Fintechs are learning that college campuses are valuable markets for their unique ecosystems and the students they serve.

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

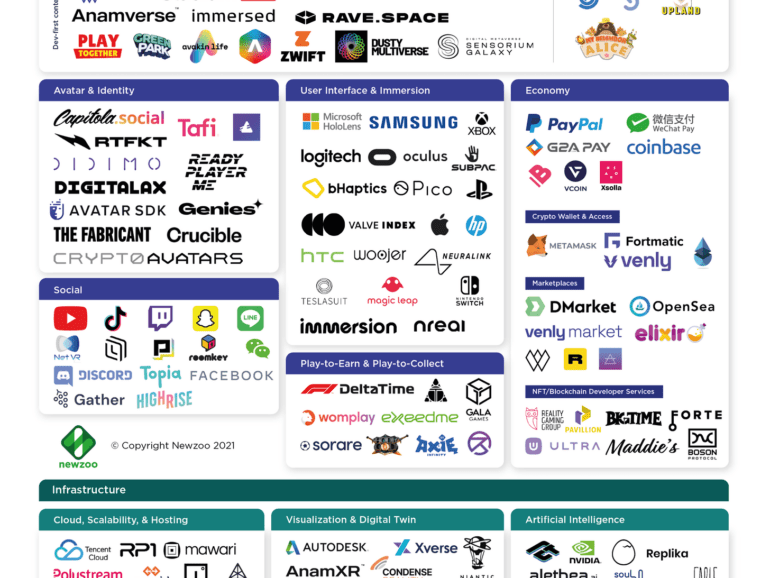

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

In this conversation, we delve deep into next generation finance and banking with CJ MacDonald, the Founder and CEO of Step – an incredibly successful neobank on a mission to improve the financial future of the next generation.

More specifically, we discuss traditional vs. digital banking, how personal experiences influence entrepreneurial the spirit, immersive market research, banking-as-a-service, the importance of financial literacy amongst Millenials and Gen-Z, the power of influencers who actually believe in a brand, aspirational brands vs. plastic Wells Fargo stage coaches, and lastly the proliferation of crypto in the minds of the next generation.

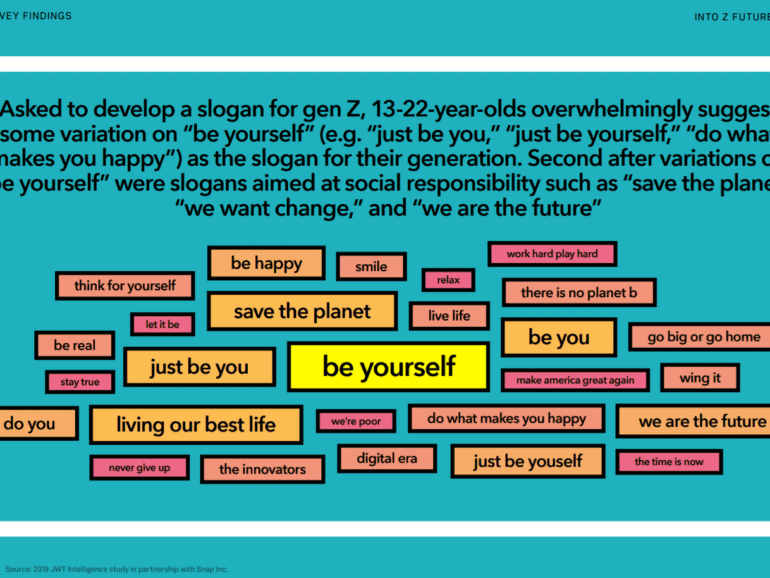

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.

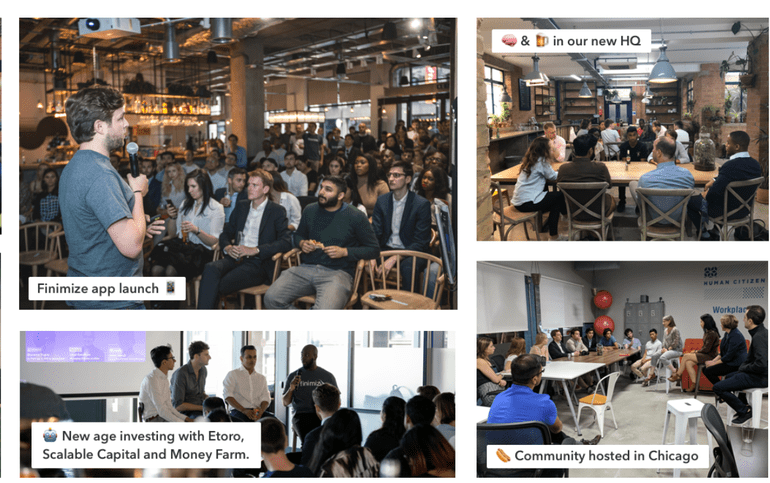

In this conversation, we talk with Maximilian Rofagha, who serves as the CEO and Founder of Finimize, about how to do personal finance right and how to do it bottoms up for the world.

Additionally, we explore Max’s journey to becoming an entrepreneur, the nuances of the e-commerce business, the building of and drivers behind community and creating business activities around it, the influences of FinTok and crypto assets on financial community, and the drivers of value back into said communities fulfilling the feedback loop.

