Despite feel-good assurances of a Net-Zero bid by those joining the Paris Agreement in 2015, the outlook seven years later is bleak.

On Dec. 12, 2015, The Paris Agreement was adopted by 196 countries in the United Nations Conference of the Parties (COP)21. The treaty focused on climate change targets with the general objective to “meet Net-Zero by 2050.”

It is an international scientific consensus that to prevent irreversible damage, global emissions of carbon generated by humans need to fall by around 45% from 2010 levels by 2030, reaching net zero around 2050.

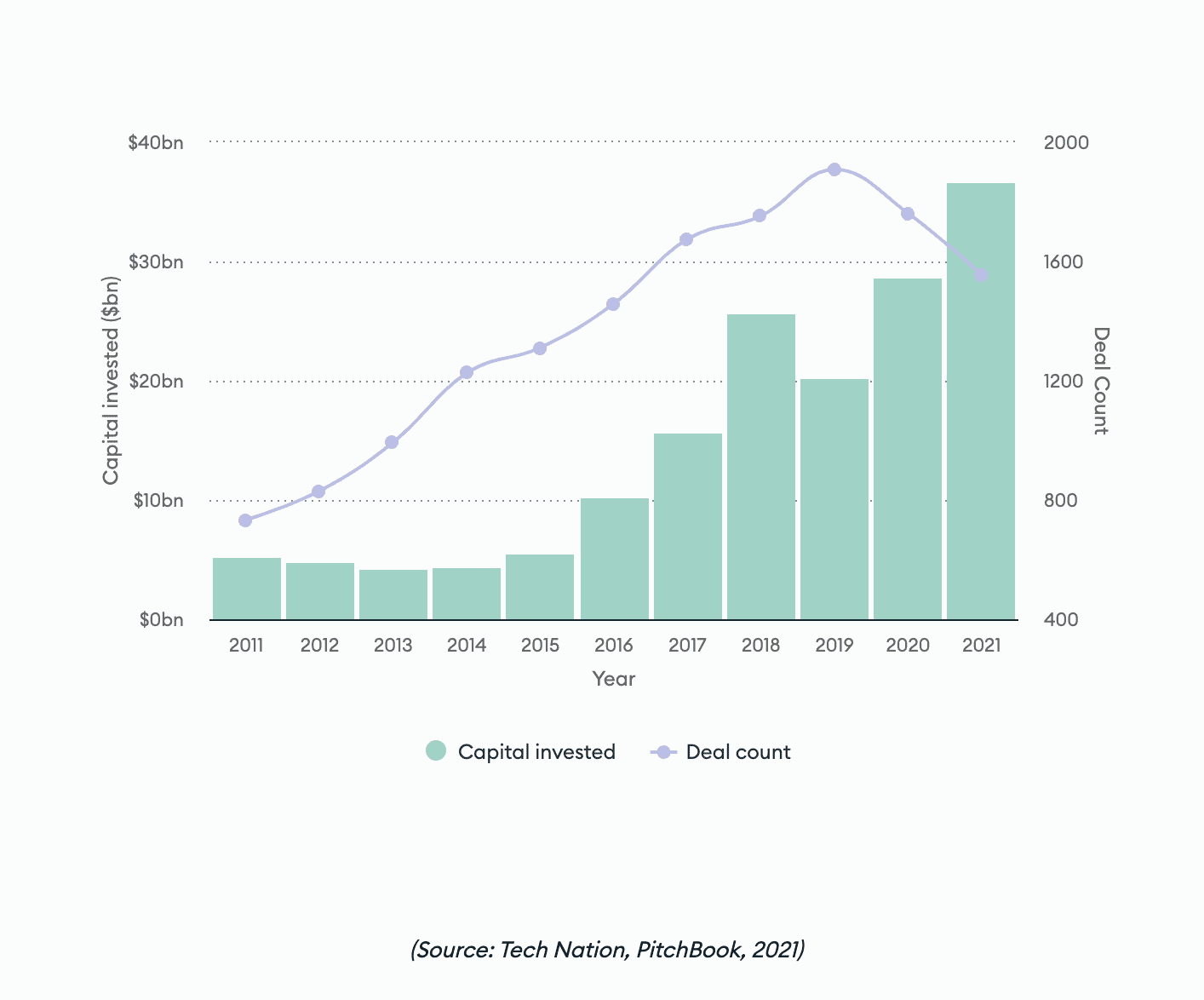

Net Zero refers to reducing carbon emissions and offsetting them through initiatives that remove carbon from the atmosphere. Globally, investment into Net Zero focused deals has increased, showing a 35% increase between 2020 to 2021.

The road ahead is challenging, requiring momentous changes and collaboration from all actors.

China leads dollar count

Although the deal count is highest in the US, valued at $20.8 billion, the median value of capital invested per deal is highest in China at $15.6 million. Sweden and the UK are also increasing their investment into Net Zero, with Sweden investing over 10 times the amount per tonne of CO2 emitted in 2021, bringing their total VC investment to $3.554 billion.

Although this is significant, there is data to suggest it is not enough.

