In its Q4 and full-year 2021 report, SoFi announced record revenue for the quarter and the year after the market closed Tuesday.

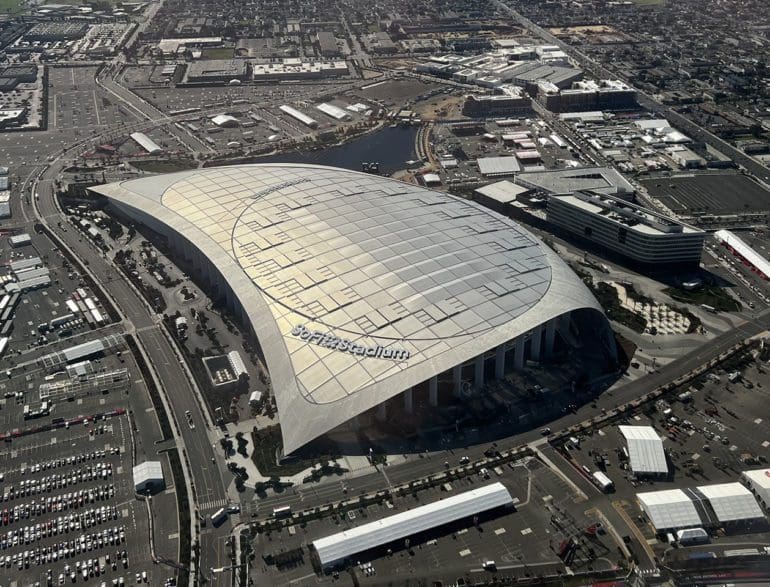

The company, famous for its branded LA Rams stadium that hosted the Superbowl in February, reported fourth-quarter GAAP Revenue was $286 million, up 67%, and $984.9 million for the year, up 74% from 2020.

“Today, we are in our best position ever to achieve our long-term strategic goals to be the digital one-stop-shop for the major financial decisions in our members’ lives,” CEO Anthony Noto said on the earnings call.

“We had a record fourth quarter, despite the unexpected federal student loan moratorium extension; we exceeded $1 billion in annual adjusted net revenue for the first time. We also delivered fourth-quarter adjusted EBITDA of $5 million — our sixth-consecutive positive quarter — resulting in positive full-year adjusted EBITDA of $30 million.”

Added 523,000 members

Noto said the company added 523,000 members in the fourth quarter, a record that brings the total count up to 3.5 million. The firm added 1.6 million members last year, 500,000 more than it had projected.

Sofi Earnings came in at the high end of their projects, and Noto said the firm raised their projections at the end of their third quarter. Investors were happy before the call; the stock popped 10% to above $11 a share: after months of tech slide, Sofi was green.

“We’re able to achieve these milestones in 2021 and get to such a position of strength today for three main reasons,” Noto said.

“First, we continue to drive strong growth through great execution across our three diverse businesses, which reflects our ability to capitalize on changing macro conditions. Second, the success of Sofi’s unique financial services productivity loop strategies accelerated as we scaled our business in 2001, which allowed us to exceed our original 2021 member growth target by 40%. And third, we took a giant step forward in 2021 and achieved our goal of becoming a household brand name.”

The lending segment brought in net revenue of $208 million for the quarter and $763.8 for the full year. Origination in Q4 increased by 67% year-over-year, personal loan originations reached $1.6 billion in Q4.