The company has teamed up with Visa on card issuance driven by stablecoin tech and operates in 100 countries Count...

For decades, payroll tech barely changed. Now, upstarts and incumbents alike are trying to overhaul how businesses pay their people...

·

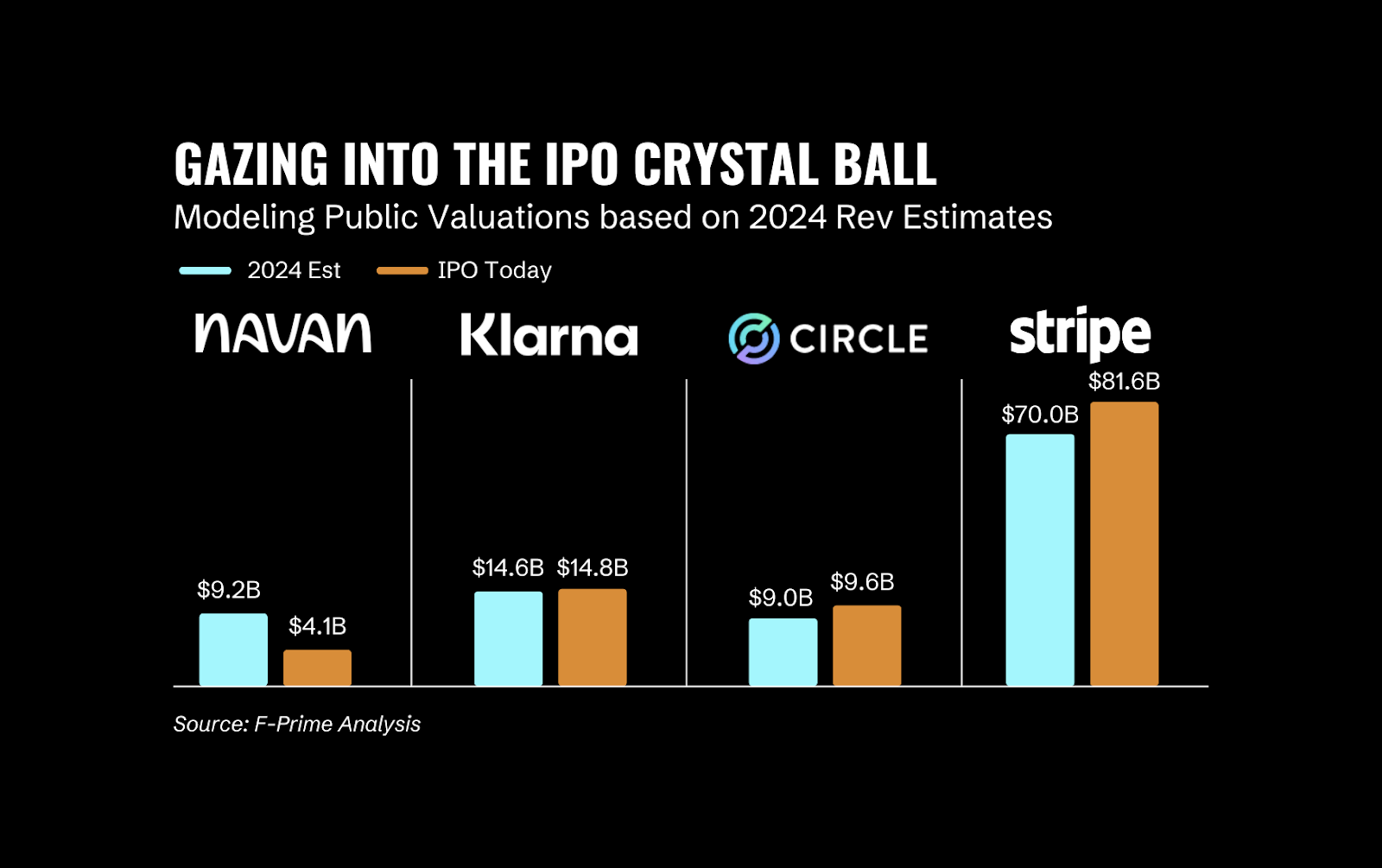

What the long-awaited IPO means for late-stage fintech Though its Form F-1 filing with the US Securities and Exchange Commission...

Murmurings from Fintech Meetup and HumanX It is amazing to me, how many meetings — even in a meeting I...

·

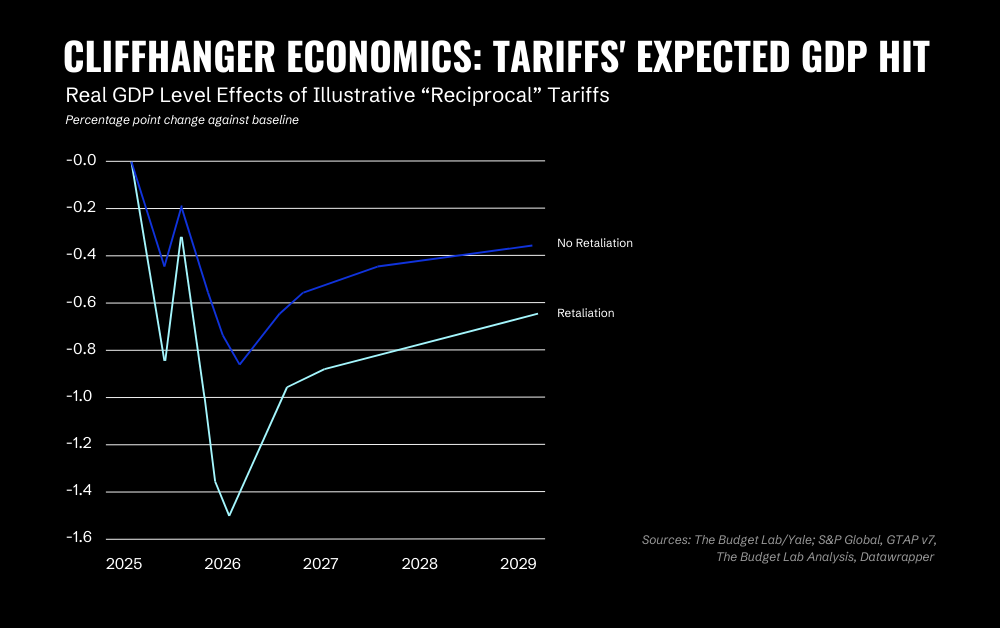

At 12:01 AM ET on Tuesday, a U.S. tranche of 25% tariffs went into effect against Mexican and Canadian imports,...

Three questions for Canaan Partners’ Dana Warren and Brendan Dickinson Given the stop-start nature of tariff imposition and other major...

How dismantling the Consumer Financial Protection Bureau turns back the clock — exposing consumers to financial harm and encouraging unfair...

Why Orum eyes debit cards as the rails for more market share The adage “If you build it they will...

Three questions for former CFPB Deputy Director Raj Date Earlier this month, Department of Government Efficiency (DOGE) czar Elon Musk...

·

Today marks an exciting new beginning for Fintech Nexus, the leading fintech media company, as it relaunches under new ownership...