There are big changes coming to the world of interchange.

Today, in a historic settlement, Visa and Mastercard have agreed to cap card interchange fees as they seek to end a legal fight that has spanned almost two decades.

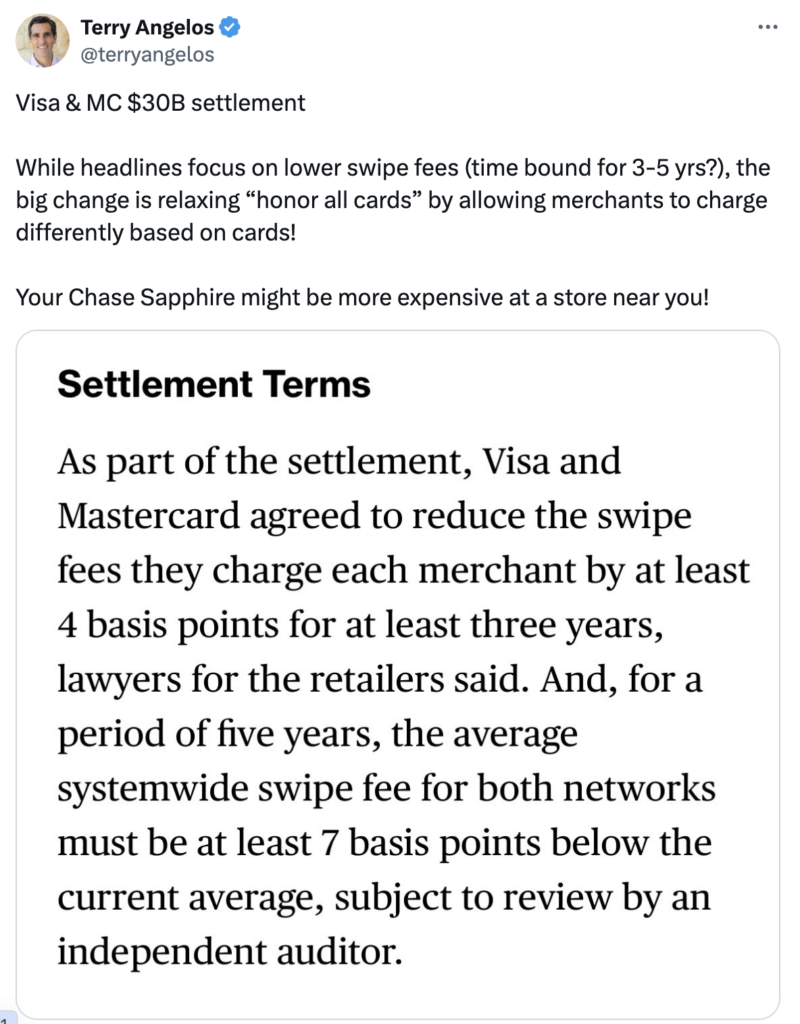

As part of the settlement, Visa and Mastercard have agreed to reduce the interchange fees by at least four basis points for at least three years and for five years, the average interchange must be last least seven basis points below today’s average.

Another big part of this deal is that merchants will now be free to charge different prices based on the cost of accepting different credit cards. This could have a profound impact on the premium rewards card market.

It is estimated that these fee rollbacks will save merchants around $30 billion a year. While there is talk this will lead to lower prices for consumers count me as very skeptical this will be the case.

But it will impact those banks and fintechs relying on interchange for revenue.

Featured

> Visa, Mastercard Reach $30 Billion Swipe-Fee Deal With Merchants

Visa Inc. and Mastercard Inc. agreed to cap credit-card swipe fees — a deal that US merchants say will save them at least $30 billion over five years — in one of the most significant antitrust settlements ever as they seek to end a legal fight that spanned almost two decades.

From Fintech Nexus

> Alkami model identifies the four stages of digital maturity

By Tony Zerucha

Alkami’s Digital Sales and Service Maturity Model shows banks and credit unions how they digitally stack up against the competition.

Podcast

> Julie Szudarek, CEO of Self Financial on building credit

The CEO of Self Financial talks about the importance of building a good credit score, financial literacy and how a credit…

Tweet of the Day

Also Making News

- USA: SEC Seeks $1.95B Fine in Final Judgment Against Ripple

The U.S. Securities and Exchange Commission (SEC) has asked a New York judge to impose a nearly $2 billion judgment against Ripple Labs, according to court filings.

- USA: Shared Payments Models Rewrite Economics of Commercial Cards

When it comes to business-to-business (B2B) payments, it’s easy to get blindsided by the staggering $100 trillion-plus annual transaction volume and miss the real action. It’s not about the money moving around; it’s about the current friction associated with workflows and data handling that set the stage for these payments.

- USA: OCC’s Hsu says prioritizing fairness can bolster innovation

Acting Comptroller Michael Hsu emphasized Monday the importance for banks to prioritize fairness in innovation, urging vigilance in navigating compliance risks associated with emerging technologies like AI.

- USA: JPMorgan Chase accuses TransUnion of stealing ‘trade secrets’

The credit bureau’s Argus unit collected the bank’s credit card data on behalf of regulators, then used it in the benchmarking service it sells to other banks, the bank says. The suit comes at a time when bank data is becoming increasingly open, at least in theory.

- UK: Fintech Wise swipes Delivery Hero alum for finance chief

Emmanuel Thomassin will leave for the London-based money transfer provider after a decade in Delivery Hero’s top financial seat.

- Global: Warhol Said Money Is Clean, But Bitcoin Is Not

Speculation aside the global demand for cryptocurrency is to a large extent a proxy global demand for US Dollars.

- Global: US Sanctions Russia-Linked Fintech Firms Over Crypto Evasion

The US imposed a fresh round of sanctions on 13 fintech firms and two individuals linked to Russia for allegedly developing or offering virtual asset services that have been used to skirt bans, according to a statement posted by the US Department of the Treasury.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.