To really address the racial wealth gap fintech companies need a new mindset. Traditional products, even with a fintech twist, are not making a big enough difference.

The British neobank, serving over 40 million customers globally, has acquired a banking license in Mexico.

With 40Seas, Eyal Moldovan believes he has solved a cross-border payments issue hindering importers and exporters who are already contending with a rapidly changing environment.

The resources from the new investment, according to the fintech's CEO, will be used to reinforce the team of engineers and invest in the development of new products.

Embedded finance and buy now, pay later (BNPL) are hotbeds of innovation, and Marqeta is in the middle of the action, CEO Simon Khalaf said.

It was a turbulent capital-raising year. What do experts see in the sale rack and what are the chances of coming home a happy shopper?

Fraudsters continue to evolve, with technology making it easier to get started and thrive, Sift's new Digital Trust and Safety Index shows.

The SBA is making updates to its lending program opening the door for fintechs. But much more needs to be done.

Proposed regulations recently released by the Treasury Department help bring added clarity to participants in the digital asset economy. But the process is far from over. Investors, centralized crypto exchanges, payment processors, some hosted wallet providers, and some decentralized exchanges are the most affected. Miners, stakers and developers are not impacted.

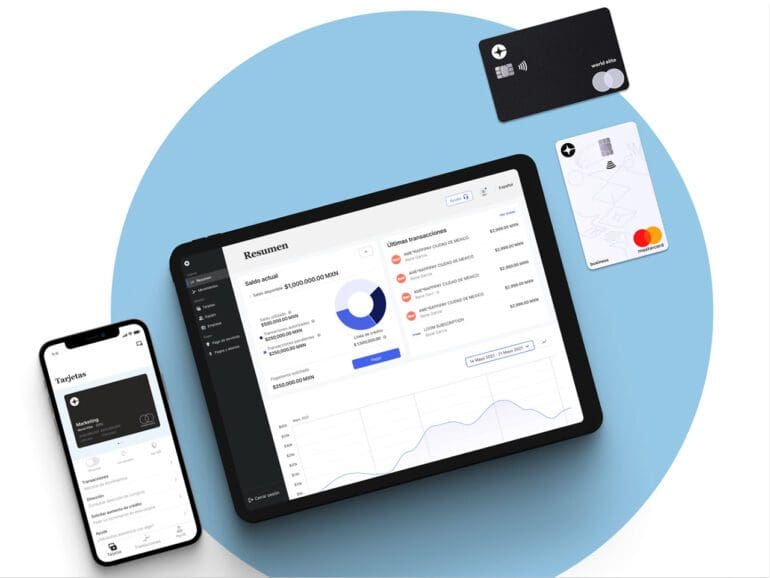

In two years, Spin has quickly carved out a place of itself as one of the most relevant fintech players in Mexico.