When writing about the UK fintech sector, the issue of national financial inclusion has become highly interlinked.

Aggravated by the pressure of COVID-19 restrictions, the UK has continued to see a geographical divide in financial inclusion, for many resolved primarily with the development of the fintech sector.

The government’s financial inclusion report for 2020-2021 stated that “Financial technology, or “fintech,” has become an increasingly important part of the financial inclusion agenda. This includes Open Banking, which has made it possible for customers to share their payment data far more easily and make payments through third-party apps.”

“Fintech offers consumers, including the disadvantaged and the vulnerable, greater choice, and more tailored services, helping them improve their finances through better credit and savings management.”

Much of the continued success of the UK’s fintech sector relies on the ability to coordinate the national fintech sector as a whole.

National connectivity essential

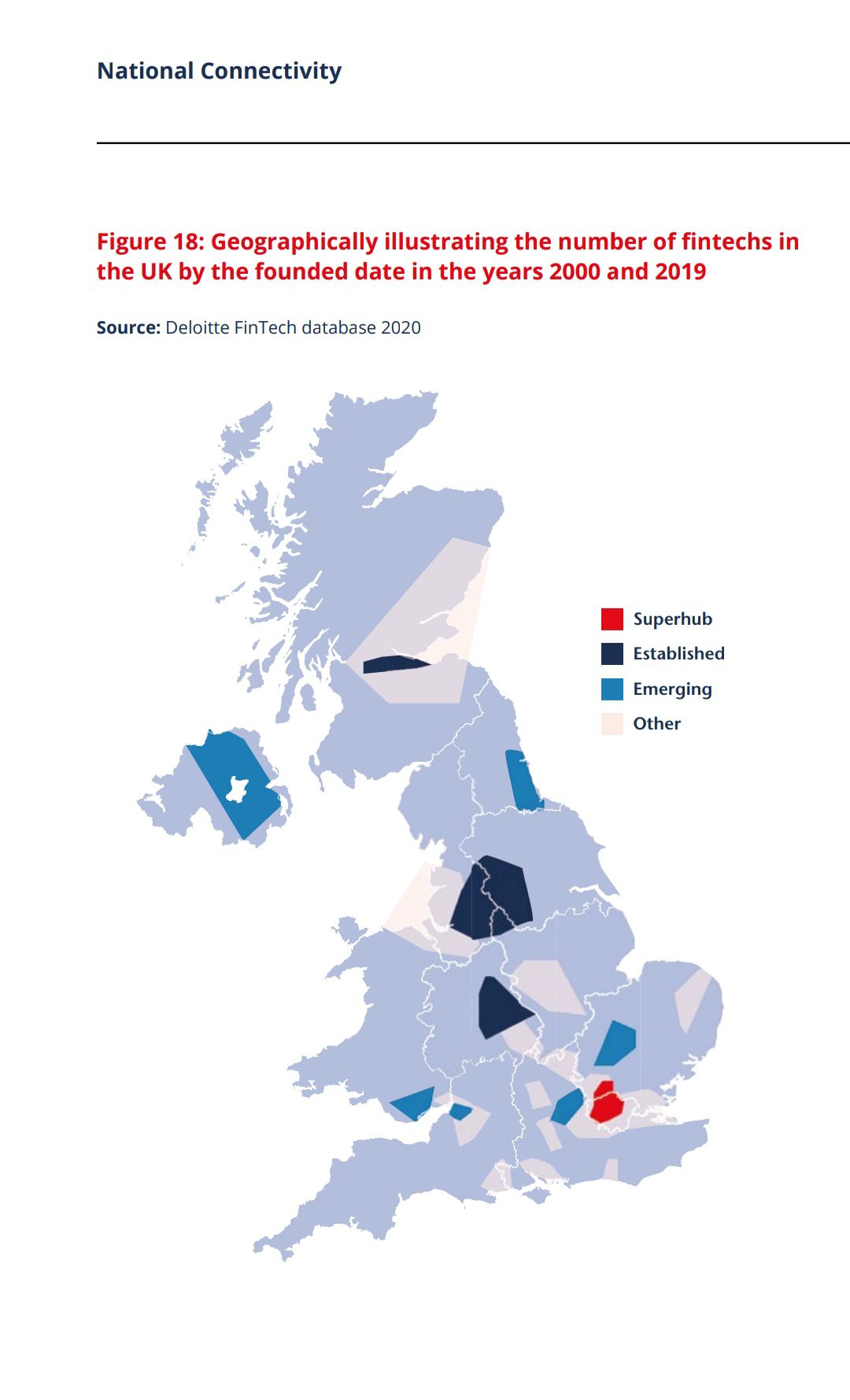

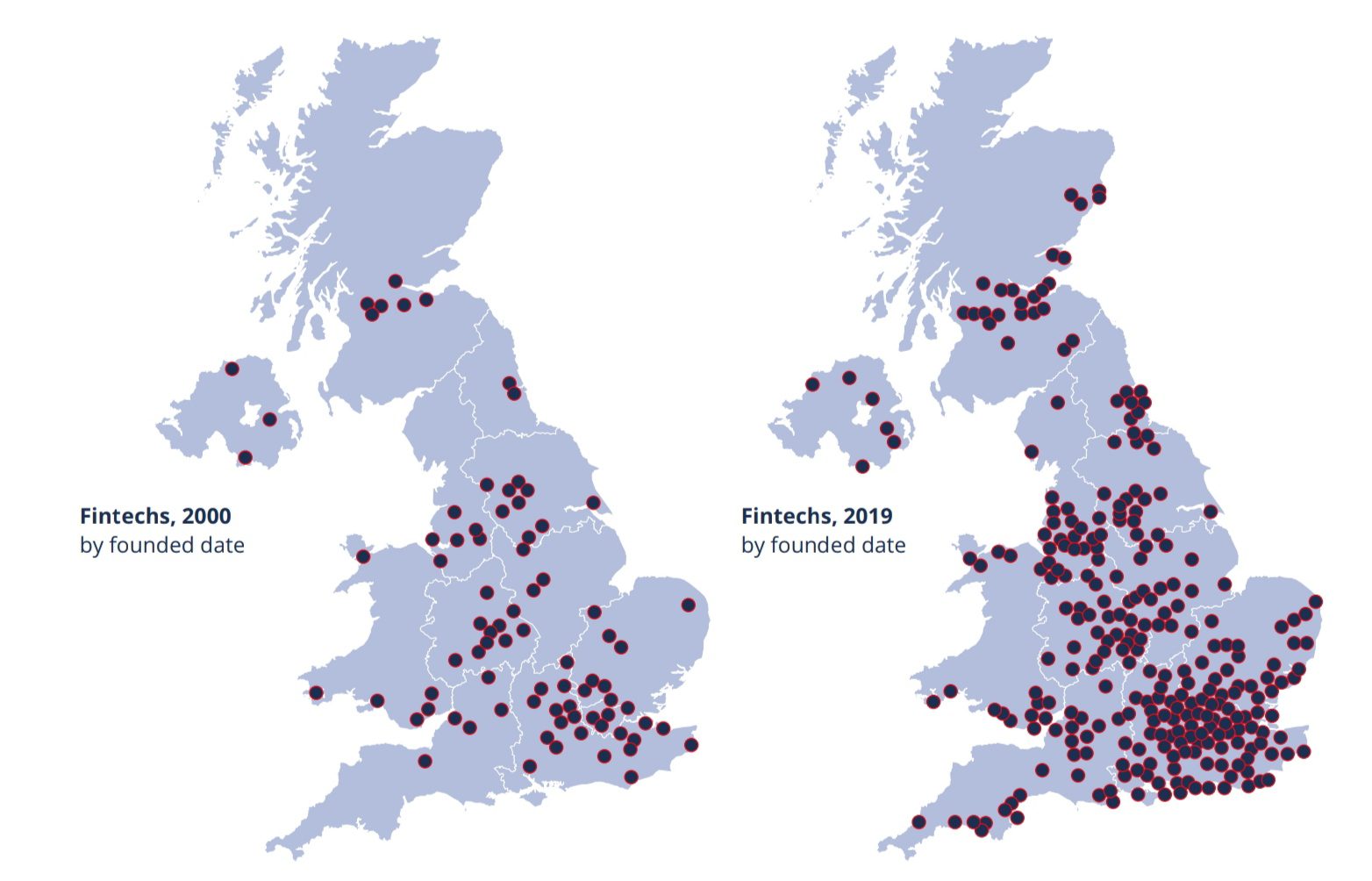

The Kalifa review of February 2021 included recommendations to connect all areas of the UK. Although the data showed London ahead of the rest of the nation as an international superhub, the growth of fintechs in other areas was seen as integral to the nation’s future success.

The review saw the growth of UK fintech in ‘clusters’ and recommended that enhanced connectivity between them was vital for continued national expansion.

It was stated that the growth of separate hubs had been due to different access to funding, organizational structures, and governance, resulting in a fragmented approach to the sector.

According to Innovate Finance insights, since early 2021 and the release of the Kalifa review, funding outside London had increased by 237%. This amounts to a total investment of $696 million.

Much of this is due to national initiatives, such as the Fintech National Network, driving incentives for a connected approach to the fintech industry based on recommendations set by the Kalifa Review.

Fintech Scotland is part of the founding partners of the Fintech National Network initiative with Fintech North and Innovate Finance. The project focuses on the inclusion and coordination of nationwide fintech ‘clusters,’ bringing attention to the industry’s success.

