The following is an excerpt from today’s Global Newsletter.

So much for a slow news week.

One day after dropping 13 counts against Binance, the largest crypto exchange worldwide, the SEC set its sights on Coinbase.

These two cases only share one common thread, yet they’ll likely be grouped together by mainstream media outlets to make crypto the financial boogeyman.

With Binance, there has been an odor emanating from their C-suite for some time now, while Coinbase has been doing the same thing since going public.

This is not the first time Coinbase has been victimized by the SEC, not only moving the goalposts but changing the rules during the game.

Coinbase was approved when they IPO’d, and now they’re just PO’d as the legal monopoly that is the SEC decided to flex its muscles. Why the SEC did not give Coinbase a warning and require platform changes within, say, 60 days further illustrates their bad faith view of crypto.

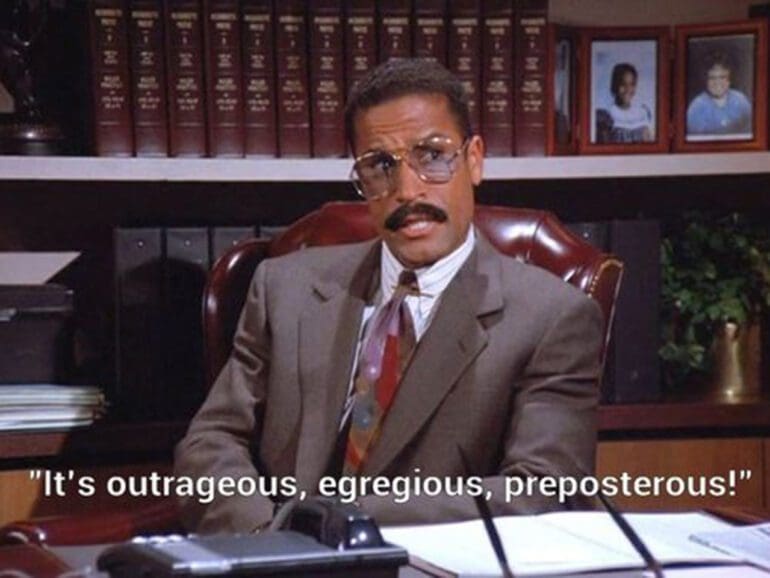

The only upside for Coinbase is they have a shot at winning this case. It’s such an outrageous, egregious, preposterous lawsuit that Coinbase could hire Jackie Chiles and still come out with a decision.

Featured

| SEC sues Coinbase in latest move against crypto www.wsj.com The regulator said the U.S.’s largest crypto platform violated rules that require it to register as an exchange. |

From Fintech Nexus

By Isabelle Castro Margaroli In the SEC’s suit against Binance, the regulator goes far beyond the “unregistered securities” take – but still lack the community’s trust. |

By Patrick Gauthier With a volatile backdrop, companies trading internationally want to future-proof their payments and their ability to deliver for shareholders. |

Also making news

- USA: CFPB enforcement actions plummet under Chopra The Consumer Financial Protection Bureau’s enforcement actions have plummeted under the leadership of director Rohit Chopra, while employee morale at the agency is lagging compared with the Obama administration.

- USA: Why JPMorgan wins I’ve written a lot about JPMorgan for over two decades, ever since Jamie Dimon took over the bank in 2004. Back then, it was notable that he made a decision to revoke a massive ten-year outsourcing contract with IBM.

- USA: Swift and Chainlink will test connecting over a dozen financial institutions to blockchain networks In a new set of experiments Swift will collaborate with major financial market institutions like Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear and Lloyds Banking Group.

- USA: Challenges facing Paze: Jostling for position in a crowded digital wallet space EWS unveiled its digital wallet service called Paze earlier this year in a move to capture value in a space where fintechs like PayPal and Apple have the upper hand.

- Global: The Fintech 50 2023 The past year has been brutal for some fintech startups, as valuations crashed, cash dwindled, layoffs mounted and fire sales and failures loomed.

- Global: Digital leaders differ from other banks in talent strategy, research shows Workforce research expert Stella Ioannidou is seeing a new class of retail banks emerge that has found effective ways to survive the ongoing digital transformation tsunami.