The following is an excerpt from today’s Global Newsletter.

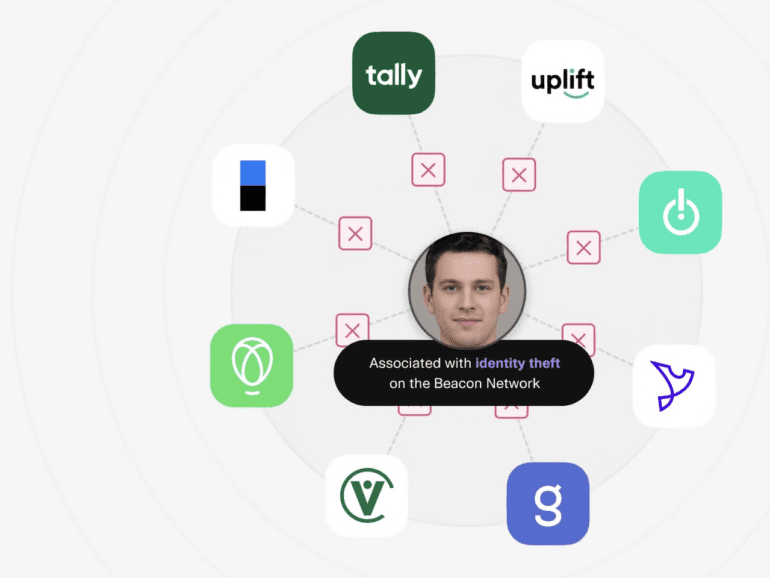

In a tale almost as old as time, the rise of a hero to vanquish rising evil has come to fintech’s fight with fraud. An announcement from Plaid, launching their collaborative fraud fighting network, Beacon, which is designed to “stop the chain reaction of fraud.”

Until now, fraud-fighting has been the plight of stand-alone entities. Lone vigilantes in their efforts to stop attacks and protect their customers.

Plaid Beacon pulls on the strength of the many by opening itself out to contributions from fintechs and financial institutions, reporting instances of fraud that can help to identify bad actors at the moment of account creation despite changes in data.

In a chicken-and-egg situation, this network approach is only effective within an already established ecosystem. Only a company of Plaid’s size and clout would be able to pull off such a feat.

Spoken in true superhero fashion, Plaid’s Head of Identity, Alain Meier, has said, “There’s power in numbers, and together we can help stop the chain reaction of identity fraud.” – maybe an en end is finally in sight for the threat.

Featured

| Plaid launches Beacon- fighting fraud in real-time By Isabelle Castro Margaroli Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed. |

From Fintech Nexus

Real-world asset tokens – a ‘killer use case’ for blockchain By Isabelle Castro Margaroli Real-world asset tokenization was set to be a multi-trillion-dollar market by 2030. It’s still on track despite FTX setbacks. |

Qik, Dominican Republic’s first neobank, to ramp up fintech services in the Caribbean By David Feliba Fintech Nexus sat down with Qik’s CEO, the first neobank in the Dominican Republic. Traditional lender Grupo Popular to invest $70 million. |

Podcast

The Fintech Coffee Break – Kevin Greene, Tassat

I sat down with Kevin to see how Tassat viewed the introduction of a new real-time payment system and how it would effect…

Webinar

Double Whammy: How Criminals Exploit Economic Turbulence and New Tech to Attack

June 28, 2 p.m. EDT

Our experts will discuss the strategic decisions executive and security leaders in fintech must address.

Also making news

- USA: Robinhood to buy fintech firm X1 Robinhood Markets is buying financial technology firm X1 Inc for about $95 million in cash as it looks for new revenue streams to counter weakness in its mainstay trading unit.

- USA: Does a federal court ruling threaten the future of decentralized finance? A judge ruled this month that a decentralized autonomous organization, or DAO, can be held liable for violating commodity exchange rules. That squashes the notion that the decentralized trading model is enforcement-proof.

- Europe: Digital Pound Should Be Interoperable with Crypto, U.K. Lobbyists Say Stakeholders also want the Bank of England to consider tougher caps on individual digital pound holdings to prevent bank runs.

- USA: CFPB says consumers in the South face banking deserts, higher rates The Consumer Financial Protection Bureau issued two reports analyzing banking and consumer credit trends in the South, where many rural areas are considered “banking deserts.”

- USA: Majority leans into subscriptions as consolidation hits fintech sector Majority raised $9.75 million in new funding this month, some of which it plans to put toward a meet-up space it recently opened at the U.S.-Mexico border in Laredo, Texas.

- USA: SEC Case Hamstrings Binance.US The crypto exchange, founded as a U.S. offshoot of Binance in 2019, is in a precarious situation after the Securities and Exchange Commission sued both exchanges and their founder, Changpeng Zhao, for securities violations earlier this month. The allegations included that Binance and Zhao commingled customer assets and secretly controlled Binance.US.

- Global: 53% of consumers trust Generative AI for financial planning Generative AI may be the new kid on the block but it is quickly earning consumer trust in areas like investment and shopping. In part this quick consumer uptake may be emerging from how companies have reacted to the race in Generative AI.

- LatAm: Now Bank, the Mexican neobank taking on digital banking Neobanks could gain ground against fintech and digital banking, representing a new alternative for younger Mexicans.