The following is an excerpt from today’s Global Newsletter.

Two of our favorite Forbes fintech pundits weighed in on the potential of the Apple Vision Pro headset to transform digital banking in the not-to-distant future.

First, there was grumpy Gus Ron Shevlin, who suggested Apple’s move was more about protecting their territory from Meta than changing the fake world.

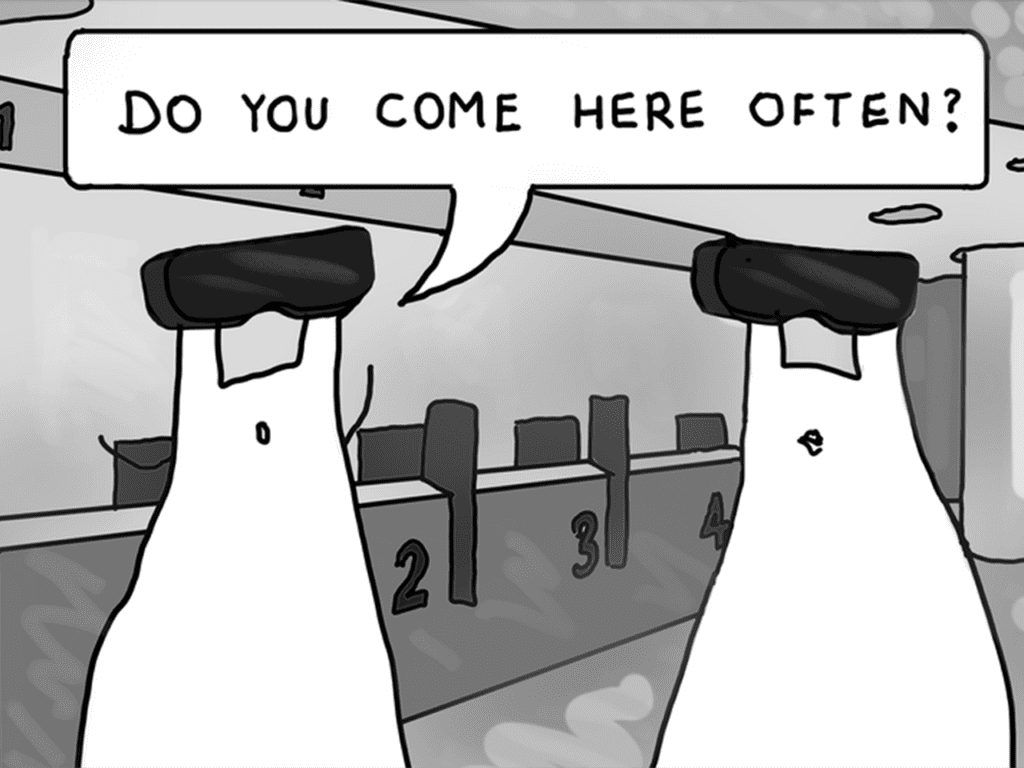

Dave Birch — and his talented cartoonist Helen Homes — were next up, and Dave was more glasses half full. His take was the divide could “cement the relationship between the user, the platform, their identity (and, in time, those wallets) but using iris biometrics, an obvious step up from FaceID.” Interesting point.

While we may be five-plus years away from a critical mass move to the metaverse (I tend to lean more toward Ready Player One and Tron versus any glorious utopia), it’s clear SOMETHING will come of this in fintech. Until the hardware is as ubiquitous as the iPhone, it will likely be an expensive sandbox for the tech nerd herd to populate.

Featured

| A fintech vision for the Vision Pro By David G.W. Birch, Contributor Apple has entered the virtual reality (VR) and augmented reality (AR) field with its Vision Pro headset, fintechs should look at their metaverse strategies. |

From Fintech Nexus

Digital banks plow ahead in Brazil despite funding challenges By David Feliba Despite a challenging scenario for Latin American fintechs, neobanks and digital wallets in Brazil continue to sign up millions of clients. |

Fintech: Apple Cash push into ID and recurring payments; Blackrock Aladdin teams up with Avaloq, no FutureAdvisor mention By Laurence Smith Businesses will be able to accept IDs in Apple Wallet with iOS 17, among other changes. |

Podcast

| Fintech Blueprint: The role of USDC and tokenized cash in Decentralized Commerce In this conversation, we chat with Teana Baker-Taylor, VP of Policy and Regulatory Strategy, EMEA for Circle. Listen Now |

Webinars

| Challenges and Opportunities of Digital Credit June 20, 2 p.m. EDT How can community banks and credit unions compete and win against big banks and fintech lenders? Register Now |

| June 28: Double Whammy: How Criminals Exploit Economic Turbulence and New Tech to Attack Fintechs and Banks Register Now |

Also making news

- USA: Crypto payments firm Wyre winding down due to ‘market conditions’ The crypto payments firm is ceasing operations less than a year after it was valued at $1.5 billion in an abortive acquisition by Bolt.

- USA: Binance reaches deal with government to avert U.S. shutdown The Securities and Exchange Commission agreed on a compromise with Binance that will keep the exchange open as it battles a fraud lawsuit.

- USA: Customers Bank hires 30 Signature bankers, acquires $631M portfolio The new team is expected to be onboarded in the next few weeks. The Pennsylvania bank bought the portfolio at approximately 85% of book value, it said.

- Global: SVB customers who lost their deposits remain on the hook for loans Customers of Silicon Valley Bank’s Cayman Islands branch who counted on using their deposits to repay credit lines are in a bind after the FDIC seized the funds.

- USA: CFPB seeks to supervise Big Tech firms under larger participant rule The Consumer Financial Protection Bureau plans to issue a larger participant rule that would allow the agency to examine consumer payment markets. The rule will allow the CFPB to examine and supervise Big Tech companies such as Apple, Alphabet’s Google, PayPal and Square.

- USA: Fed launches master account database The Federal Reserve will now disclose all entities that have access to its payments system, as well as those that are seeking access. The move ends a yearlong standoff with Congress.