The final countdown is on for the launch of FedNow, and while there continues to be confusion about what the system means for the financial system, in the fintech sphere, most are optimistic.

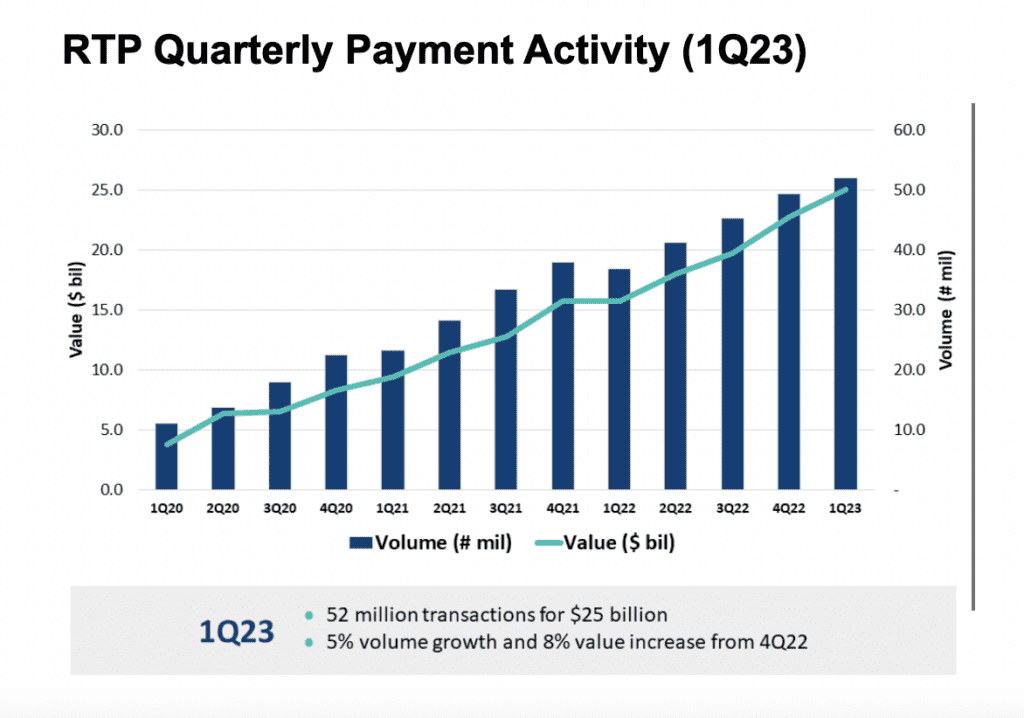

Instant payment networks have been on the rise globally for some time. Within the US, The Clearing House launched its real-time payment (RTP) system in 2017, registering increased usage year-on-year.

In addition, there has been a rise in the popularity of apps that give an instant payment experience. Zelle, founded in 2017, has now been integrated into over 1,600 financial institutions’ banking apps. While it initially used the Automatic Clearing House (ACH) payment system, users saw funds in their accounts within a matter of minutes. Between 2019 and 2023, Zelle more than doubled it’s user base.

RELATED:

- FedNow brings innovation, fraud concerns, and conspiracy theories

- The global state of real-time payments

“What happened during the pandemic was, even though we had these capabilities of digital applications before, it became a forcing function for consumers to say…I really want this all coming directly into my phone,” said Bala Janakiraman, CEO of Onbe. “So we saw that shift happening from physical cards to a digital instant confirmation from a consumer standpoint.

Real-time payments aren’t new to the ecosystem and have been proven to be a favorite among consumers. In the increased competition between banking entities, fintechs could provide valuable resources for innovation.

The Fed is “just catching up”

The launch of FedNow is a big move from the Federal Reserve. The ACH system, which was launched in the 1970s, recently had an upgrade to allow for same-day transfers. However, movements have continued to happen within traditional banking hours. FedNow opens this window out to 24 hours a day, 365 days a year, as well as making them instantaneous.

While it is significant for the Fed, within the global ecosystem, instant payments are old news. India, at the forefront of introducing instant payments on a national level, introduced its Unified Payments Interface (UPI) in 2017. The UPI was an upgrade of a previous system introduced in 2010. As of December 2022, it was handling over seven billion transactions per month and registered 300 million active users.

India is one of many nations that have introduced an instant payment system. The UK has its Faster Payments Service (since 2008), Europe its SEPA Instant (2017), and Brazil its PIX (2020).

Even within the US, The Clearing House and various fintechs like Zelle jumped on the instant payments bandwagon. The Federal Reserve has been left behind.

“Even prior to FedNow coming in, we had the ability to instantly activate payments onto a mobile wallet. And again, consumers have now learned how to use it,” said Janakiraman. “I personally see the FedNow service as, in many ways, the US catching up to infrastructure that we already see in a variety of markets.”

This could be a good thing, as many in the financial industry consider the ecosystem to be ready for the new infrastructure. Between The Clearing House and Zelle, instant payments have already been made widely available, giving businesses time to digest what FedNow could mean for their solutions.

“If you look at it from a macro standpoint, the concept of digital instant payments is not new to the financial ecosystem in the US,” said Janakiraman. “Banks have figured out that Zelle as an instant payment service, whether it’s B2B or B2C, is already there. And most banks have started to roll that out. And they’re available to a variety of consumers.”

“They figured out how to deal with instant payments, and they figured out the right kind of applications in the context of the consumer.”

“So I kind of look at FedNow as ACH that’s been souped up and now can really go instant. So the question for me, and I’m sure for most people in the banking network, is, what is the applicability or the use cases around taking what was traditionally ACH and now driving those applications through FedNow?

“That’s going to be a fascinating set of assessments. I’m confident that the financial institutions will come up with applications on how to use it because this is familiar to them, the whole idea of instant payments.”

Partnering with Fintechs

The introduction of FedNow could therefore spark significant innovation. However, within a banking system of over 10,000 insured financial institutions, with the top 200 housing 70% of all depository accounts, some are likely not to have the resources to develop in-house solutions.

“The large banks pretty much run their own infrastructure…so they have full control on innovation around that,” explained Janakiraman. “If they can find the use cases and applications for it, now they have the resources to go deploy it to make it happen.”

“When you go down the chain to the 5000 plus banks that are more regional or community banks, they’re more reliant on vendors that provide the core processing platform.”

Already, partnerships between fintechs and banks have seen an uptick, driven by increased pressure to innovate in order to compete.

In the context of FedNow’s launch, fintechs could be the missing piece, providing services to improve competition between smaller and larger banks in embracing the new payment rail.

“It’s an opportunity for those providers that are providing the core pricing platforms to help the smaller banks think differently about FedNow and find a path to competitiveness.”