A few months ago I took out a loan on Prosper and I recorded the entire experience for Lend Academy readers. This was my second loan on Prosper, I first did this four years ago and I shared that experience as well. In comparing the process from 2011 to 2015 I can say that Prosper has made applying for a loan quicker and easier for potential borrowers.

I decided to borrow money from Prosper not because I needed a loan but because I wanted to get a first hand look at their borrowing process. This will be the first in a series of posts over the next few weeks where we share the borrower experience of various different platforms. For investors I think it is important to have some understanding of the borrowing process, this is the core of what marketplace lending is all about and something few of us stop to consider.

I have created a screencast video of the actual application process. This walks you through the different screens and lets potential borrowers know what to expect. It runs just over five minutes and if you are looking to obtain a loan on Prosper I highly recommend you watch the entire video.

Discover Your Interest Rate Quickly

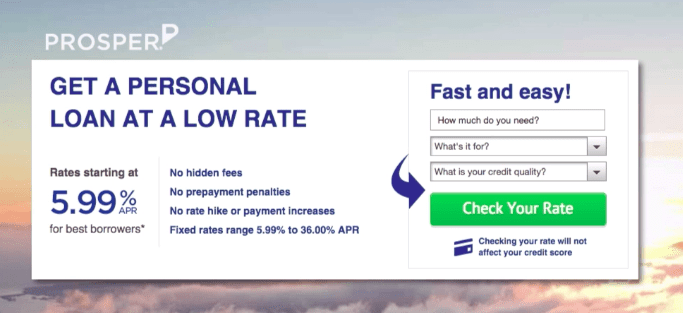

Prosper realizes that most borrowers want to find out two things: their interest rate and whether they are approved. So, applicants have to enter just a bare minimum of information before Prosper will provide that information. They will do a soft pull on your credit after you enter your name, address and income. No social security number is entered until you see whether you have been approved or not. If approved, you will see your interest rate and monthly payment and only after that do you have to enter in your social security number.

Of course, you are under no obligation to accept the terms that Prosper offers to you. I chose a small amount of $2,500 and my loan was graded AA with a 5.32% interest rate. Once you accept the loan terms Prosper will do a hard pull on your credit and you will see an inquiry for this loan on your credit report.

When you have completed the online loan application process there is still more you need to do. Prosper does verification on all their borrowers. Given this was my second loan and I had been an investor for 5+ years this verification was minimal. They requested a copy of my driver’s license and also sent me a postcard in the mail to verify my address.

My loan was funded as soon as it was made available – it went on to Prosper’s whole loan platform so one investor funded it. You can see my listing here.

Four Working Days from Loan Application to Money Received

The entire process was quick and easy. From the time I started the process until the money was in my bank account was just four working days. Here is a timeline with most of the steps involved:

Day 1 – Applied for a loan on Prosper.com

Day 2 – Prosper emailed request for valid driver’s license

Day 2 – Loan is made available to investors

Day 2 – Loan is fully funded by one investor

Day 5 – Postcard received from Prosper

Day 5 – Loan issued

Day 6 – Money appeared in my bank account

There was no phone call from Prosper this time. And interestingly enough, when I got around to verifying my address with the postcard I received in the mail, my loan had already been issued. I questioned Prosper CEO Aaron Vermut about this and he said for some of the lowest risk borrowers they do automated address verification and so this manual step in the process has become unnecessary for those borrowers.

Overall, I was very happy with the entire process at Prosper. It was easier than last time and as I said some of this had to do with the fact that I was a lower risk borrower. Every month I get a reminder email from Prosper a few days in advance of my payment being taken out of my bank account.

Now, if you want to take out a loan on Prosper then you can use this link (it is an affiliate link). Later this month I will be reporting on the loan application process with Lending Club.