During the height of the 2021-22 fintech VC boom, no sector was hotter than spend management.

Companies like Brex, Ramp and Navan all raised massive rounds at multi-billion dollar valuations. While the category has cooled off, like most areas of fintech, it is still attracting capital from some big names in venture capital.

Coast was founded in 2020 and today announced a new round of funding: $25 million in equity and $67 million in debt financing. But it is not competing with the aforementioned big names.

Instead, Coast is focused on what it calls “real-world” businesses, those that have personnel and vehicle fleets in the field like plumbers, HVAC businesses, trucking companies and delivery companies.

There is certainly less competition at that end of the market and these companies could certainly use cutting edge expense management technology.

It is another great of example of the verticalization of fintech.

Featured

> VCs double down on fintech Coast, which aims to be the Brex for ‘real-world’ industries

By Mary Ann Azevedo

The expense management arena is a crowded one, with well-funded players such as Brex, Ramp and Navan all clamoring for market share. Those companies are generally focused on tech startups and large corporations. But a four-year-old contender, Coast, is pursuing a different type of customer.

From Fintech Nexus

> TruStage delivers Payment Guard Insurance as digital lending insurance solution

By Craig Ellingson

Neither the lender nor the borrower want a loan default, now with this innovative new solution from TruStage the risk of default can be removed.

> Banking for the Unbanked: How BaaS is Driving Financial Inclusion

By Nicky Senyard

For the unbanked and underbanked, BaaS means easy access to financial services that meet their specific needs. By combining fintech’s approach with the capabilities of traditional banks, BaaS fosters financial inclusion.

Editorial Cartoon

Webinar

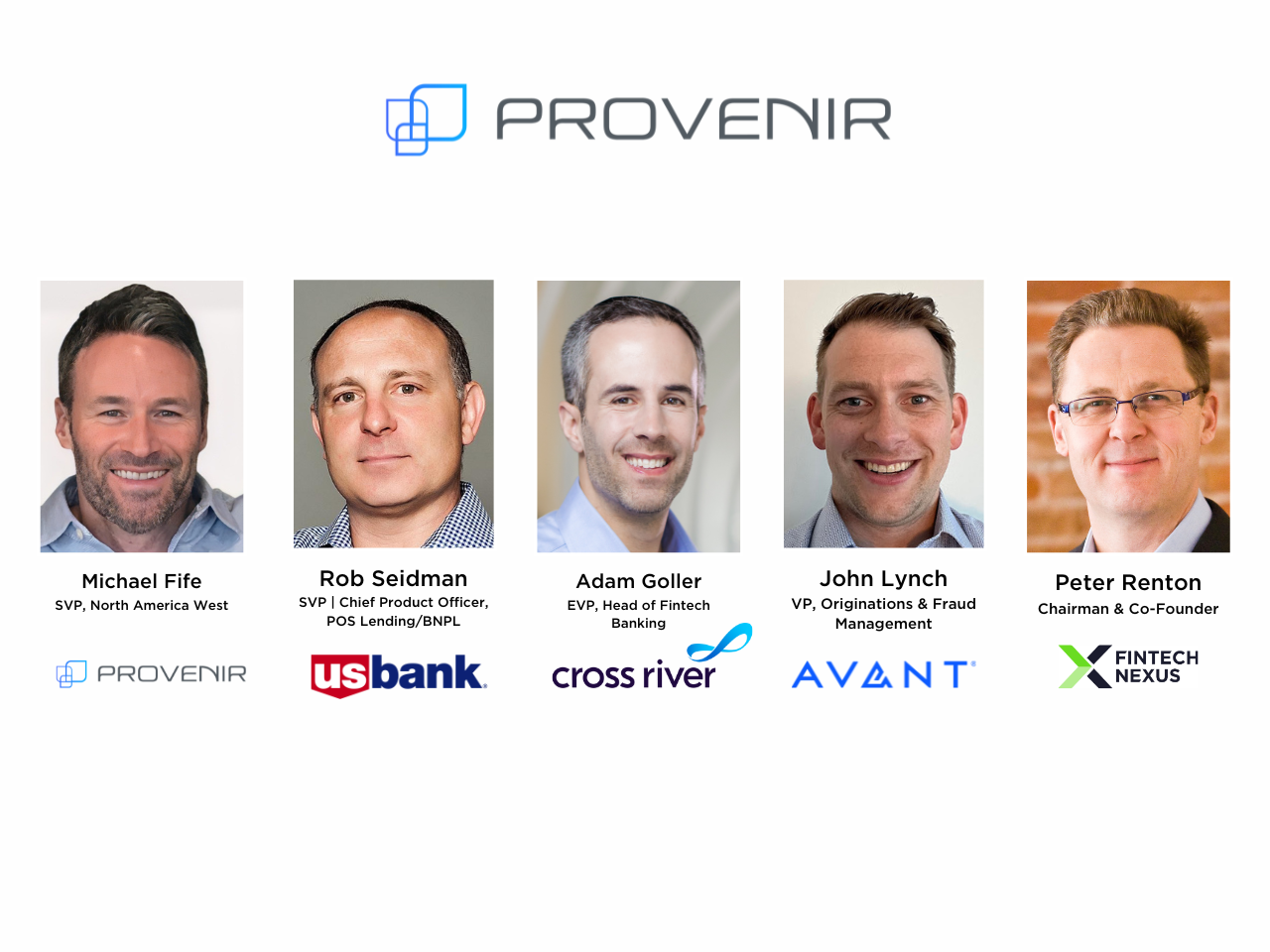

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- USA: 8 of the biggest issues facing the banking industry today

A major shake-up in the payments world, a data breach that’s opened up a debate on who is ultimately responsible for cyberattacks, and uncertainty about the future of the Basel III endgame proposal are among the issues banks need to watch.

- UK: UK set for soaring digital wallet adoption

The UK is approaching a seismic shift in how people pay, with digital wallets set to comprise half of all e-commerce spend and nearly a third of POS transaction value by 2027, according to a report from Worldpay.

- USA: Varo hires Zillow, Amazon alum as next CFO

The fintech will tap Allen Parker’s financial acumen as it looks to return its path to profitability following a rocky 2023.

- USA: The Importance of Primacy in Banking

In the face of increasing acquisition challenges and rising attrition rates, retail banks must not only focus on acquiring new customers but also on

- Europe: PayPal-Backed NX Technologies Raises $24 Million to Streamline Automotive Payments

NX Technologies raised 22 million euros (about $24 million) in a Series B funding round led by PayPal Ventures.

- USA: Link Money Collaborates with Silicon Valley Bank to Scale its Pay by Bank Solution

Link Money, a US-based open banking payment platform, and Silicon Valley Bank, a division of First Citizens Bank, today announced a strategic collaboration.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.