It is a theme that has been reported widely — gender diversity in the finance sector is dire.

Yes, we are increasingly hearing of improvements and appointments of women to higher-level positions. Unfortunately, these developments still leave much to be desired.

In a survey conducted by Findexable, it was reported that 11.3% of board members are women globally, while 19% are company executives. Most female executive positions are held in HR, accounting for 27%. Only 7% hold the CEO title, which drops to 3% if the focus is on Noth America.

In the UK, the results have improved but need continued focus. Despite diversity being a strong focus of the 2021 Kalifa Review, there continues to be an imbalance in gender representation at all levels of the fintech industry.

“A recent report we have produced in partnership with EY highlights that the ratio of men to women in UK fintechs currently stands at 2-to-1,” said Janine Hirt, CEO of Innovate Finance.

“Some of the biggest barriers exist in supporting top-level management positions and underrepresented founders in accessing investment and increased capital.”

Problems accessing capital

Female-only founders make up 1.6% of the global fintech ecosystem, stretching to 10.5% with the inclusion of founding teams of men and women.

According to the Innovate finance report, in the UK, this number stands well above average at 40% for fintech start-ups. When reviewing larger businesses, however, the proportion of female founders drops to 15% of scale-ups and 5% of financial institutions.

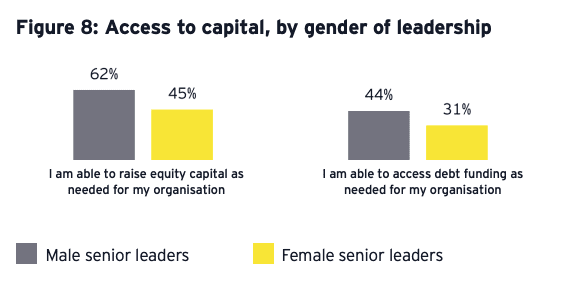

The drop could be accounted for by female leaders’ issues in raising capital. In an earlier study by Innovate Finance, only 10% of venture capital was reported to go to female-driven fintechs. Below half of the female leaders surveyed reported easy access to capital.

“We know that female founders often don’t have sufficient access to the capital they need to fuel growth for their businesses,” said Hirt. “Female founders need the same support that any other founder receives to grow their business and ensure the playing field is leveled.”

“The UK clearly has an opportunity now to set international standards for diversity in the fintech industry and lead by example,” said Hirt. “To maintain our global leadership in financial innovation, we must work to achieve more progress on diversity and inclusion.”

Disparity increases at every level

The issue of low levels of female founders and C-Suite operatives is far-reaching and could have a knock-on effect on the diversity of the whole business.

More than a quarter of female respondents came from firms founded by at least one woman, compared with 17% of males. “Workplaces with fewer women in top management positions are statistically less diverse and tend to attract non-diverse talent in a repetitive vicious cycle,” continued Hirt.

