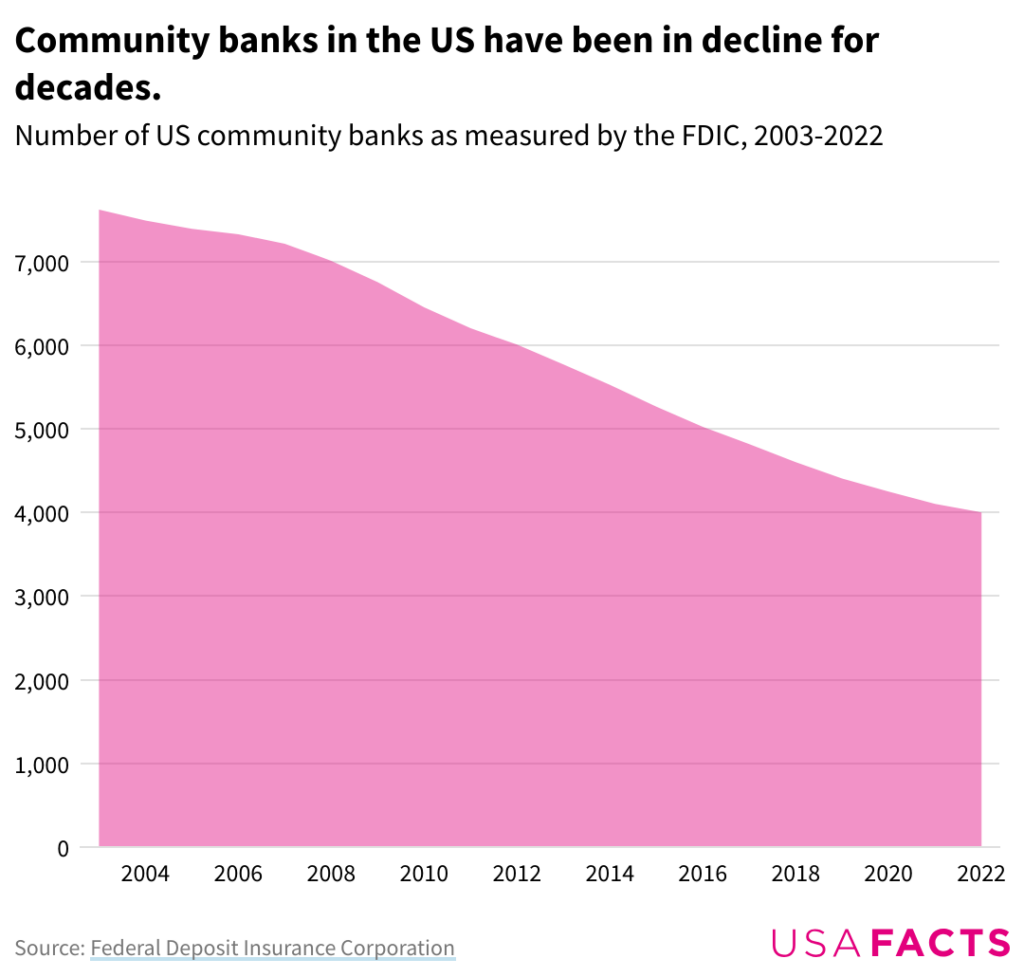

Community banks, defined as having under $10 billion in assets, make up 97% of the US banking system despite only holding 15% of assets. Focused on local and rural communities, they hold particular significance despite their small size. However, for years, they have been facing a crisis.

According to the FDIC, the number of community banks has been declining for decades. With limited access to resources, many have been challenged by shifts in the banking industry. Large institutions have gained market share, and the consolidation of community banking has continued at a rate of 2.7% over the past year.

Within the increased digitalization of the banking industry, community banks have held a distinct disadvantage. Larger institutions have a wealth of data from their vast customer base that community banks, mainly focused on smaller demographics, have difficulty matching. As consumers start to expect better digital services, this lack of data can impact community banks’ ability to serve them.

The response for many has been partnering with fintechs to better enhance their digital offering. Now, increased access to data may help further community banks competitivity.

AI solutions drive a need for Data

While data forms the basis for many digital solutions, an increased focus on AI has further driven the need for access to data.

Consumers, accustomed to the speed of AI-integrated solutions that create an ease of access to products such as loans, are now ever more likely to switch banking providers due to their digital offerings. Marqeta’s Q3 2023 Consumer Pulse survey showed that consumers are increasingly open to Generative AI being deployed to help them manage their financial lives, and innovation to improve access to finance is becoming a deciding factor in who they choose to interact with.

RELATED: The Fintech Coffee Break – Laura Merling, Arvest Bank

Community banks, while having a legacy of improved customer interaction and personalization for in-person service compared to their larger counterparts, have faltered in their digital dexterity. As in-person branches continue to close, their comparatively small database, for some, creates limitations in developing in-house solutions despite increased access to AI technology.

“AI and machine learning have been democratized by ChatGPT and similar platforms. There’s very low barriers to entry for anyone to leverage this technology into their own offering,” said Lei Wang, CTO of Torpago. “Community banks have the expertise to create value for their customers, but they need to combine it with data.”

“Data is the one thing that can create a unique solution for the customer base. Without that, they wouldn’t be able to do anything with it.”

He explained that for many smaller banks, it had made sense to partner with specialized providers to leverage their datasets and expertise in creating digital solutions. Increased access, as is proposed in the CFPB’s draft open banking rule, could further feed into the creation of innovative solutions.

“Community Banks have a unique advantage in their own business model. The narrative surrounding them, however, is that the technology offering has been lagging behind,” said Wang. “People don’t expect them to offer great technology and easy-to-use mobile apps. Even big banks are having difficulties with that.”

He said that if community banks have increased access and can create these solutions, it could change consumer sentiment and increase their customer base.

“AI is so accessible to everyone, anyone can access the OpenAI model,” he continued. “If you want to create extra value for the AI solution, you need data to feed into and fine-tune the model. The way to fine-tune a particular model is to have a community and enough data to do that.”