The following is an excerpt from today’s Global Newsletter.

Another day, another major fintech partnership involving BNPL.

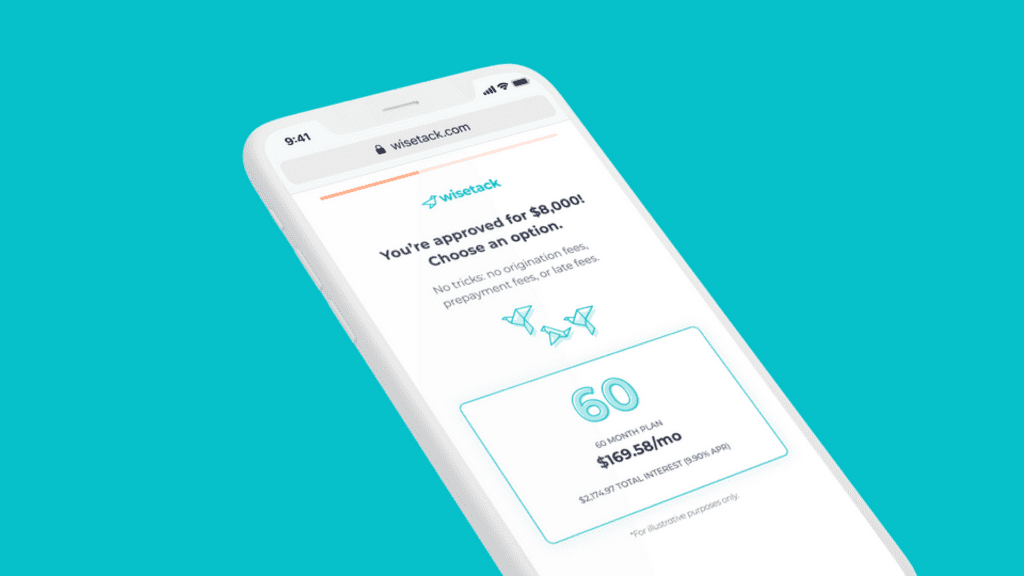

This time it was Citizens Financial Group announcing it is working with Wisetack to offer a B2B2C service.

As a super-regional bank, Citizens has been at the forefront of fintech for some time, as deals with Apple, Best Buy, and Microsoft had them heavy in the consumer space. With the latest move, they’ve ramped up small business BNPL loans in a major way.

For Wisetack, this is their first partnership with a large bank.

Let’s call this an early feel-good Friday win-win story.

Featured

| Citizens launches small-business installment loans with fintech partner By Kate Fitzgerald Citizens Financial has teamed with Wisetack, which supports dozens of platforms connecting to thousands of home improvement, dental, and veterinary service providers. |

Sponsored

Calling all builders! By Fintech Nexus Subscribe to The Fintech Blueprint for in-depth analysis of fintechs, DeFi & investing. From the mind of Lex Sokolin, Chief Economist, ConsenSys. |

From Fintech Nexus

Credit and Underwriting – Best Practices for Uncertain Times By Peter Renton At Fintech Nexus USA the Credit & Underwriting track is always one of the most popular. Here is a description of the track and links to the audio of all the sessions. |

DeFi: Uniswap V4 and its new Hooks; Machine learning compute protocol Gensyn raises $43MM By Farhad Huseynli Neuromancer, William Gibson’s sci-fi novel, saw a future of decentralized networks, free from the constraints of concentrated power. The AIs were its alien gods. |

Podcast

| The Fintech Coffee Break – Adam Nash, Daffy This week Isabelle sat down with Adam Nash from Daffy to talk about modernizing donor-advised funds and why it’s under-utilized… Listen Now |

Webinars

| Unmasking Sanctions Evasion: Trends, Challenges, and Solutions Today, 2 p.m. EDT One of the most crucial components of compliance is sanctions screening, which entails identifying and blocking transactions… Register Now |

| June 20: Challenges and Opportunities of Digital Credit Register Now |

Also making news

- USA: Trouble in Camelot, as the Home Loan banks face scrutiny The idyllic existence of Federal Home Loan bank leaders has persisted for 90 years. Now the castle walls may be crumbling.

- USA: PE firms eye Goldman’s GreenSky at steep discount Goldman Sachs has received several offers from investment firms to buy its BNPL-based home improvement lender GreenSky, according to a press report.

- USA: BNY Mellon, MoCaFi link up to bring digital payments to unbanked The bank’s treasury services clients will now be able to disburse payments to those without bank accounts through MoCaFi.

- USA: Crypto can run, but It can’t hide Cryptocurrency firms besieged by the SEC might be lured to friendlier jurisdictions overseas until they cause scandals that again lead to tighter regulation.

- USA: Why a Ripple win isn’t a free pass for Coinbase In the week since the Securities and Exchange Commission filed its lawsuit against Coinbase, the buzz has been building in the crypto community about another case that could derail the security regulator’s sweeping crackdown.

- USA: On Fifth Third Bank’s acquisition of Rize Money As the hammer of economics lands on fintech, multiple firms are getting acquired by incumbents, like banks. Last month, Fifth Third Bancorp acquired Rize Money, a payments infrastructure provider.

- USA: $5 billion fintech Zepz looks to take on rivals like PayPal with digital wallet, M&A plans Money transfer unicorn Zepz is looking to expand its business through mergers and acquisitions, the company’s CEO Mark Lenhard told CNBC.

- LatAm: Brazilian fintech Kanastra closes $13m Seed investment Kanastra, a capital markets infrastructure fintech in Brazil, is today announcing a $13 million seed round investment, one of the largest at this stage in Latin America.