Funding Circle has been approved by the SBA for one of three new licenses for its hallmark 7(a) small business lending program, the only fintech to be approved.

With the heightened cost of living battering UK PSPs, many consider Open banking to be the silver bullet, but with adoption at only 10% of the population, innovation is needed.

Embedded lending technology now allows any brand to offer high margin lending products quickly and easily.

The US is ranked highly for financial inclusion, but it faces dropping further amidst waning Government and Employer support.

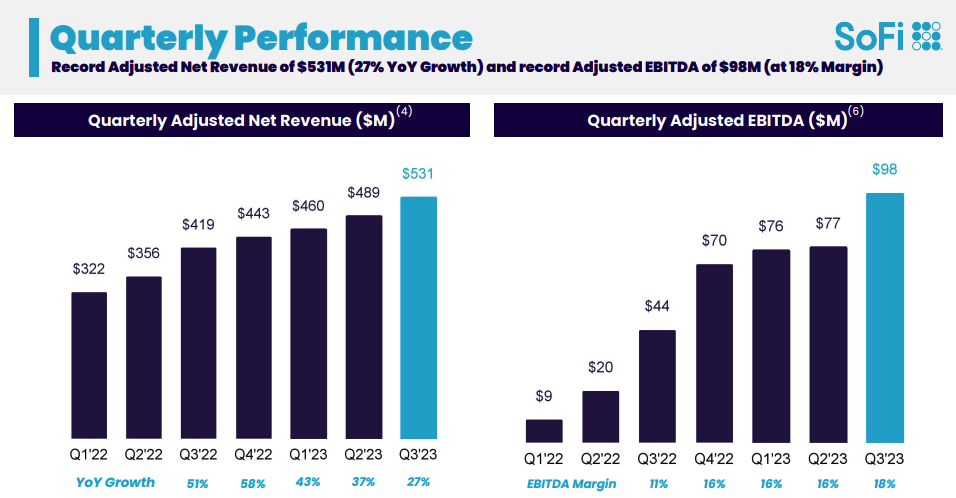

SoFi reported their financial results for Q3 2023 and showed considerable improvements across all areas of their business.

As fintechs and tech giants engage in finance through embedded solutions, banks may need to become the center of their own digital ecosystem.

A look behind the numbers in AU10TIX’s Q2 2023 Global Identity Fraud Report gives clear insight into the mind of the professional fraudster. The report analyzed millions of global transactions from April through June 2023 to identify industry-specific patterns.

The top five stories in fintech this week are from the Federal Reserve, Marqeta, Synapse, US Bank and we finally have new CRA rules!

Often marketed as a "force for good," UK fintech's actual impact on issues such as diversity and the climate crisis remains limited.

Fintech Galileo announced an expansion into five new regional markets, driven by an alliance with Mastercard.