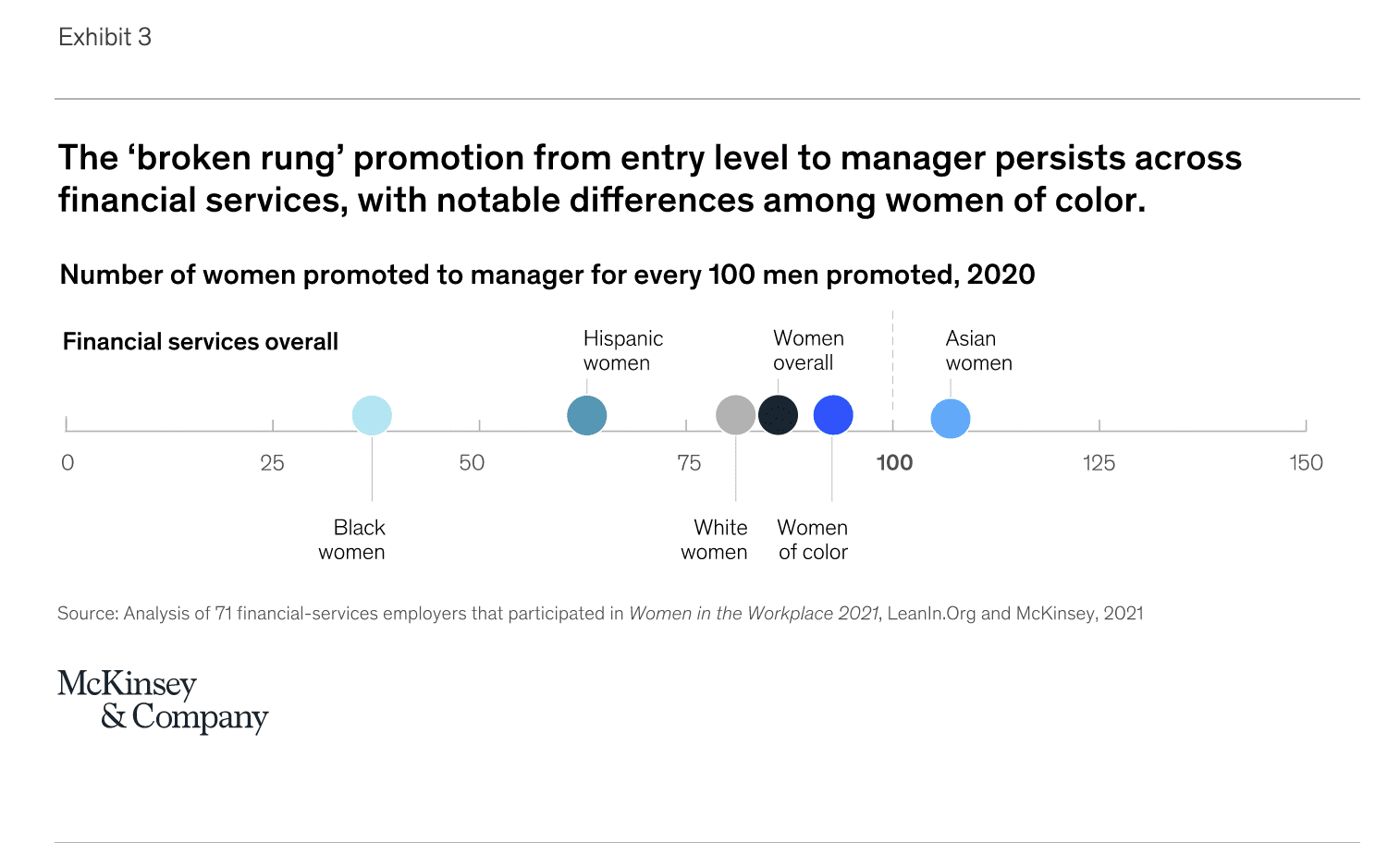

The lack of representation in the C-Suite poses an issue from the beginning of the career progression.

Traditionally perceived as a “boys club,” the finance sector has been notoriously difficult for women to enter on a social level.

Reports on discriminatory jokes and comments towards minority groups have reduced but remain in the public mind posing a barrier to entry. It is reported that the number of women entering STEM degrees is dwarfed by the number of men, many citing a lack of leading figures in the industry.

Some women felt access to networking opportunities to achieve promotions was also out of reach. In a report conducted by Lean In, it was found that even the first step of promotion is difficult. For every 100 men promoted to a first-level management position, 86 women are promoted.

Innovate Finance found that in terms of networking, 86% of women say they can build and leverage a network of peers and advisors, and 78% feel peers and broader society support their work. Although those numbers are encouraging, they are noticeably lower than the 92% of men who think the same.

Hirt, who has had many leadership positions in the finance sector, cites mentorship as a great help. “Having spent over 15 years in various leadership positions,” she said, “I’ve been privileged to have many opportunities to experience various industries – giving me a close understanding of many areas of business.”

“This taught me a lot about adjusting and adapting to different environments, cultures, sectors, and teams. I have been incredibly fortunate to have close mentors – both men and women – supporting me along the way, helping me grow, and offering guidance and wisdom during the inevitable challenges and struggles that so many of us women face in the industry.”

Many institutions have implemented mentorship programs to address this need.

