The rise and rise of Jack Dorsey and his fintech powerhouse, Block, was threatened yesterday by a damning report from short sellers, Hindenburg Research.

Claiming fraud and manipulation, with activities to aid the operations of criminals, the research group set forth several points that they allege prove Dorsey’s wrong-doing.

Of course, Dorsey has denied the allegations and has announced he will be exploring legal action against the group for publishing the “factually inaccurate and misleading report.”

“We are a highly regulated public company with regular disclosures, and are confident in our products, reporting compliance programs, and controls,” he continued. “We will not be distracted by typical short-seller tactics.”

Shareholders were not convinced, and stocks took a dive as a response.

The fintech darling falls from grace

Like many fintechs that have made headlines recently for all the wrong reasons, Block was the industry’s poster child.

Formerly known as Square, the company burst into the payments sector in 2009 with a revolutionary idea to make card payments accessible for even the smallest merchant.

With its pocket-sized tap-to-pay device that plugged into merchants’ mobiles, the company rose to stardom, gaining a valuation of $3 billion at the time of its public listing in 2015.

By 2022, the firm had changed its name to Block and grown into a $54 billion powerhouse. Touting FDIC-backed bank accounts with partner banks, a payments platform, stock and crypto trading facilities, and physical debit cards (as well as acquired BNPL provider, Afterpay), the founders stood by their mantra of “providing economic empowerment” for the unbanked and underbanked.

Perhaps too frictionless

The Hindenburg report focuses primarily on CashApp, the company’s peer-to-peer payment app that facilitates the frictionless movement of money between customers and investments.

They said the “empowerment” of the unbanked and underbanked had extended to one of the most underbanked groups — criminals.

The short sellers allege that the company inflated reports of user accounts, allowing customers to create multiple accounts and facilitating identity fraud and criminal scams. According to the report, former employees estimated between 40%-75% of accounts were false.

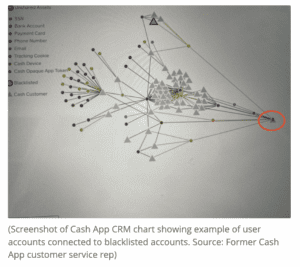

“Even when users were caught engaging in fraud or other prohibited activity, Block blacklisted the account without banning the user,” read the report, alleging that many flagged accounts were often associated with many other active accounts.

Sex trafficking, drug dealing, and COVID-relief payment fraud are just some of the activities Hindenburg explained were facilitated by the app due to “frictionless” policies and lax compliance measures.

To prove their point, Hindenburg executed a plan to set up an account and receive a payment card under the name Donald J Trump, claiming hundreds of other customers have done the same. The result is a network of “Donald Trumps” and “Elon Musks.”

The group claimed these activities bloated numbers during the pandemic, causing the company to soar to success. The founders are said to have cashed out over $1 billion in stock, ensuring “they will be fine, regardless of the outcome for everyone else.”

In addition, the group claimed that many of the statements Block and Dorsey himself had made about their services were misleading. Bloating numbers in the face of competition and failing acquisitions had become commonplace.

Afterpay also comes under fire

Aside from the allegations of facilitating fraud through Cash App, Hindenburg also brought the Afterpay acquisition into their sights.

The deal closed in 2022, allowing Block to bring their customers a BNPL platform that they said would add to the Cash App offering, “supporting consumers with flexible, responsible payment options.”

Related:

However, the short sellers have said the acquisition was more an attempt to avoid responsible lending and consumer protection laws in Australia. As a result, the group has said the platform facilitates a cycle of debt that makes the company money while preying on vulnerable customers.

This is an argument the BNPL sector has faced numerous times. Still, Hindenburg has made Block’s activities in the industry look particularly predatory, outlining an awareness in balance sheets of heightened delinquency rates. At the same time, the company claimed to be “a responsible consumer product subsidized by fees from merchants.”

‘A banker’ in a tie-die costume

As a result, Hindenburg Research has deemed Block, with Jack Dorsey at the helm, akin to “a traditional financial services company.”

As they put it, the company’s “key focus seems to be on dressing up predatory loans and fees as revolutionary products, avoiding regulation and embracing worst-of-breed compliance policies to profit from its facilitation of fraud against consumers and the government.”

Whether Dorsey and Block, like many others who have been the subject of a Hindenburg report, will face an investigation remains to be seen. Dorsey has launched, all guns blazing, into a full denial defense.

However, Block’s stocks took a hit, and while they have since crept up slightly, doubt hangs in the air – Perhaps Dorsey’s shining vision of a financial company “for the people” may never recover.