Financial institutions have access to a vast amount of customer data, including account information, transaction history, and credit scores. However, much of that data is siloed by different payment platforms and networks and out of reach when fraud teams need it most. Banks can address this data drought problem by finding ways to modernize their tech stack, getting creative with existing rails, and leaning on providers to gain scale.

Advances in embedded lending provide better options for consumers and higher sales with more certainty for merchants. It's a win-win.

The payments landscape is undergoing a significant shift right way with new payments rails gaining more market share. And we have only just begun.

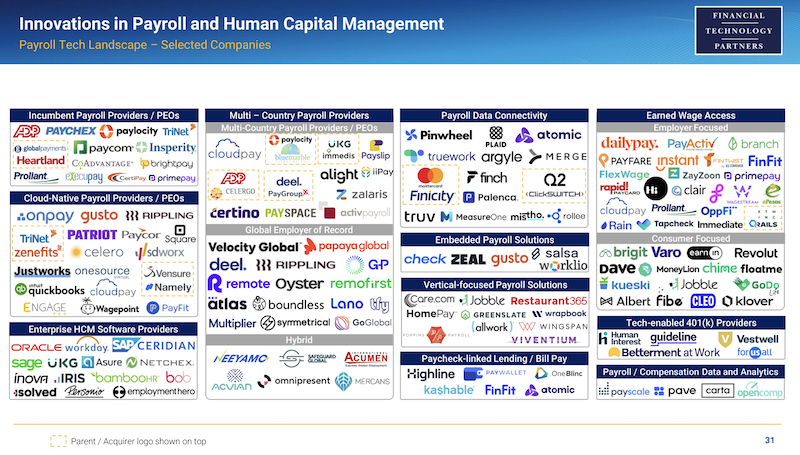

The co-founder of DailyPay shares his views on earned wage access, why it is so important, why it is obviously not a loan, and what is next.

Lenders’ delinquency strategy must be rooted in an “empathy-first” model to support customers in experiencing hardship. Customers in distress need support and resources, not shame.

APIs can provide banks a customer-centric transformation for enhanced user experience

With community banks pulling back on lending to small businesses vertical software platforms are filling the void. They provide software, of course, but are increasingly also providing access to capital.

Banks and credit unions need to be doing more to service Gen Z. Here are five considerations to help make the shift to service the first digital-only generation.

The responsibility for managing compliance is increasingly falling on fintechs. Here are seven areas where fintechs need to focus.

Checking out in a physical store often involves special hardware that can create a barrier for BNPL adoption. Embedded lending is the solution.