FedNow is almost here. Some are concerned innovation for the new payment rail may cause the divide between small and larger banks to widen.

In the Financial Health Network's recent report it was found economic conditions are "disproportionately" affecting vulnerable households.

·

The new iteration of Fintech Nexus will focus on digital information services and intimate events for the leaders of financial services innovation.

The MiCA Bill was passed in April, bringing with it a possible end to the lack of clarity in European crypto but it's not all plain sailing.

This week Isabelle sat down with Ben Borodach to talk about how fintech can make tax descisions a part of every day life.

Real-world asset tokenization was set to be a multi-trillion dollar market by 2030. It's still on track despite FTX setbacks.

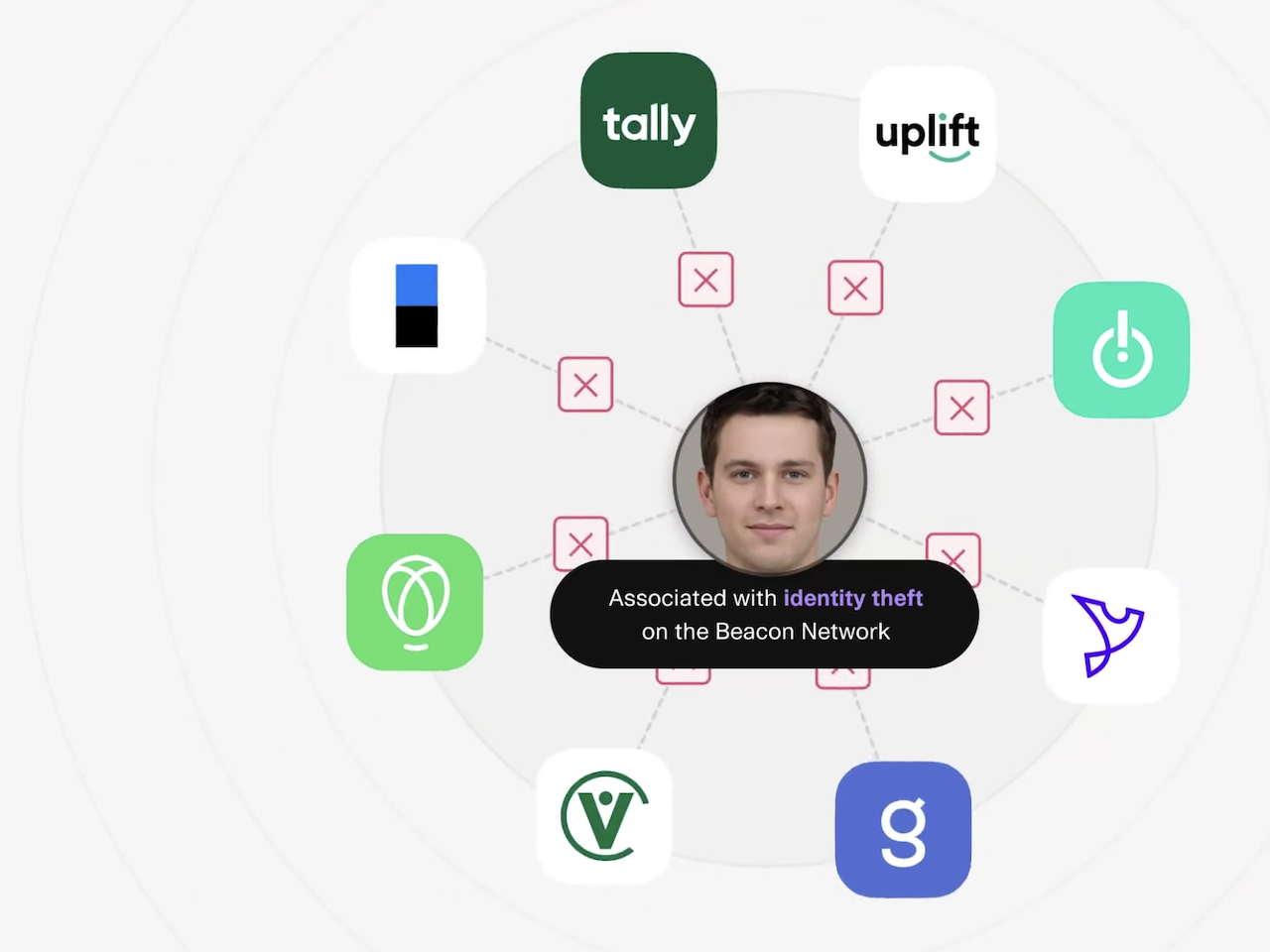

Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

Earned Wage Access has, until now escaped the confines of sector-specific regulation. Nevada has stepped up to change that.

Instant payment system Pix has overtaken credit and debit cards as the most used means of payment in Brazil.

Fintech Nexus sat down with Qik's CEO, the first neobank in the Dominican Republic. Traditional lender Grupo Popular to invest $70 million.