Paradigm, a zero-fee liquidity network for crypto trading, launched one-click futures spread trading on FTX on Friday.

FTX is the third exchange to use Paradigm for fee-free futures trading as a service, the firm said in a release.

A Singapore-based startup, Paradigm posted a $35-million Series A Round in December 2021.

FTX CEO Sam Bankman-Fried said Paradigm was a top choice for crypto derivatives.

“Paradigm is a leading network providing institutional liquidity for crypto derivatives, and we’re excited to expand on our relationship with a formal partnership to collaborate on product developments for both of our users,” Bankman-Fried said in a release.

“This structured spread trading product is the first that will enable crypto investors to utilize cash and carry trades through FTX and Paradigm.”

Liquid interest rate curve

Paradigm said the partnership was a significant step towards developing a “liquid interest rate curve” in crypto. The idea is that commodities like oil have a curve of futures pricing for any given day that changes up or down as the market fluctuates. In crypto, a lack of liquidity keeps futures a laggard trading vehicle.

Paradigm users can trade the spread between spot prices and futures on BTC, ETH, SOL, AVAX, APE, DOGE, LINK, and LTC, all with guaranteed “atomic execution” and clearing within FTX.

CEO Anand Gomes said he was ecstatic to partner with the talent at FTX.

“FTX and Paradigm have a longstanding relationship, and I am ecstatic that we can bring our two companies together to improve the crypto ecosystem. With basis trading becoming a tradeable asset class on FTX, we should see significant interest from both crypto-natives trading yield and new crypto investors who can now trade cash and carry as a single asset,” Gomes said. “Looking ahead, combining the client base and product expertise of both companies will undoubtedly lead to more synergies and new product offerings further down the road.”

Futures trading coming to DeFi

Finance professor Richard Excell, an advocate of the Paradigm mission, said he believes DeFi futures trading can revolutionize markets through more efficient pricing, and futures trading within crypto is only increasing.

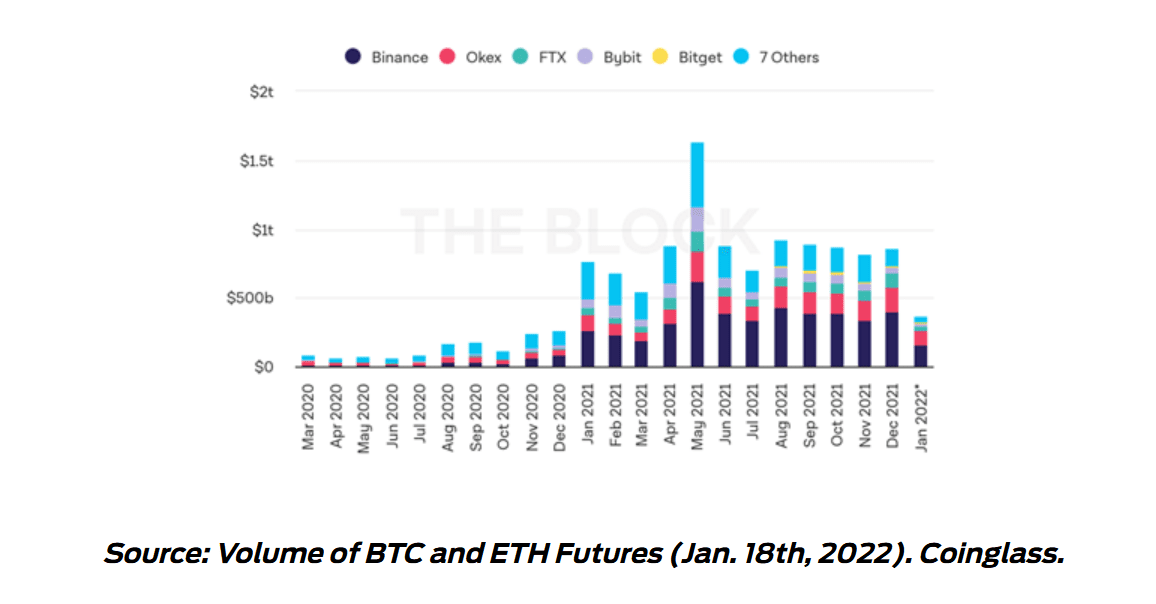

“Futures trading is increasing along with the increase in spot trading in cryptocurrencies. As more institutional investors enter the market, either as end-users, hedgers, or speculators, there will be a need for sophisticated futures markets and futures curves to develop. We can see the volumes of just BTC and ETH futures below. This will surely go up over time,” he wrote in a blog post, referencing this graph plotting the brief history of crypto futures trading.

Paradigm said in a release that efficient spread trading would benefit the collaborative ecosystem.

After the partnership, yield-seeking investors can now effortlessly execute “cash and carry” trades leveraging FTX’s spot and futures instruments across multiple currencies and futures expirations. In addition, traders can farm funding rates on perpetual with a single click.

According to Paradigm, many traders and investors use futures to hedge or replicate crypto exposures. Futures spreads enable market participants to buy one futures contract and simultaneously sell another futures contract with a single trade. The firm said spreads provide more tools to traders and investors looking to save money on “Rolling” expiring future positions.

Fewer fees

Spreads executed on Paradigm and cleared on FTX will be charged 50% fewer fees, the firm said, compared to executing two individual outright trades.

Paradigm is a zero-fee liquidity network for crypto derivatives traders across centralized finance and DeFi.

Launching out of stealth in 2018, Paradigm aims to create a platform where traders can trade with anyone and settle it anywhere. The firm said that the new platform provides traders with unified access to multi-asset, multi-protocol liquidity on demand without compromising on price.

Related:

Paradigm has the largest network of institutional counterparties in crypto, with over 1,000 institutional clients trading over $10 billion per month, the firm reported, including hedge funds, OTC desks, lenders, structured product issuers, market makers, and prominent family offices.