This week the Latin American fintech community came together for the second annual LendIt Fintech LatAm event. Just over 700 people enjoyed two full days of great content, networking and more.

In December last year we held our first Latin American event in Miami but this year, like all events, it was conducted online. This was actually LendIt’s third big online event so we have really started to get the hang of things, as everything went quite smoothly.

I came away with a much greater understanding and appreciation for the fintech community in Latin America. Many of the fastest growing fintech companies on the planet are located in this region. There are three main factors underpinning this growth: the large number of unbanked consumers, the deep penetration of smartphones and the poor job the incumbents are doing in serving consumers and small businesses. These things, combined with an indomitable entrepreneurial spirit, have led to several fintech companies achieving significant scale.

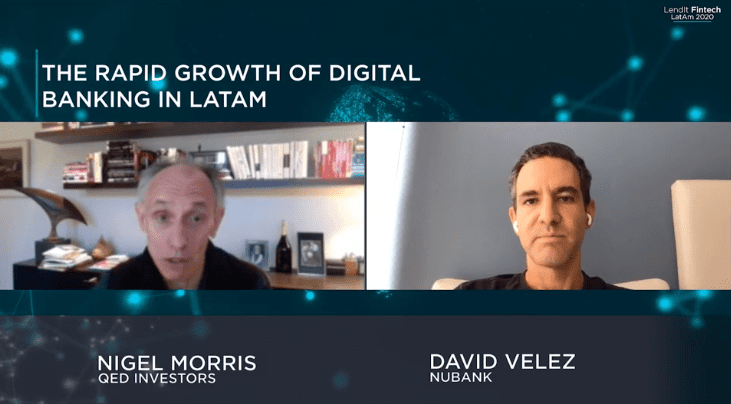

When it comes to scale no Latin American fintech company can come close to Nubank. Based in Brazil, with a population just over 200 million people, they have already attracted over 30 million customers to their digital banking platform. David Vélez is the CEO and co-founder of Nubank and he kicked off our keynote “stage” with Nigel Morris, the co-founder and Managing Partner of QED Investors. Nigel was also the co-founder and President of Capital One back in the ‘90s and he reflected on the many similarities between the early days of Capital One and the early days of Nubank. David also shared that, despite Nubank’s growth, the big banks in Brazil still have about the same market share as they did a decade ago demonstrating that Nubank is really growing the market.

Next up we had Sergio Furio, the CEO and co-founder of Creditas, chatting with Paulo Passoni, Managing Investment Partner at Softbank. A story that Sergio told was indicative of why fintech in Latin America is taking off. Three years ago he was chatting with a senior executive at a large incumbent bank who told him that what he had created was just an app and any bank could copy it. As he has reflected on that comment, he realized that a fintech company is not just about the technology, it is a mindset, an entrepreneurial approach to move fast and try new things but most importantly to make an impact. This bank executive was just plain wrong.

Hector Cardenas is the CEO and Co-Founder of Conekta, an online payments platform in Mexico and he chatted with Arnoldo Reyes, the VP of Digital Partnerships in Latin America for Visa. They announced that they have formed a partnership on online fraud detection tools that provides better protection for both merchants and consumers. Hector also shared that 91% of transactions in Mexico are still made in cash but that is slowly changing as the population begins to trust some of the fintech offerings. Interestingly, Arnoldo shared that 13 million Visa cardholders in Latin America made their first ever online transaction in 2020 and many will be repeat buyers as they appreciate the speed and convenience of shopping online.

We heard from two of the leading Latin American venture capital firms, Hernan Kazah, co-founder and Managing Partner of Kazsek Ventures and Claire Diaz-Ortiz, Partner at Magma Partners. They shared the phenomenal growth story of Latin American fintech and how that growth has been enabled. Hernan was a co-founder of Mercado Libre, the Amazon of Latin America, that has become the largest company the region has ever seen and he is now funding the next generation of startup with his VC firm. Claire talked about the verticalization of fintech that has been enabled by three things: new data, new founders and new investors.

We kicked off day two with the fastest growing company in Latin American fintech. Pierpaolo Barbieri is the CEO and founder of Ualá and if you have never heard him speak, let me just say he is a force of nature. His enthusiasm and passion is infectious and he is a man on a mission. That mission is to bring simple financial products to all of Latin America and he is well on his way with almost three million people in Argentina using the Ualá mobile banking app for bill payments, cell phone top-ups, instant transfers and more. He talked about the widespread use of cash in Latin America, saying that they have won the battle on cash but the war is ongoing. There is still a lot of work to do, Latin America needs an open banking approach, because at the end of the day the data is the users’ and with a more open approach this will be the tide that lifts all boats.

Angela Strange, General Partner at Andreessen Horowitz and Nick Shalek, General Partner at Ribbit Capital gave the Silicon Valley perspective on the Latin American market. Both VCs said that the entrepreneurial talent in Latin America today is every bit as good, if not better, than the talent in the US. What is considered a fintech company is shifting and we see that in Latin America with companies like Rappi and Mercado Libre. While neither company could be considered a fintech, they are offering a broad suite of financial services. When asked what her favorite category is today Angela said infrastructure. This piggy-backed on what many other speakers have said. The fintech infrastructure is still being built today in Latin America so there are tremendous opportunities here.

Speaking of infrastructure, we also heard from Tory Jackson, Head of Business Development and Strategy, Latin America at Galileo and Thiago Dias, VP of Fintech Strategy, LAC for Mastercard. Tory talked about the importance of speed in such a rapidly evolving market, fintech companies need to be able to deploy new systems in days and weeks, not months or even years. Thiago said this has changed even this year. In the last 10 months Mastercard, working with partners like Galileo, has dramatically increased the speed at which they can deploy new products.

Our last keynote session was with Juan Guerra, CEO of Rappipay Mexico, interviewed by Andres Fontao, Managing Partner at Finnovista. Rappi started in Colombia in 2015 but it has quickly expanded to nine Latin American countries and has become a “SuperApp” in the process. Rappipay is a QR code-based digital wallet and they launched in Mexico earlier this year in a partnership with Banorte, one of the largest banks in Mexico. Juan talked about the unique advantages of Rappi. They already have millions of customers in Mexico using their other services so they will have very low customer acquisition costs. With the quality of data they have they can serve consumers that others cannot which will help bring new people into the financial system.

Those were some of the highlights from our keynote stage. Of course, we had multiple breakout tracks focused on digital banking, online lending, payments and the cutting edge of fintech. One thing I found surprising throughout the event was how companies had performed during the pandemic. Pretty much every fintech company, even those on the Online Lending Track, said that this year was good for them and they are well placed to grow quickly in 2021.

The videos for every session are available online via our Brella platform until January 8 for all registered attendees.

Virtual Networking and More

We had just over 700 registered attendees, most of whom logged in to the Brella app for networking. Meetings are always a focus for LendIt Fintech events and attendees scheduled almost 1,000 meetings through Brella’s virtual networking tool over the two days. During our Overtime session to conclude the event we heard from many attendees who said they really appreciated being able to meet with so many people, many of whom were senior executives at banks and fintechs. Our Women in Fintech Power Hour was a highlight, as usual, for everyone who attended. We also had another Networking Roulette, the fintech speed dating platform, which was also quite popular.

While the sentiment was positive, many people lamented the fact that we could not meet in person this year. Given that we will be in December next year, we fully expect to be able to have an in-person event for LendIt Fintech LatAm 2021 in Miami next year.

Thanks to everyone who attended and sponsored the show to help make it a big success. This event was our last big show of the year and now we turn our attention to our flagship USA event in the spring. Onward.