This week marks one year since many fintechs thought their world was ending.

Almost every venture-backed fintech company banked with Silicon Valley Bank and for three harrowing days last March, many wondered if all their non-FDIC-insured money sitting at Silicon Valley Bank would be safe.

Some fintechs such as Mercury not only rode out the storm but ended up benefiting from the SVB collapse. Mercury quickly stood up Mercury Vault, offering $5 million in FDIC insurance and garnered 8,700 new clients in just five days. Six months later 92% of these customers had stayed with Mercury.

MoneyLion had a deep relationship with Silicon Valley Bank and had a stressful few days where they had to stand up new bank relationships. Now, the company has updated its operations to account for a bank failure and is much more resilient today.

The demise of Silicon Valley Bank disrupted the venture debt space, but the longer lasting effect has been on fintechs now rethinking their banking relationships.

Every fintech today realizes that you cannot rely on just one bank anymore. You can’t have a single point of failure.

Many fintechs, like Mercury and MoneyLion, are stronger for it.

Featured

> A year later: SVB’s impact on fintech

By Rajashree Chakravarty

Fintechs like Mercury and MoneyLion showed their resilience, offering innovative products and assisting their customers through difficult times.

From Fintech Nexus

> Insights from the 2024 Payments Innovation Jury Report

By Fintech Nexus Staff

The 2024 Payments Innovation Jury Report does a deep dive into the changes happening in the payments space by interviewing 136 experts from around the world.

> Brazil, India lead instant payments growth worldwide with Pix, UPI

By David Feliba

Brazil and India are leading instant payment growth, with Pix and UPI accounting for over a third of total instant payments worldwide.

Editorial Cartoon

Webinar

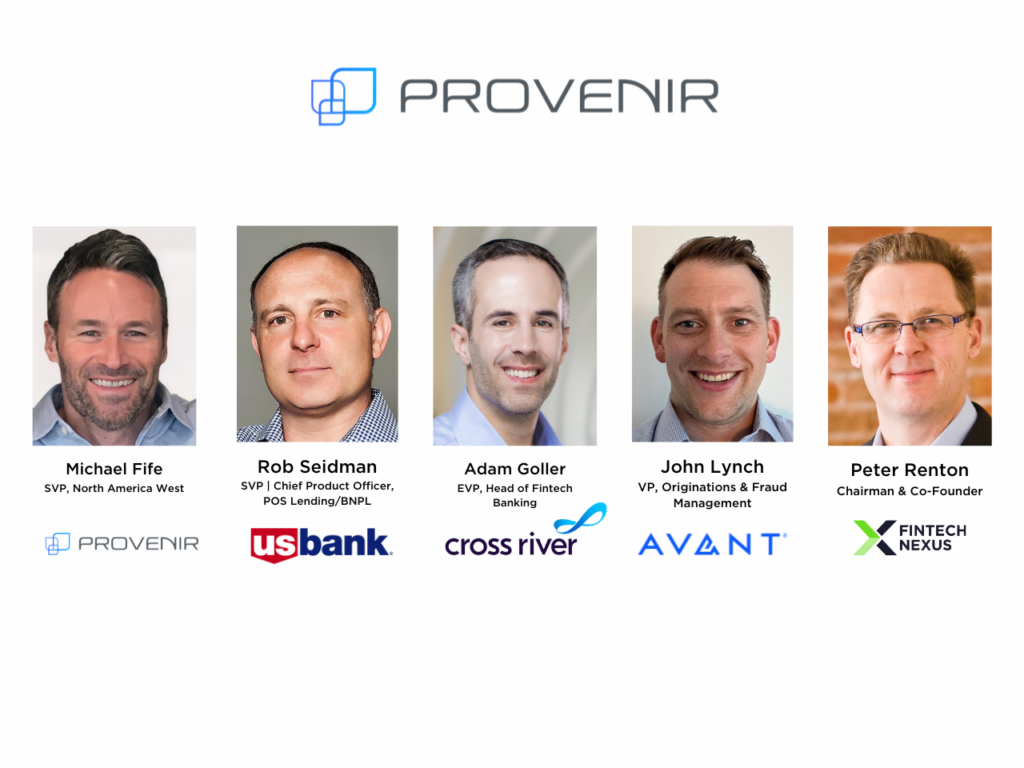

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- USA: Senators urge FDIC to act on pending ILC applications

A bipartisan group of senators called on the Federal Deposit Insurance Corp. to exercise transparency and expedience in evaluating industrial loan company applications, which grant a type of charter industry experts say is unlikely to be issued in this administration.

- USA: Why Direct Relationships Are The Way Forward For BaaS

If BaaS banks own relationship management (and some already do), they can better position themselves to stay ahead of oversight demands.

- USA: Private Equity Wants Your Credit Card Debt. And Car Loan. And Mortgage

Private fund managers like Apollo, Blackstone and KKR are pushing into asset-based lending and targeting the global economy’s biggest prize: the American consumer.

- USA: Consumers Spend More at Restaurants When Using Digital Wallets

Merchants — especially restaurant owners — who facilitate digital wallet purchases stand to gain by catering to key consumer segments.

- India: India’s Paytm secures third-party app license ahead of bank unit curb

The National Payments Corporation of India, the firm that built the eponymous UPI rail in the country, approved Paytm’s application to participate in the payments ecosystem as a third-party application provider, delivering much-needed relief to the financial services firm.

- UK: Lloyds teams with fintech startup ApTap to help people manage household bills

Lloyds Bank is to make managing household bills easier for mortgage customers through a partnership with ApTap, a fintech startup graduate of the bank’s ‘Launch’ innovation programme.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.