Gold has long been the choice for secure, low-risk investment.

Characterized by its resistance to inflation over the years, the asset has withstood the test of time. Gold value trading can be dated as far back as 500 BC, although use within jewelry dates to even earlier.

Investment in gold as a diversifying asset is essential for many. “If you want to keep your gains in a stable asset, then it certainly works better with gold than USD or anything else when we look at inflation,” said Brian Hankey, co-founder of Cache Gold.

“The price of gold fluctuates, but historically it goes up in value relative to the dollar by 7 or 8%. It depends on the time frame. Generally, gold goes up in value on average, and fiat currencies go down.”

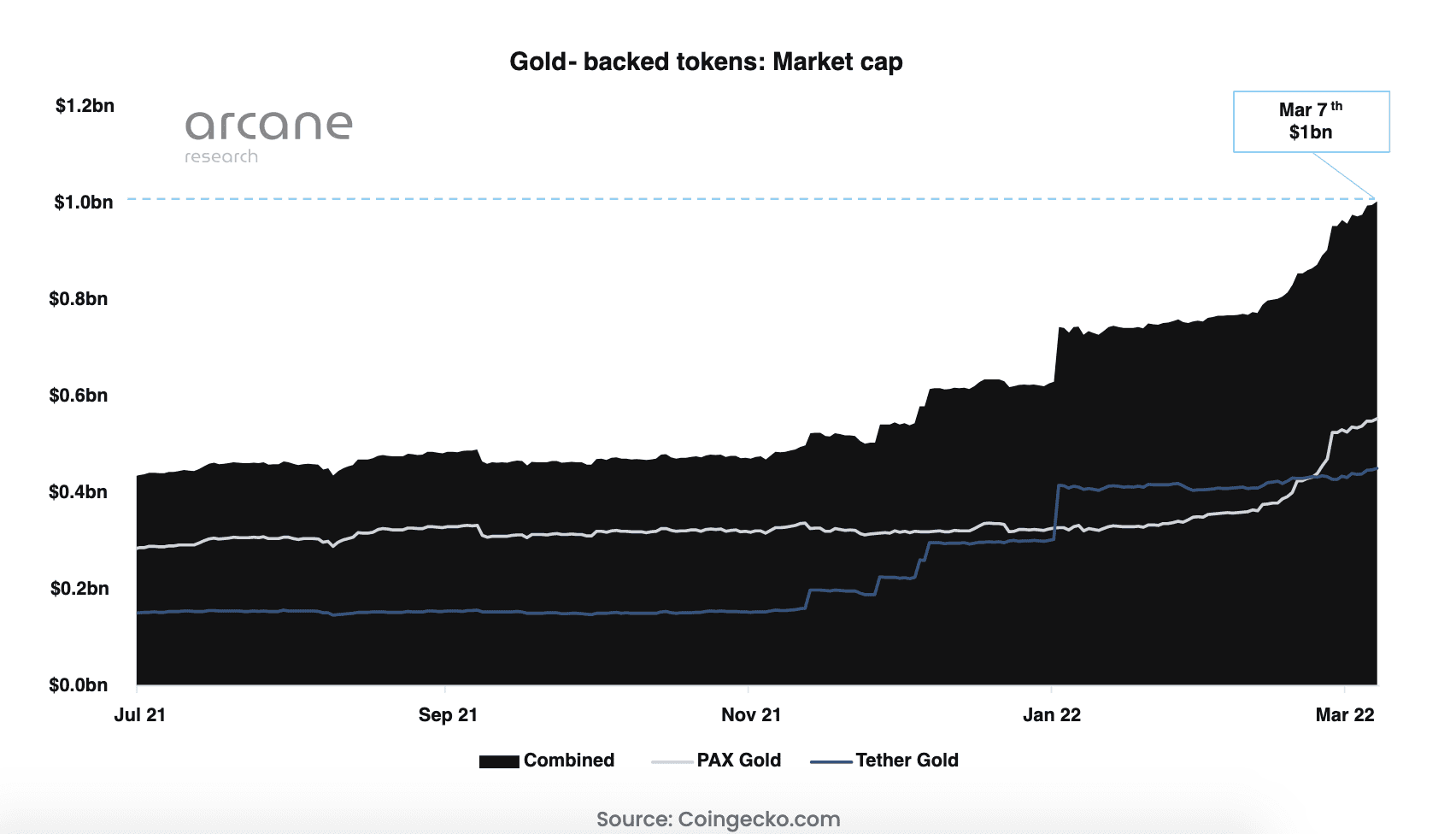

As inflation soars at an ever-increasing rate, there has been an influx of companies offering gold tokens. These digital assets can be an alternative investment to stablecoins and even physical gold. Investors are responding. In 2022 the market has already seen gold token capitalization reach over $1 billion, and Arcane Research reported investment to be up 4%, while Bitcoin saw a drop of 18% in the first quarter.