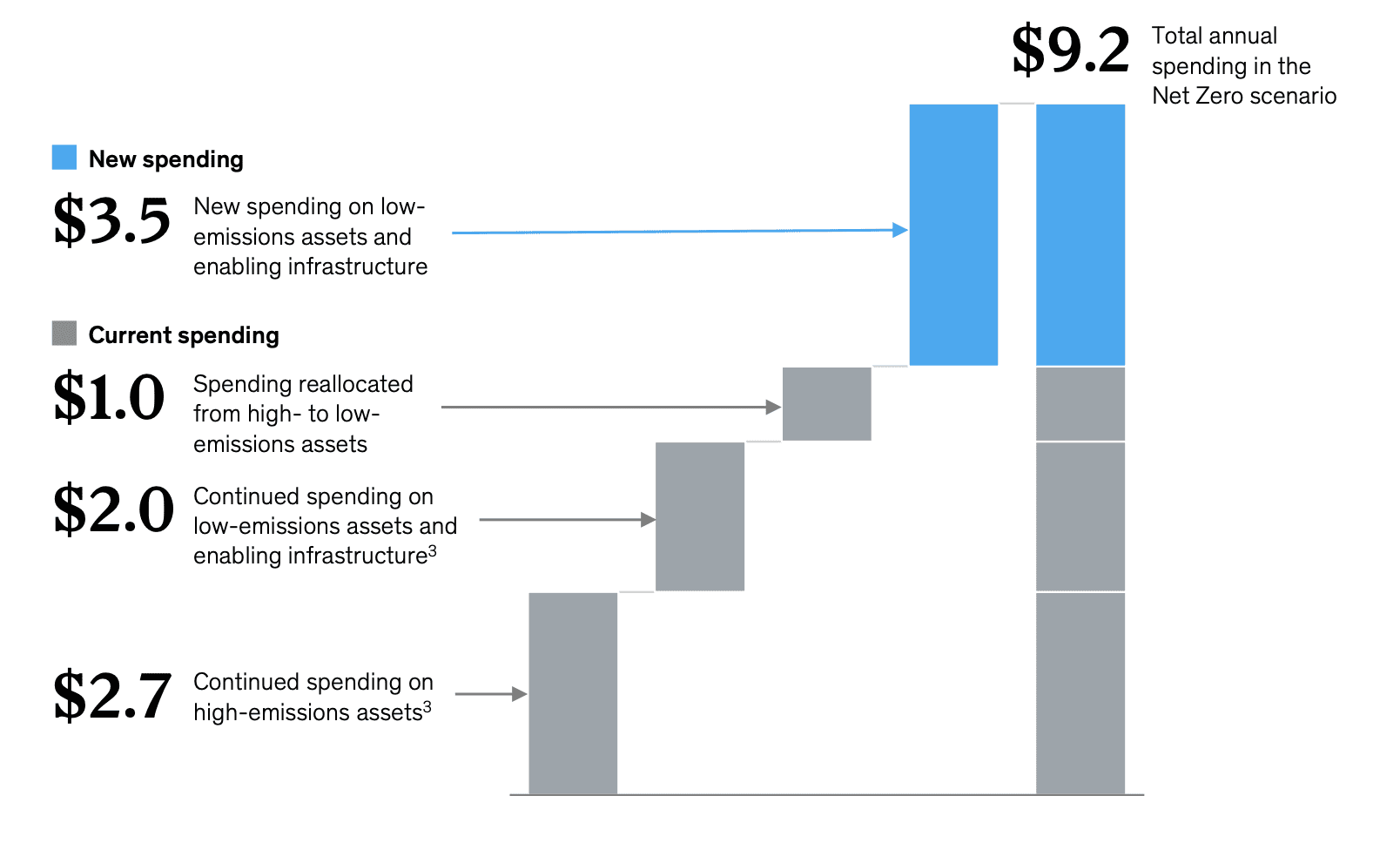

A report published by Mckinsey & Company in January 2022 on the transition to Net Zero stated that to meet objectives, investment focused on physical assets would have to reach $9.2 trillion per year on average until 2050.

This would be a $3.5 trillion increase on current investment, equal to half of the global corporate profits from 2020, one-quarter of total tax revenue, and 7% of household spending.

For many, achieving Net Zero by 2050 is essential to the future of the human species and the world as we know it. It affects all levels of human civilization, and fintech will play a significant role in facilitating this.

Fintech’s role in the achievement of Net Zero

Fintech comes from marrying two profoundly influential areas to achieving Net Zero: Finance and Technology.

“Financial technology will be the thing that unlocks climate change solutions and critically enables capital to be diverted,” said Adam Jackson, Innovate Finance.

The essential factor to innovation in the fintech sector is data, an analysis of which reveals opportunities for solutions to be developed.

“You can take it one step further as financial data and the rest of the economy becomes intertwined,” continued Jackson.

“The more you can link personal financial data to other data, whether it be energy company data or supermarket data on items…it enables an analysis of your carbon footprint based on individual items, and you can apply that more broadly.”

This point inevitably brings us to the issue of “Greenwashing, ” becoming more apparent in long-established businesses.

Greenwashing is a term used to describe the act of businesses to convey that their products or practices are more environmentally friendly without making the significant changes needed to substantiate these claims.