This week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

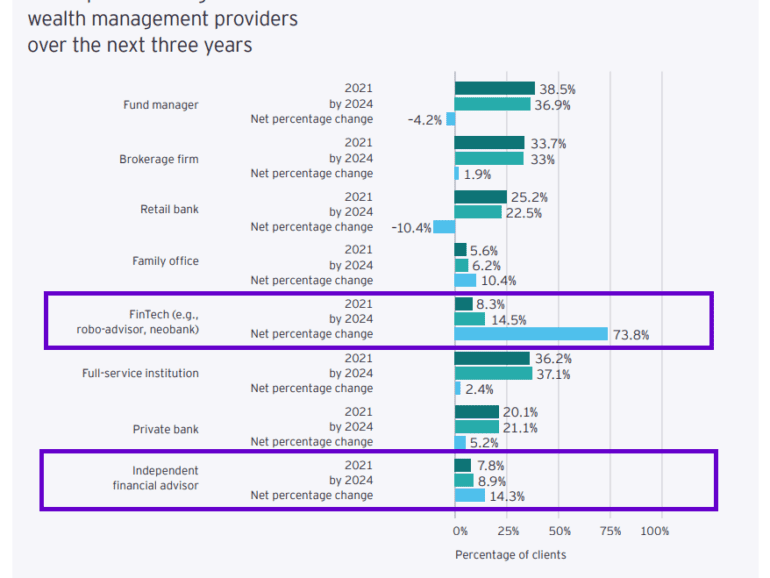

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process

central bank / CBDCdigital transformationgenerational changemega banksnarrative zeitgeistphilosophyvisual art

·This week, we look at:

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

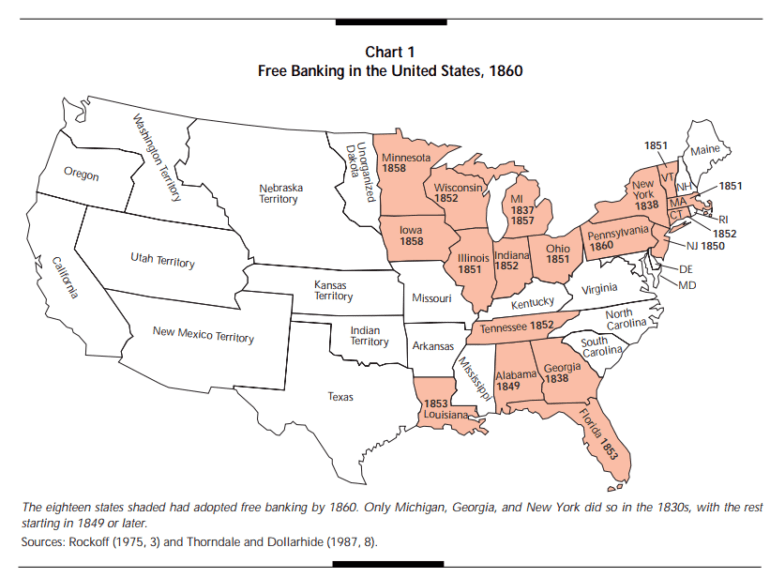

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

This week, we look at:

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

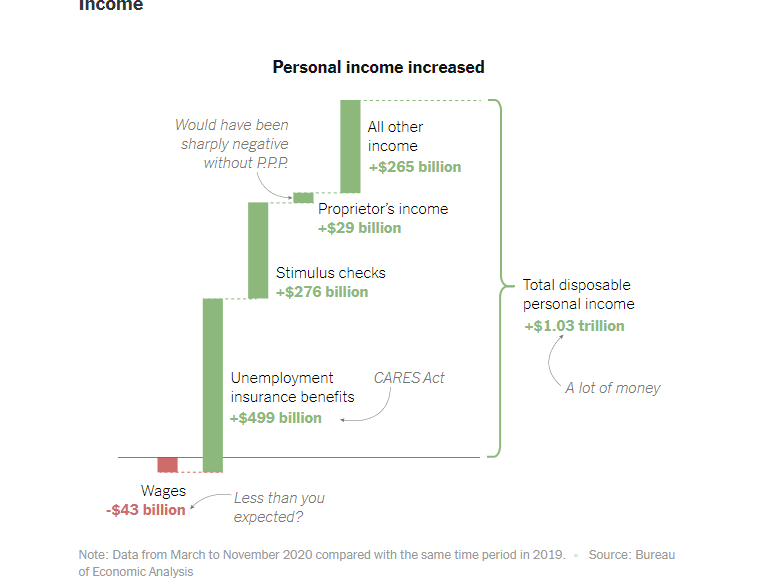

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

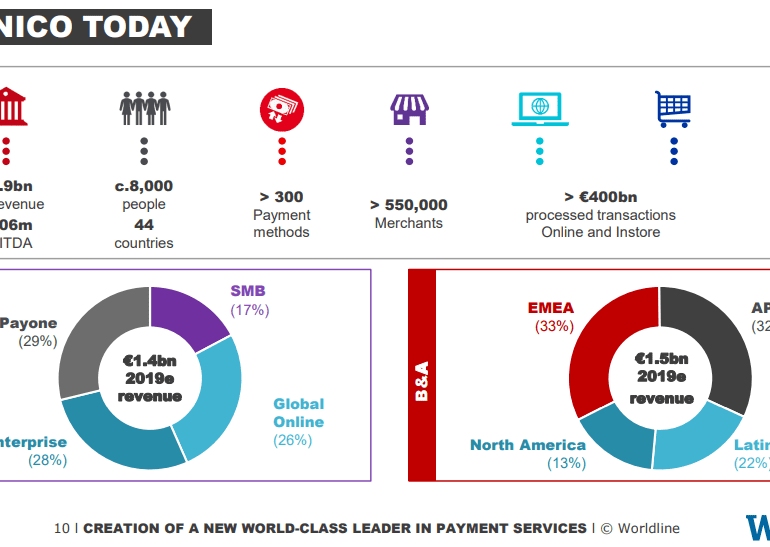

I look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.