Last month the UK announced new regulations for the Buy-Now Pay-Later (BNPL) sector to “protect millions of people.” The move is in response to controversy surrounding the industry, which, despite rapid growth, has been met with criticism and claims of “misleading customers.”

As the cost of living crisis becomes more prominent within the UK, more consumers have been turning to BNPL. Used by 25% of e-commerce shoppers and 20,000 merchants, transaction volume reached £6.4 billion last year. The sector is expected to continue growth at a rate of 24.5% CAGR.

A controversial credit option

In a report conducted in February 2022 by Barclays, one-third of BNPL customers aged 18-34 were concerned about their ability to pay back BNPL bills. A further 31% reported being overwhelmed by the amount coming out of their account in BNPL bills.

The claims were met with outrage by some BNPL companies. Klarna UK head, Alex Marsh, is reported to have called Barclays “irresponsible,” claiming the report was used to endorse their own installment product with 10.9% interest.

Generally, the UK government remains in favor of BNPL. In the announcement of the proposed regulations, John Glen, former Economic Secretary to the Treasury, said, “BNPL can be a helpful way to manage your finances, but we need to ensure that people can embrace new products and services with the appropriate protections in place.”

“By holding BNPL to the high standards we expect of other loans and forms of credit, we are protecting consumers and fostering the safe growth of this innovative market in the UK.”

Additional reports have found a tendency for BNPL to be skewed towards sub-prime and younger demographics, with TransUnion reporting that about 69% of BNPL users are subprime or near-prime.

Primarily, the regulations focus on customer protection, requiring lenders to complete affordability checks. All lenders will have to be approved by the FCA, and customers will also be able to take complaints to the Financial Ombudsman Service (FOS). In addition, companies offering BNPL will have to review advertisements to ensure they are “clear, fair and not misleading.”

Entities within the BNPL sector are supportive of the new regulations. Marsh told Fintech Nexus, “These additional protections are good news for UK consumers and will raise the standards of the whole BNPL sector.”

He explained that Klarna had for some time adhered to regulated credit standards. “We agree with HM Treasury’s plans to take a proportionate and risk-based approach to future BNPL regulation as it will balance appropriate consumer protections without unduly limiting their availability or stifling innovation of the sector. Under this approach, consumers will benefit from the same regulatory protections as when using a credit card, regardless of which BNPL provider they use.”

Concerns about misleading advertising

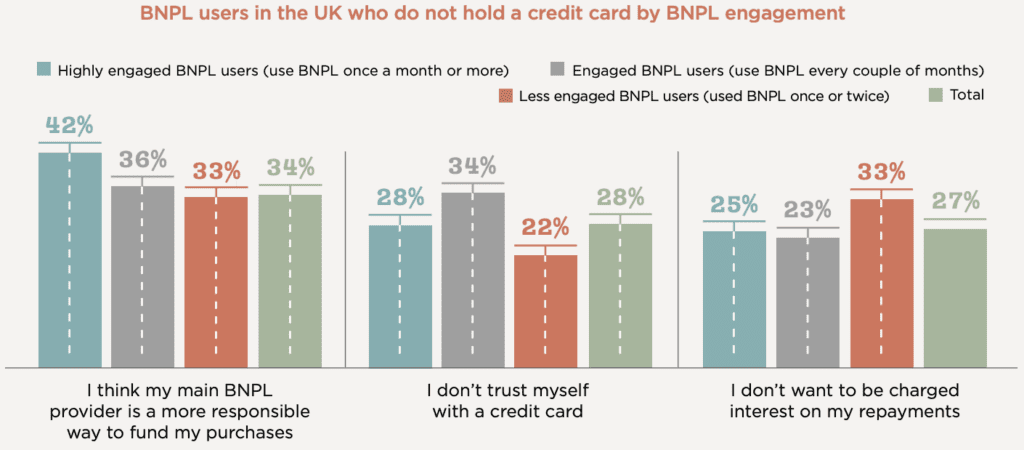

An RFI Global report found that an average of 28% of BNPL users in the UK “don’t trust themselves with a credit card,” and additional studies have indicated customers regard BNPL to be “safer” than credit cards.

The Barclays report found that 18% of BNPL customers aged 18-34 had their credit score affected by missed BNPL payments. They stated, “The research demonstrates that there’s still a knowledge gap that needs to be addressed, with 11% of BNPL users believing that if they missed a payment, it wouldn’t affect their credit score. This concern is seemingly reflected in the proposed regulation regarding a requirement for clear advertisement.

Marsh said, “We make it clear in our marketing that BNPL is credit, we check consumers’ ability to repay on each transaction, and we now share data with the UK credit reference agencies to increase the visibility of BNPL use across lenders.”

Klarna welcomes the regulations.

“We want to see regulation which will give additional protections to consumers implemented as soon as possible, as more providers enter the sector who may not be working to the same high standards as Klarna,” Marsh continued.

“As the UK’s largest BNPL provider, we will continue working closely with HM Treasury and the FCA to accelerate progress and make future regulation of the highest possible standard globally.”

Despite the HM Treasury’s announcement, regulations are unlikely to be implemented before 2023. HM Treasury will publish a consultation on draft legislation toward the end of this year and lay secondary legislation by mid-2023. The FCA will then consult on its rules for the sector.

RELATED: