You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

Crypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

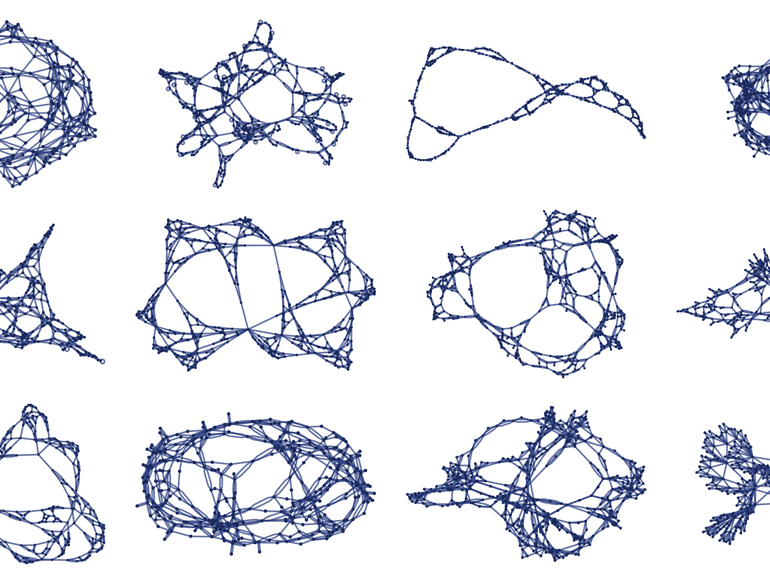

I came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

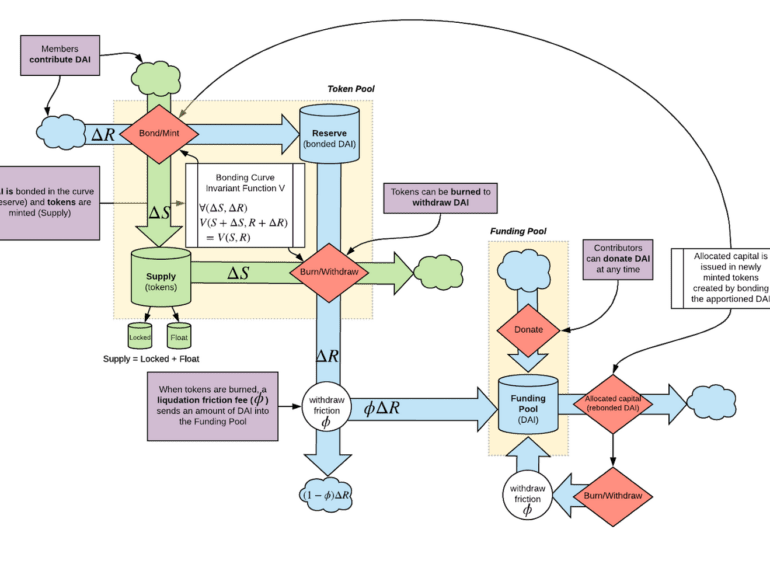

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

The question of consciousness goes to the root of why we build, what we create, and how we decide what is valuable and what is not. And if we can control our self-conception and the modeling we do of the world, the texture of life becomes better. A recurrent theme in our writing is that systems don’t care about their agents per se. There are many game theoretical equilibria where agents suffer, but systems perpetuate. So figuring out how an agent within a system reflects on happiness is paramount.

This week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

his week, we look at:

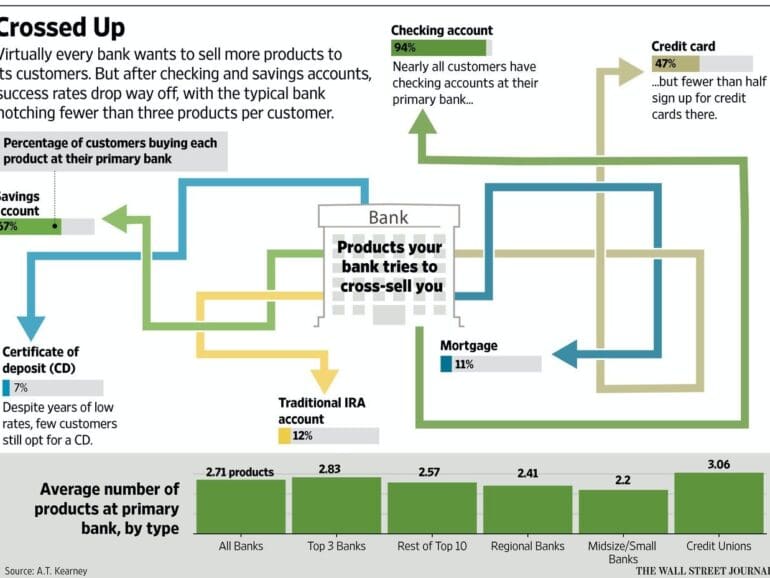

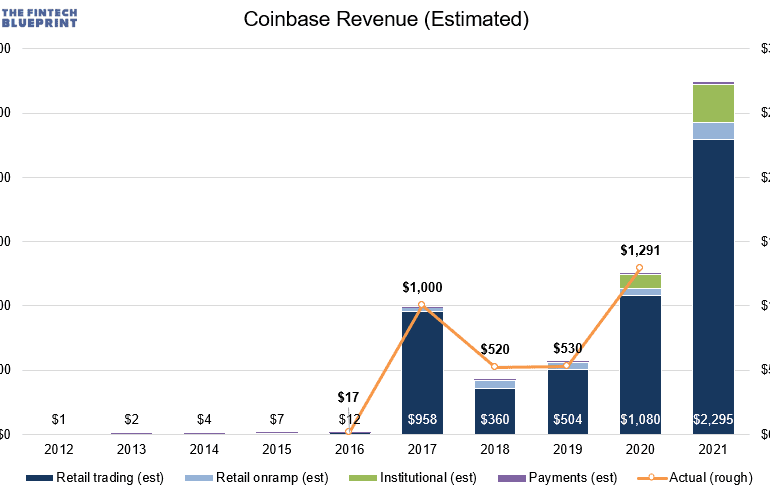

There are two very large revenue pools in the crypto asset class — (1) mining, and (2) trading. There are some large revenue pools in crypto-as-a-software, too, but those tend to be less sensational.

This analysis will establish a 2021 baseline for the most regulated of crypto exchanges, Coinbase, including a detailed financial model building a $100B+ valuation case

We then consider the valuations and multiples of capital markets protocols in Decentralized Finance of Ethereum, now making up over $60B in token value

Lastly, we look at Binance’s $1B in profits, its $35B BNB token, and the activities on Binance Smart Chain

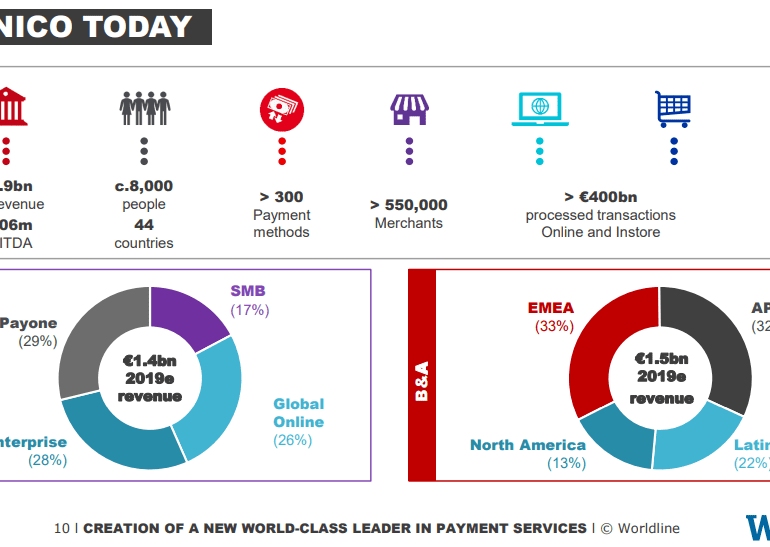

I look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.