Real-world asset tokenization was set to be a multi-trillion dollar market by 2030. It's still on track despite FTX setbacks.

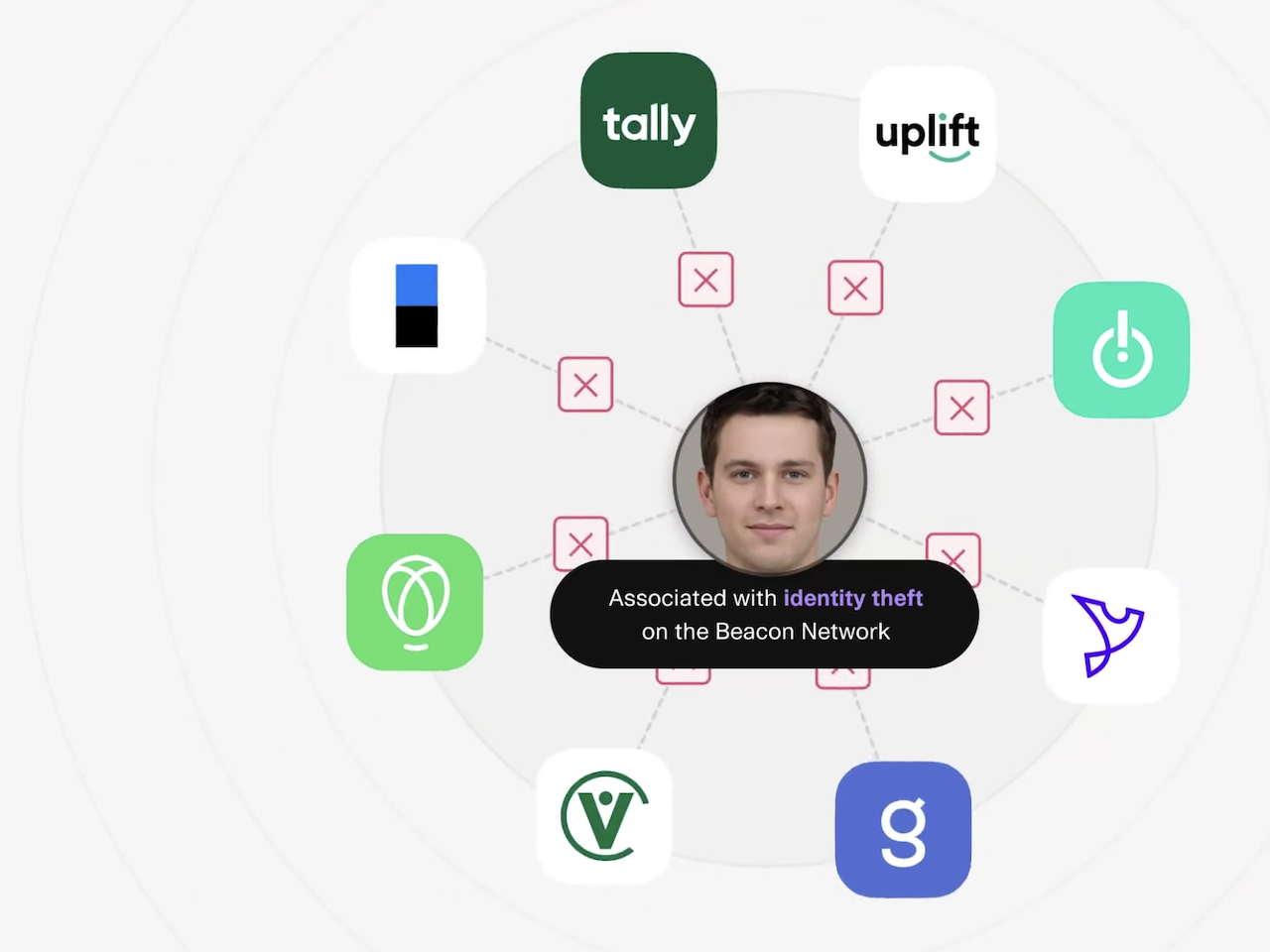

Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

Earned Wage Access has, until now escaped the confines of sector-specific regulation. Nevada has stepped up to change that.

Instant payment system Pix has overtaken credit and debit cards as the most used means of payment in Brazil.

Fintech Nexus sat down with Qik's CEO, the first neobank in the Dominican Republic. Traditional lender Grupo Popular to invest $70 million.

FedNow's launch is imminent and there seems to be a whole lot of confusion about what it means - Here's all you need to know.

Rising rates and inflation have caused employee financial stress to skyrocket. The partnership could ease some of the strain.

Money Laundering is a perpetual thorn in the side of financial institutions. BIS reports that AI and use of networks could be way forward.

Despite a challenging scenario for Latin American fintechs, neobanks and digital wallets in Brazil continue to sign up millions of clients.

At Fintech Nexus USA the Credit & Underwriting track is always one of the most popular. Here is a description of the track and links to the audio of all the sessions.