“We are in an unparalleled time,” said Jordan Wexler, CEO, and founder of Early Bird, during Fintech Nexus USA 2022. “Fintech is creating unlimited access.”

The evolution of fintech has brought many financial services into the hands of the general public. The sector has seen increased opportunities for wealth creation, and the adoption of Web3 is continuing development in the space.

Now, processes such as investment involve the simple act of downloading an app. Sometimes, anyone can access crypto investment, the stock market, and options trading within minutes. “The rate of innovation is compounding,” he continued. “Ten years ago, we were still spending $12 per trade on each trade. And today, to even think about spending $1 or any money in a simple investing platform is insane.”

The shift has changed the financial profile of many and has started to identify and address societal issues. However, this rapid development comes with new risks, and some are calling for increased regulatory clarity to aid in secure adoption.

Unlimited access creates new areas of change

“With that unlimited access,” continued Wexler, “It has been great to see the next stage of fintech. How companies are tailoring to specific demographics and finding their needs where they need these products.”

Increasingly, fintechs are forming to reach niche markets. Increased access to data has resulted in heightened market transparency, making it easier to identify and address deep-rooted issues in existing financial services. However, it seems there is a lot of work still to do.

“We talk a lot about sustainable and inclusive finance and the convergence of fintech and other industries,” said Kelly Fryer, Executive Director of Fintech Sandbox.

“We see so much around democratization, which I think is a wonderful concept, but I see so many startups that, when you look under the hood, it’s like you’re democratizing nothing. You’re just offering us the new solution for the existing crowd who’s already experienced in this space or has well-versed access to that space.”

“A big need in the space is about taking a step back and saying, am I actually helping those who don’t have access to XYZ thing that I’m working to give access to?”

For Fryer, the answer lies in partnering fintechs with other sectors, pulling on their access and experience to target problems effectively.

“How do you build financial solutions for real humans and real human problems? By pairing fintech and healthcare, fintech and supply chain or infrastructure or what have you, you start to meet the challenges of these real-world issues out there.”

Wealth creation in the face of recession

An area that has significant success in the creation of wealth is crypto investment. Although investment has slowed down in recent months, the crypto market has steadily risen.

“People are slowing down their crypto investments slightly in light of what’s happening. But over the last five years, and the last two years, in particular, they’ve ramped up – crypto had its moment,” said Dave Abner, Head of Global Business Development.

“The way to think about it is that cryptocurrencies are now an additional asset class. They are an alternative asset class within a traditional investment portfolio.”

“Last year, crypto established a foothold in the mainstream consciousness of investing. It entered the radar and became part of the process for institutions to start building toward it. So 2021 was really that lightning moment, and we haven’t even seen the results yet,” he continued.

