Speaking at an event yesterday, CPFB Director Rohit Chopra said his agency is looking at “price gouging” in credit reporting.

With credit reports required for selling mortgages to Fannie and Freddie, mortgage lenders have no choice but to pay for them. Some lenders have shared that the costs for credit reports have increased by up to 400% since 2022.

To make matters worse credit reports are often rife with inaccuracies and the CFPB is inundated with consumer complaints regarding this problem.

These costs lead to more expensive mortgages in a market that is already reeling from the highest interest rates in more than 15 years.

“We are eager to hear from lenders and will look at possible rulemaking and guidance to improve competition, choice and affordability,” he said.

Featured

> CFPB calls out “price gouging” in credit reporting

By Spencer Lee

At an industry conference, Consumer Financial Protection Bureau Director Rohit Chopra said he was open to suggestions on how to increase choice and competition to benefit mortgage lenders and borrowers.

From Fintech Nexus

> Brazil’s Nubank profit surges to nearly $400M in Q1 2024

By David Feliba

Nubank booked $380 million in net income during the Q1 as it benefits from increased cross-selling and a growing customer base.

Podcast

Brendan Carroll, Co-Founder & Senior Partner of Victory Park Capital, on the growth of private credit

The Co-Founder of Victory Park takes us through the history of asset backed lending, how the industry has grown, and what…

Webinar

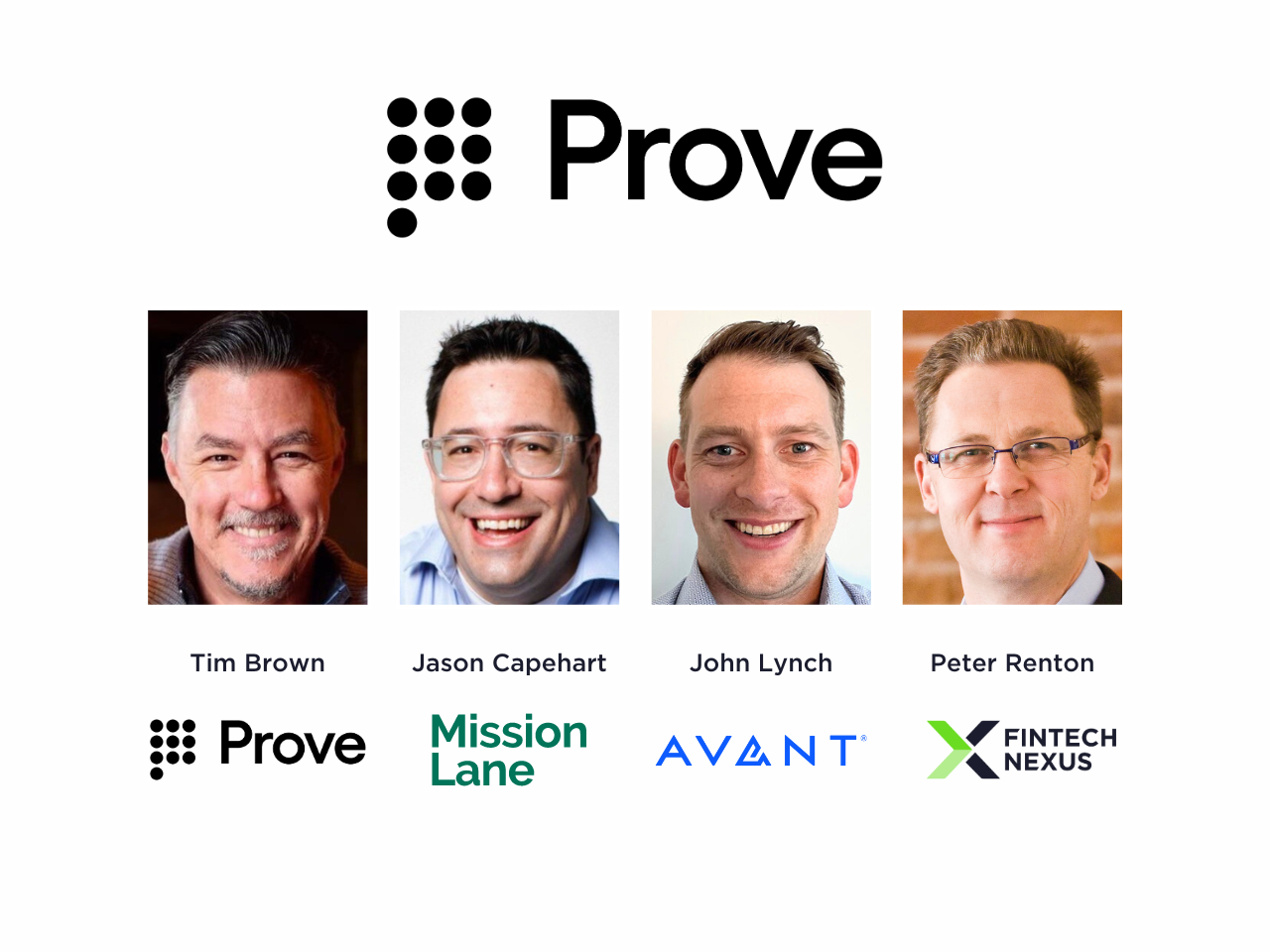

Identity Verification Strategies in a World of Deepfakes and AI

May 22, 2pm EDT

With the rapid proliferation of deepfakes and advancements in AI, businesses face new challenges in verifying identities…

Register Now

Also Making News

- USA: FDIC Chief Gruenberg to Resign and Biden Will Choose His Successor

Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation, said he would step down once the Senate confirmed a successor.

- USA: Jamie Dimon says JPMorgan stock is too expensive: ‘We’re not going to buy back a lot’

JPMorgan Chase has seen its shares surge 40% over the past year, reaching a 52-week high on Monday before Dimon’s comments dinged the stock.

- USA: Fidelity Drops Staking Plans in Updated Ether ETF Filing

Annualized yields on ether staking are nearly 3% as of Tuesday, data from popular staking service Lido shows.

- Europe: BaFin Mulls Lifting Cap on N26’s Growth After €9.2 Million Fine

The German watchdog has said it would relax its stance toward fintechs. The €9 million penalty is one of BaFin’s biggest fines to date.

- USA: Footprint Raises $13 Million Series A led by QED Investors to Automate Consumer Onboarding and Make Identity Portable

Footprint’s platform helps companies reduce fraud and friction in verifying identity at creation and log-in.

- USA: Fintech firm Payactiv—valued at over $500 million in 2020—is seeking a minority investor

Payactiv provides technology that allows employees to access their wages before scheduled paydays.

- UK: Visa and Mastercard Face Calls for More Transparency in UK

The U.K.’s payments watchdog says card giants Visa and Mastercard need to offer greater transparency. The Payment Systems Regulator (PSR) said Tuesday (May 21) that it is proposing that both companies routinely turn over financial information to the regulator and consult with retailers and merchants ahead of any fee changes.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.