Inclusive workplaces drive diversity

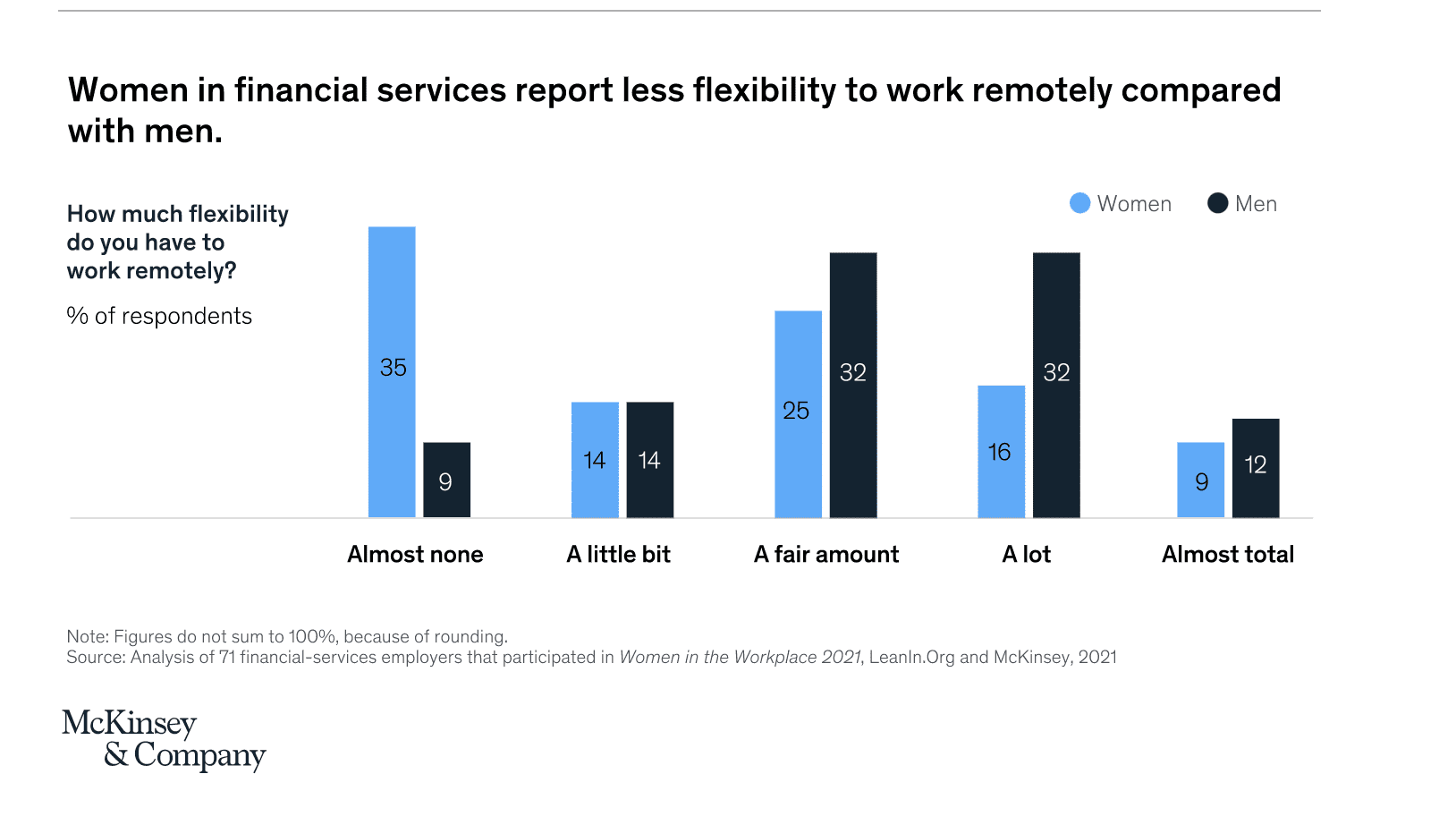

Hirt explained that an inclusive workplace environment was essential to achieve increased diversity. “In terms of diversifying talent in the workplace, more robust recruitment and career programs must ensure that companies are hiring people at equal rates and creating opportunities for all. Beyond this, workplaces need to be physically or digitally inclusive and accessible for all, offering flexible working arrangements.”

In Findexible’s Fintech Diversity Radar report, women were more likely to take on roles with flexible working environments, highlighting the differing needs of different demographics.

Although women reported an environment where they could voice their opinions, many felt they were not acted upon. Even more said they would be unlikely to request changes to their working environment for fear of it reflecting poorly on their career.

It is an issue that seems to affect many areas of employment. Fundamentally, nearly two-thirds are reported to have felt their gender affects how they are perceived professionally. In start-ups, 71% of women are less likely to voice opinions on ethical issues for fear of professional repercussions. Under 20% of women are uncomfortable asking for flexible working conditions, compared to 30% of men for the same reason.

Although these issues are not constrained to the fintech industry, many are turning to fintech as a tool for change. The sector which uses innovation as a driving factor has opportunities for many types of change which could extend to rethinking the status quo in employment and diversity.

Data Drives Change

Of all the respondents in leadership positions, 70% of males in leadership positions felt the fintech industry was inclusive, while only 25% of female leadership said the same.

Given the disparity in perception, data is critical to assess the environment properly, and surveys are essential for continued development. This general misconception at higher levels could pose an obstacle to change.

Related:

“Measuring impact and applying data-driven models for business growth can act as a guideline for recording and measuring results, identifying room for development, and celebrating progress,” said Hirt. “The Innovate Finance report showcases the efforts made by the UK ecosystem so far to secure a more inclusive future. I hope this momentum can be reflected globally and that the fintech sector embraces a bright and diverse future for all.”

Although the current statistics still paint a gloomy picture of the gender divide, it has continued improvement.

“I definitely feel that on the whole, we are on a positive trajectory, with strong momentum towards a more inclusive future,” said Hirt. “And I am passionate that we continue working together to move forward in the right direction.”