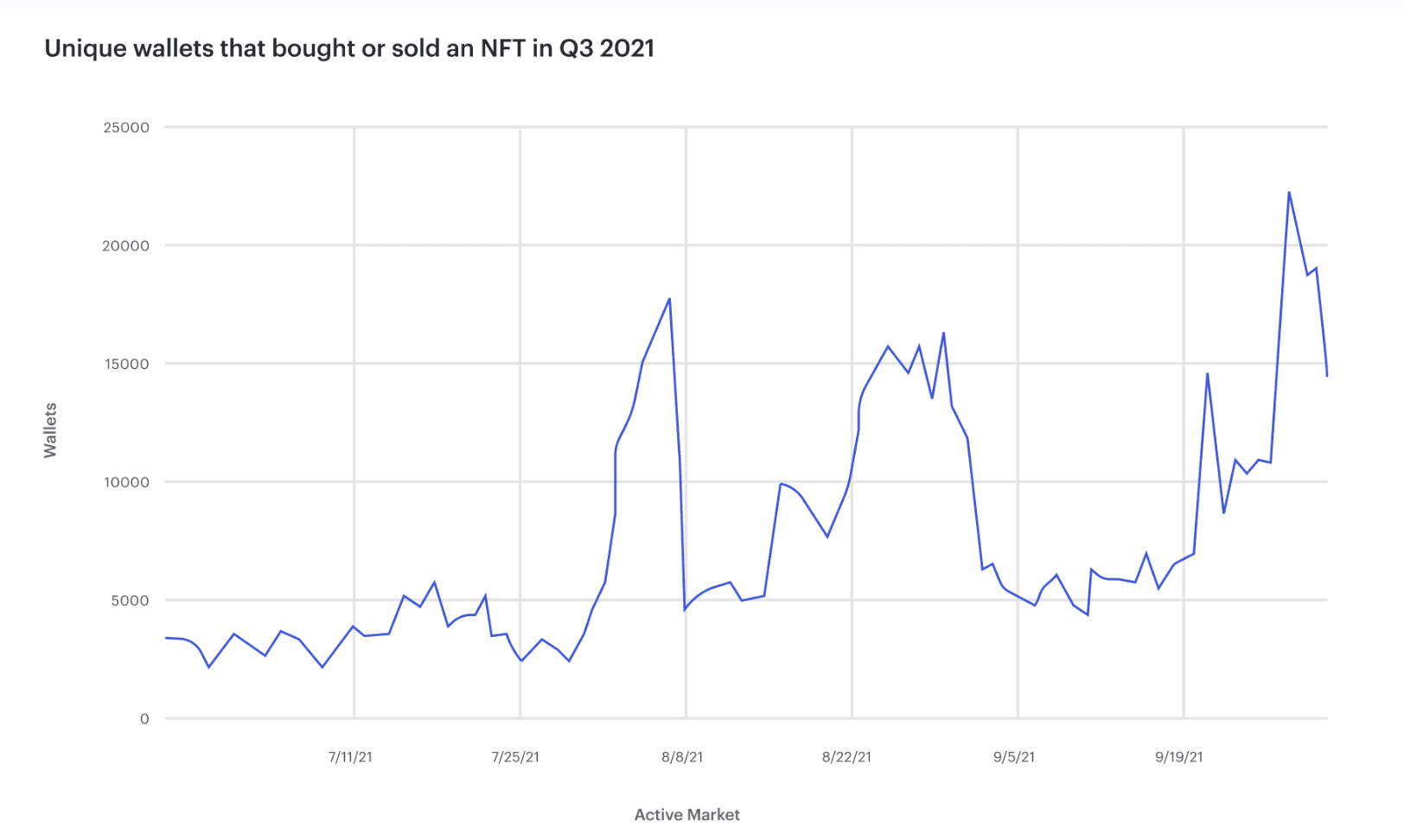

As well as cryptocurrency investment, 2021 saw the development of the NFT space. For many, this established a wealth creation sector for artists, traditionally the victims of an elite, centralized structure.

“I would say it is a wealth creation tool,” said Victor Fang, Co-founder, and CEO of AngChain.ai. “Last year, $17 billion was transacted on the NFT space. Of those $17 billion, 90% are art-related, and 10% are gaming related. That also shows how many new opportunities there are for wealth creation.

“Web3 is a great technology to connect to the fans. If you are an artist or if you have a brand, NFTs can be an additional revenue stream.”

There is some concern over the crypto market. In the past month, many cryptocurrencies drastically fell, and NFT investment has also dropped. Many believe heightened inflation and impending recession will hit the market further still.

Abner believes that the current decline is unlikely to shape the sector in the long term. “If you look at charts, I cannot predict the future, but I believe that 10 years from now, recent moves in crypto will be something you don’t even see on a general long-term performance chart. Now it’s important in the context of the market landscape, but it’s minor over the arc of the growth of the business overall.”

The importance of cybersecurity and regulation

For the potential of the space to be fully realized, some believe a focus on the safety of the underlying infrastructure is still needed.

“There are two pieces to security when you talk about Web3,” said Fang. “First of all, it’s still very hard. You’re talking about many blockchains, and you must secure all these assets that people are building their businesses on top of.”

He continued, outlining that the stakes of a vulnerability within those blockchains or smart contracts are incredibly high. It has become commonplace to hear of security breaches in even the largest blockchains, resulting in a loss of hundreds of thousands of dollars. These mistakes can potentially devastate the economy as more is built on top of the Web3 infrastructure.

In addition, external factors such as regulation and compliance standards can hugely affect businesses. This area is only starting to be addressed, but for Fang, it is essential to the development of the space in reaching goals for growth.

“I think the government is trying to protect consumers and investors, especially in the US,” he said. “Biden’s administration has released a new framework for cryptocurrency security. This is the first time the White House has developed a relatively clear framework.”

For Fang, this was welcome news, creating a structured step in the right direction for future development.

However, he said, clarity and interrogation of the regulatory landscape for specific sectors are still needed.