Reliable off-chain credit scoring on the blockchain provides better service and attracts participants to DeFi.

The offering streamlines Web3 business' ability to maintain KYC compliance in the US as they navigate the regulatory landscape.

Mercado Libre will hire 13,000 new jobs this year, bucking a lay-offs trend. Most of the new employees will be based in Mexico and Brazil.

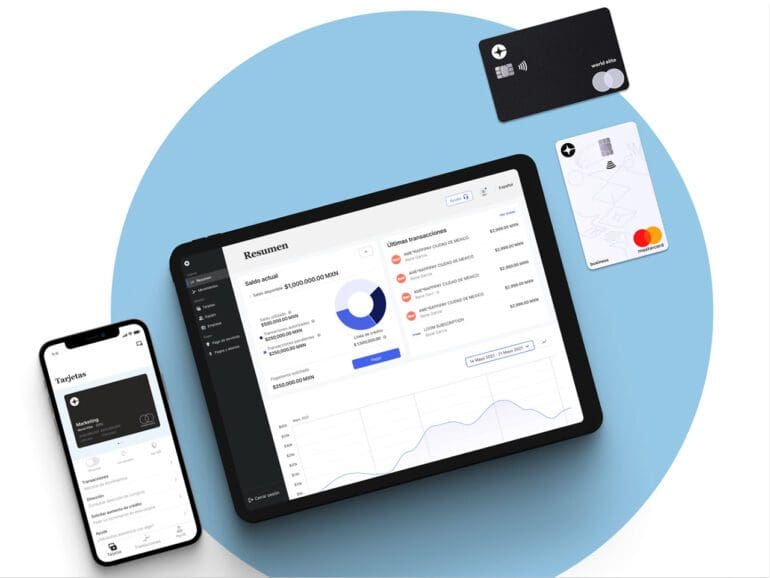

The fintech will operate in Panama, El Salvador, Guatemala, and Mexico, where it plans to become an ally of the region's underbanked population.

Watch a replay of our weekly news roundup show with hosts Todd Anderson and Peter Renton, with special guest Andrew Dix from Crowdfund Insider.

Venture-backed Nova Credit set about developing an alternative to traditional credit analysis to empower borrowers and lenders.

Private permissioned blockchains are a key feature of Tassat’s B2B payments and financial services for banks.

Last year was the year of CeFi collapses. While detrimental, investigations are shedding a light on CeFi's (not DeFi's) lack of transparency.

The resources from the new investment, according to the fintech's CEO, will be used to reinforce the team of engineers and invest in the development of new products.

Brazilian Nubank reached 79.1 million customers in Latin America by early April. That is up almost 20 million compared to a year ago.