Although steps have been made towards generalized availability of companies’ Environment Social and Governance (ESG) data, this data remains unaudited. Companies can choose what data is released, creating an image of the business that is at times misleading.

Greenwashing is especially concerning in developing solutions based on data that companies release, with tailored results potentially leading to irrelevant or missed opportunities for development as a response.

Issues with blockchain and energy consumption

The many fintechs using blockchain technology are concerned about its energy intensiveness. Bitcoin, for example, consumes 100TWh a year, and data centers using Blockchain have been found to consume double this.

For some, the issue is not the technology but the energy source.

Spanish financial analyst, Juan Valcarcel, says, “Blockchain is just a technology. The energy we use for it can be changed to make that technology sustainable….In El Salvador, geothermal energy is used to power their Bitcoin mining and consumption.”

El Salvador adopted Bitcoin as their official currency in September 2021 with a mixed response. To uphold this decision while maintaining a commitment to Net Zero targets, they have harnessed the energy of the 30 volcanoes situated in the country to generate electricity.

Alternatives to blockchain technology that are less energy-intensive include cloud computing.

However, with the increasing demand and processing power needed to incorporate AI, it is apparent that it isn’t long before these too require a significant reduction in energy usage.

A unified transformation from all stakeholders

The targets set out by the Paris Agreement in 2015 are highly ambitious yet essential, and even more, progress is needed to reach them.

The change required to achieve Net Zero is necessary on many levels, all of which fintech can play a big part.

Governments and regulators must implement policies and incentives for businesses to adopt more sustainable and energy-efficient practices and adjust national infrastructure.