The appeal of gold tokens

“It’s a growing trend,” said Hankey. “In our core business of buying and selling physical gold, there has certainly been a strong upward trend since the beginning of 2020.”

“Tokens offer a pretty cost-effective and transparent way to do that cheaply, and you can also invest in very small amounts.”

Like any other digital asset, gold tokens are issued on the blockchain, with every token reportedly backed by physical gold. Using the security of the technology, investors can diversify their portfolios without the added risk and expense of storing the physical asset.

Most tokens are backed with small amounts of gold, meaning the asset is more accessible. “If you’re going to a dealer and buying a physical bar, the smaller the bar you buy, the higher the premium,” continued Hankey. “If you buy something like 10 grams of gold, the premium might be 220%.”

“Gold as an asset class is still very important,” said Matthew Alexander, Head of Tokenization Solutions at SEBA bank. “The accessibility to physical gold is made easier with gold tokens, which allows the democratization of the asset to be more effective.”

“There’s also now an increased interest in digital assets. Being able to buy a digital token that has an underlying factor that people know and trust like gold allows many people interested in decentralized finance to come into the space.”

Most gold tokens are accessible via online exchanges, meaning redemption in fiat currency and trading is also facilitated.

Issues in redemption of tokens

The ease of redemption for physical gold, on the other hand, is slightly less apparent.

While all businesses which issue the tokens market ease of redemption, some have specific requirements that some investors may find difficult to adhere to.

Tether, which has one of the largest gold token capitalizations along with Paxos, states on their website that the minimum purchase of Tether Gold is 50 XAUt, equivalent to 50 fine troy ounces.

As of January 2022, 50 XAUt was valued at around $90,000. Despite this, fractions of the token are available on exchanges. Regarding redemption, on the website, it seems unclear.

Tokens allocated to a whole bar of gold can be redeemed according to the equivalent fine troy ounces. However, it is also stated on Tether’s website that “If your tokens are not allocated to a full bar of gold, we normally request that you deposit 430 XAUt tokens to ensure you have enough to redeem a full bar of gold. Our bars of gold (like all LBMA bars of gold) vary in size and can be as big as 430 fine troy ounces.”

These conditions could be unattainable to many investors who want to redeem tokens in gold, leaving them to redeem in either fiat currency or traded with other cryptocurrencies.

Even here, Tether’s handling remains blurry.

Requests for redemption in fiat undergo a process where TG Commodities Ltd will “attempt” to sell the gold in the Swiss gold exchange, “If the gold is successfully sold, TG Commodities Limited will pay you the proceeds of the sale, less a 25 basis point fee (on the price of gold),” reads their website.

Other companies have addressed these issues. Both Cache Gold and SEBA Bank have made their tokens redeemable in smaller amounts. Cache has options for redeeming in 100g and 1kg bars, while SEBA offers redemption for a single token, equivalent to one gram.

Addressing trust in the tokens

Given the controversy surrounding the redeemability of the gold, there has been increased pressure to provide proof of the physical asset backing the tokens.

Cache Gold founders have used their expertise to develop a tracking system focusing on improving the transparency of the vaults storing the physical gold. “The smart contracts behind our tokens only allow us to create the tokens after the token is already inside the vault, so they ensure that they are backed,” explains Hankey.

“We have a blockchain tracking option that we call Gramchain, which provides the scanners to the operators that supply the gold. We use these scanners to track the gold bars, and this gets made public in virtually real-time. Everyone can see where the bars are, how many they are, and what type they are.”

Many gold tokens function similarly, storing physical gold in vaults. SEBA Bank has opted to go straight to the refinery for the physical backing of their tokens. The digital asset banking platform partnered with Argor-Heraeus, one of the leading precious metal suppliers in the world, for their gold token.

“Gold tokens are not something you can create quickly because they’re en vogue. It takes a lot of work for institutional-grade,” Alexander said. The company took 18 months to develop the product and form a partnership with the refinery.

FINMA regulates both companies, and Argor-Heraeus is additionally regulated by institutions specific to gold supply. SEBA Bank’s gold token is the first to be regulated.

Although steps have been made towards regulating digital assets in recent months, regulators on large still struggle with the space.

“When you’re proposing a new investment product to a regulator who has different levels of experience with digital investment products and cryptocurrencies, if the underlying investment is gold, it’s much easier for them to get their heads around it.” SEBA hopes to ensure trust from investors with this added layer of regulation.