A road map for focused growth in the sector

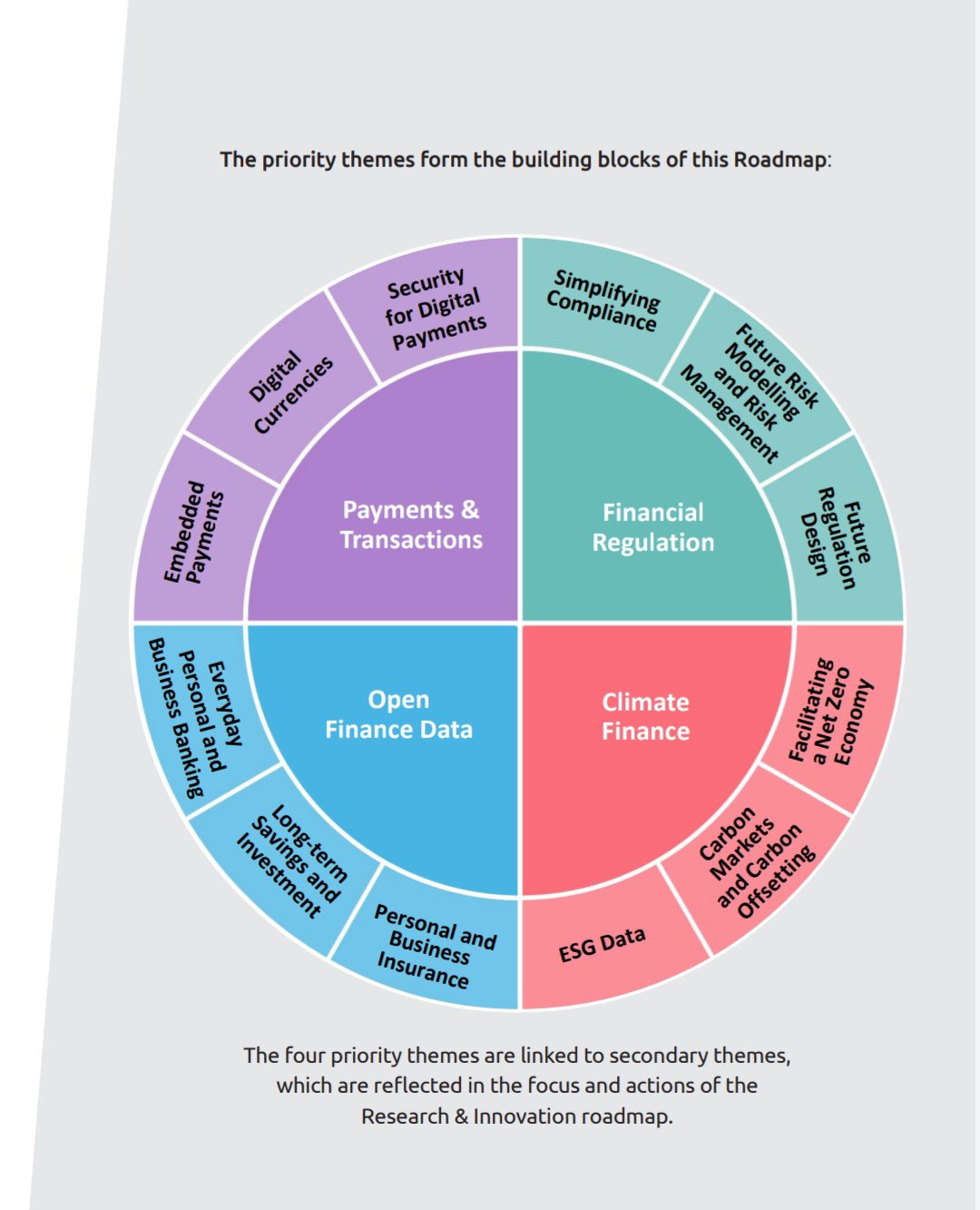

In early March 2022, Fintech Scotland released a roadmap focused on the research and innovation (R&I) into Scottish fintech, intending to bring growth, jobs, and economic recovery to that region of the UK. It is the first roadmap to be created in the UK.

“This Roadmap sets ambitious targets for sectoral growth and job creation, building on the wealth of talent and innovation across the wider tech ecosystem in Scotland,” stated Kate Forbes, Scottish finance secretary.

Currently, only 3% of funding in the UK goes towards R&I despite the consensus of its importance to the industry. The roadmap is unique because of this focus and aims to use it to the advantage of the UK fintech industry.

The plan ahead

Integral themes of the roadmap include:

- Open Finance

- Climate Finance

- Payments and Transactions

- Financial Regulation

The focus on Open Finance marks a definitive push to develop the nation’s success in Open Banking and broaden it out to the whole financial sector.

The plan pulls on collaboration between industry stakeholders and research into applying new and emerging technologies.

Initially, the roadmap aims to consolidate the current infrastructure and optimize it to benefit local citizens and SMEs. The focus in the latter part of the roadmap turns to innovation in the four sectors through technologies such as AI, robotic automation, and quantum computing.

Increased jobs and economic value

The plans set out by the roadmap aim to bring 30,000 extra jobs to Scotland and increase the economic value of the Scottish Fintech sector by 330% to over £2 billion.

Although ambitious, many are heralding the plans to be a structured and realistic response to the Kalifa Review of 2021.

Nicola Anderson, CEO of Fintech Scotland, stated, “The roadmap is a combination of the work we have been doing over the last couple of years. It helps us to deliver against some of the recommendations in the Kalifa Review.”

“We are confident it provides a framework created by the industry that really demonstrates the priorities. With that, it enables confidence for real and responsible innovation.”