Financial institutions have access to a vast amount of customer data, including account information, transaction history, and credit scores. However, much of that data is siloed by different payment platforms and networks and out of reach when fraud teams need it most. Banks can address this data drought problem by finding ways to modernize their tech stack, getting creative with existing rails, and leaning on providers to gain scale.

To really address the racial wealth gap fintech companies need a new mindset. Traditional products, even with a fintech twist, are not making a big enough difference.

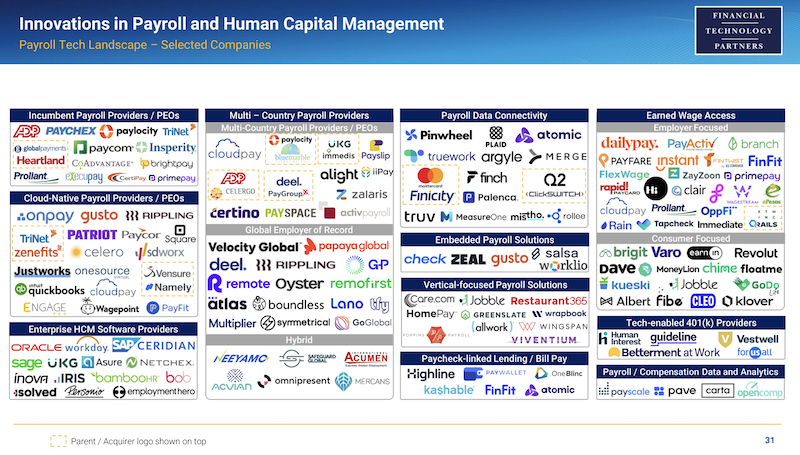

The co-founder of DailyPay shares his views on earned wage access, why it is so important, why it is obviously not a loan, and what is next.

Banks must find a way to optimize the digital customer experience while simultaneously ramping up security.

Earned Wage Access (EWA) providers could be creating potential consumer debt with the same perspective for jeopardy as BNPL.

[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] The Paycheck...

Mortgage automation can be applied to every step of the mortgage process to help make lenders more efficient and provide a better user experience.

SME-focused fintechs are better known than banks as sources of advice and guidance on financial matters, such as cash flow management.

For too long small businesses have suffered a lack of access to capital. Now, banks and fintechs are in a unique position to combine their strength to help provide financing in underserved communities

In celebration of International Women's Day we provide some suggestions for female founders in fintech to help grow their startups.