial Times, for quite a while. He’s the guy who broke the Wirecard story, even though it could have meant quite a lot of personal danger.

- USA: Lenders score win as IRS sidelines plan to restrict tax data

The agency had intended to block access to tax data by most lenders on June 30 as part of a policy change that sought to protect taxpayer privacy. But drew broad opposition from the financial services industry.

- Global: Visa and Taulia/SAP form embedded finance partnership

Visa has teamed up with SAP-owned supply chain finance outfit Taulia to make embedded finance accessible to businesses worldwide.

- Global: Goldman aims to grow its private credit portfolio to $300B: report

The bank’s footprint there already far exceeds its rivals. Goldman, in a year, also nearly cut in half a $30 billion cache of legacy investments.

- UK: UK’s Starling Bank Appoints Raman Bhatia as Group Chief Executive Officer

Starling Bank announces the appointment of Raman Bhatia as Group Chief Executive Officer. He will take over from John Mountain, who has “been acting as interim CEO since our founder Anne Boden announced she was stepping back from the role last year.”

- USA: Hot New Bitcoin Funds Are Still Waiting for Buy-In from Financial Advisers

Individual investors, who are shifting their bitcoin holdings from more expensive crypto products, appear to be driving the ETF demand.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.