The glittering potential of the GenZ market has affected many aspects of the finance industry.

This new generation, now many in the midst of early adulthood, is said to be more engaged in their finances, more tech-savvy, and craving for a personalized touch.

“They want something more fun, flexible – something that they can relate to on a brand level,” said Olle Lind, Founder of Buddy app.

With rising costs and inflation rates outpacing salary increases, budgeting has become a necessity.

According to Bloomberg, on average, GenZ consumers save around a third of their income, and in light of recent economic challenges, 40% have reported reducing expenses.

General anxiety about the landscape has also been heightened, with GenZ showing higher levels than all other generations.

Digital Payments Met With A Digital Solution For Budgeting

In response, GenZ has turned, as always, to digital devices for an answer.

App Radar found that in 2022, money management apps had shown an increase in popularity, gaining six million users in H1 on android alone.

Lind felt the shift has been a logical one.

“Growing up without a mobile and with fewer options for digital payments, you could organize things automatically. You had the physical money in your wallet, so you knew how much you had to spend. “

“That’s almost like having a budget. You can see you have the money in front of you. And if you use some, you can see how much you have left.”

“The younger generation is growing up with all these other ways of spending their money. They don’t even have to have the money to spend it. They can just press the button anyway and get the stuff and then deal with it later.”

A recent study by the New York Federal Reserve found that younger generations were significantly more likely to become delinquent on credit card debt and auto loans. BNPL is an area particularly favored by GenZ, but the demographic has shown issues with repayments.

Lind felt the answer was to meet the generation where a lot of their lives already lie.

RELATED: Quirk: The GenZ financial literacy app tailored to user’s personality

An Intuitive approach

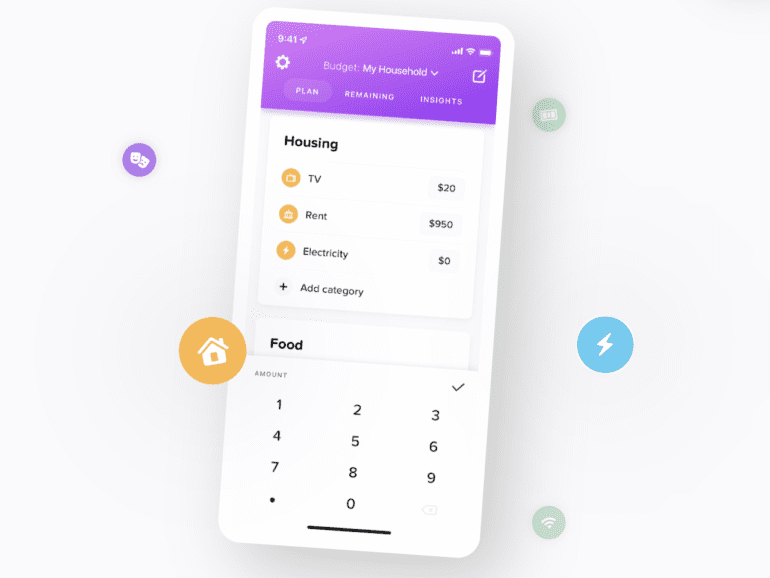

Buddy was created by Lind as a response to his own need to create a budget, a process he described as “not intuitive.”

“A budgeting app is something you’re going to use maybe several times a day, or at least a couple of times a week when you’re tracking your finances and updating your budget,” he said. “So it needs to be an app that you actually want to use.”

He explained that with more consumers turning to shared living, the need for the budget is compounded.

“Everyone that I asked had the same problems. They were either, at the end of the month, looking at their expenses and trying to cut them in half to make it fair, or they had rigid systems where they’re putting down the receipts, making notes of everything, and calculating – It’s messy.”

The Buddy app, therefore, has two components, one budget for the individual and the capability to link accounts with another Buddy user to create a shared budget.

The app was popularly received, expanding beyond the European market to the US and Canada in 2022.

While initially, the app had been created to approach a problem he found in his own generation, Lind found that the main demographic for downloads was GenZ.

“GenZ is used to digital services, so it makes sense for them to get an app to handle their financial needs.”