In November, the UK government set out a 10-point plan for a “Green Industrial Revolution” to accelerate their path to Net-Zero. Many of the policies set out by this plan focused on increasing renewable energy sources into the national energy grid and improving transport and infrastructure to become more carbon-efficient. However, point 10 focused on Green Finance and Innovation.

In this 10th point, among other things, it was stated that Research and Development investment into green technologies would rise to 2.4% of GDP by 2027 and from 2025, a “mandatory reporting of climate-related financial information across the economy.” In addition, a proposed green taxonomy is to be implemented defining which activities work towards the Net Zero objectives.

Combined, these measures are said to clarify investors in delivering finance for a Net Zero economy by 2050.

UK regulatory service, the Financial Conduct Authority (FCA), is also making moves to support these objectives and encourage green innovation in fintech by creating a second digital sandbox cohort focusing on testing and development of products and services in the area of ESG data and disclosure.

Investors are also the drivers of the change in their choices in where to direct capital. Many firms internationally have been launched with this in mind, focusing on SME funding.

SME face tall barriers

SMEs currently make up 90% of business worldwide, making their contribution to carbon emissions significant, in the UK, for example, contributing to a third of the total amount.

Adjustment of their practices is, therefore, a focus for net-zero objectives.

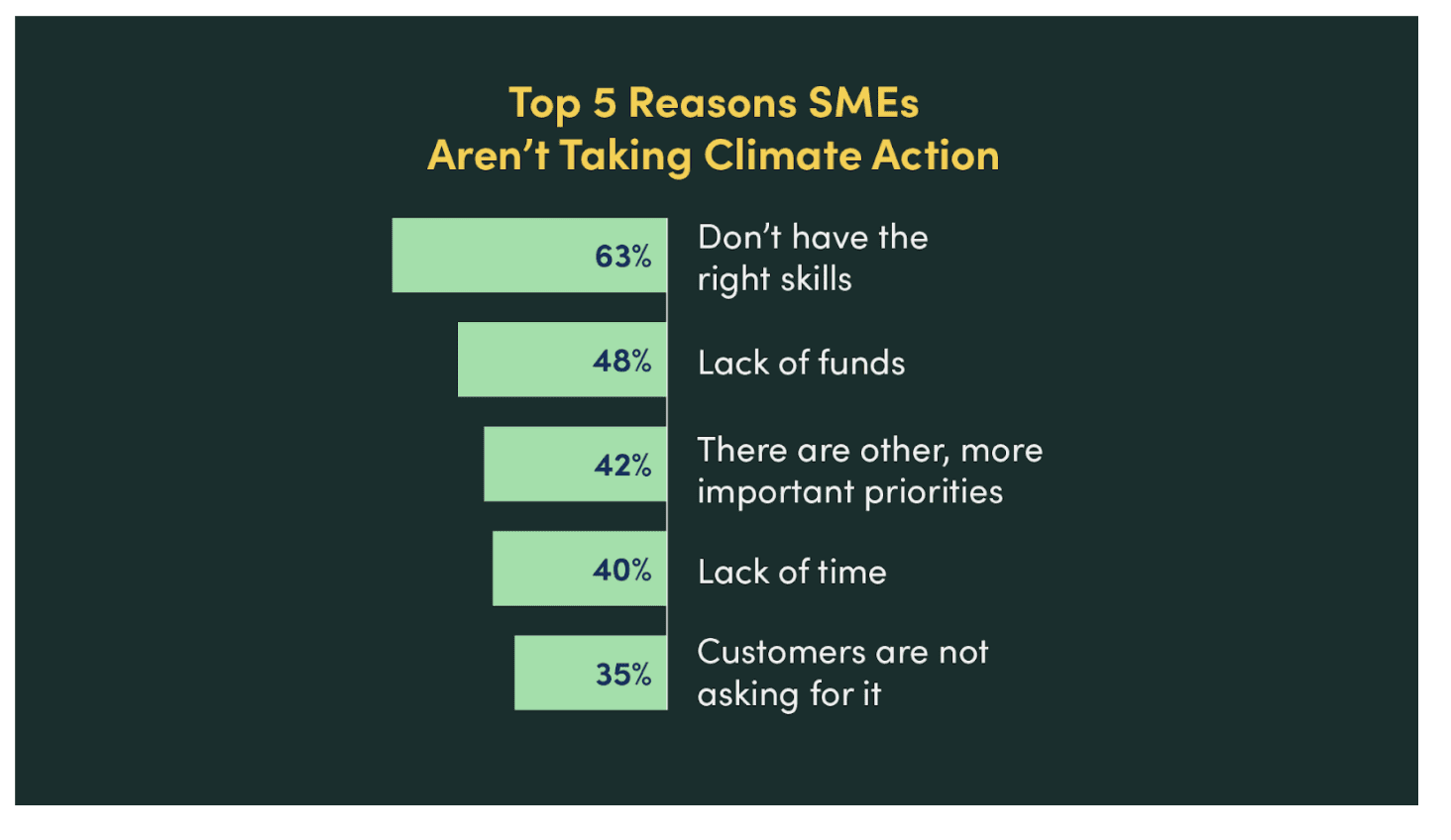

However, they face barriers to their ability to do so. Given their small size, resources and funding are limited. In a study conducted by the SME climate hub, 48% of SMEs surveyed indicated that funding was the main reason for their inability to take climate action.

Swishfund is an alternative lender to small businesses that offer APR discounts to carbon-neutral customers and customers involved in renewable energy. It also offsets 10 tons of carbon for new loans by building wind farms in India and UK reforestation projects. Funding Options has also created a green finance marketplace that helps SMEs fund shifts in practices towards reaching net zero.

Enabling consumers to adjust their spending patterns and engagement according to their carbon footprint is hugely influential to reaching carbon neutral objectives.

In the McKinsey & Company January 2022 report, it was stated, “The goal of Net Zero emissions can only be reached if people adopt new behaviors and consumption patterns…an informed, engaged public that recognizes the imperative for a Net Zero transition could spur decisive and transformative action on the part of government and business leaders.”

More than just offsets

Many institutions have argued that offsetting is not enough and should be carried out in conjunction with the initiation of fundamental behavioral change. Options ranging from data publication to payment solutions have been launched.

According to Aspiration, many commercial banks have ties to fossil fuel industries, so they have launched a bank that has pledged never to fund projects that destroy the atmosphere. They also offer options for customers to offset their car usage and cashback rewards when they reach individual net zero.

Green Wallet is another conscious spending and banking app with an in-app sustainable products marketplace from 100s of ethical businesses. Green Wallet plants a tree for every purchase and rewards customers with green coins.

Other companies, such as Connect earth, focus more on general publication and awareness of environmental data. By creating an API code for integration into tech products, Connect earth allows businesses to adjust themselves regardless of their background to show customers the carbon impact of using their products.

As well as this, groups and initiatives have formed to bring together, businesses focused on climate change objectives.

Bringing business groups together

An example of this is Tech Zero, an initiative headed by Tech Nation and Bulb to bring businesses from all sectors, including fintech, together to speed up progress towards sustainable objectives. Since its launch, hundreds of international companies have become signatories, including Monzo, Revolut, and Starling Bank.

“We set up the Tech Zero workforce because everyone is grappling with the challenge of net-zero, and by working together, we can make progress faster,” said Hayden Wood, Co-founder and CEO of Bulb.

Signatories of Tech Zero commit to various policies on joining, including measuring and publishing company greenhouse gas emissions, setting ambitious net-zero targets, and posting details on how they plan to reach net zero.

Jamie Rowles, Head of Investments at Sky Ocean Investments and a signatory of Tech Zero, commented, “While data for the ‘sector’ is showing great momentum, the reality is that we are below the rate of innovation required to reach Net Zero….The great news is that there is a known problem and outcome required – how we get there is where entrepreneurs can thrive.”