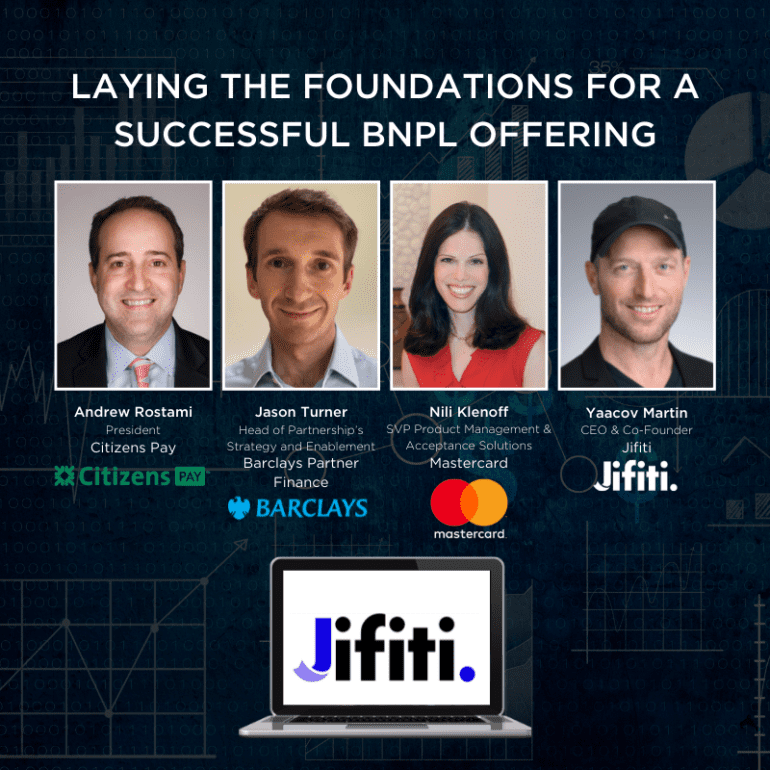

Yesterday morning, four fintech experts joined a LendIt panel to discuss Buy Now Pay Later: how to lay the foundations for a successful BNPL offering.

The talk featured Nili Klenoff, SVP of Product Management for Mastercard, Andrew Rostami, president of Citizens Pay; Jason Turner, Head of Partnerships for Barclays, led by host Yaacov Martin, CEO, and Co-Founder of Jifiti.

Martin began by thanking and introducing the panelists, organizers, and the audience.

“I am told we that have an audio ence of close to 500 if we were sitting face to face all in one hall, I’m sure we would have been infused with energy, but this is the second-best thing,” Martin said. “The panel is only as good as the audience gets, so thank you for participating.”

What are retailers looking for in BNPL?

Martin posed the first question to Rostami: given the explosion of BNPL recently, what products do we still need at the point of sale? Rostami said that traditionally BNPL was thought of as a loose underwriting for small-time purchases, and the idea is evolving.

“What we’re seeing in the market is you need to have a full set of capabilities as merchants have gotten rightfully so much more sophisticated,” Rostami said. “And so what that means is you generally need a longer-term option, paying in four paychecks is not it’s not going to cut it for a lot of the consumers, particularly for what they need to do to fund their dreams and desires right. It’s more than just buying a pair of jeans.”

Rostami, head of unsecured lending at Citizens Financial knows consumer lending first hand: Citizens is a considerable consumer bank headquartered in Rhode Island with $151 billion in deposits.

Along with longer-term BNPL lending, he said the best programs should include tools for the merchant, like marketing and sales support. He said to compete, banks had to “work at the speed of fintechs” to develop new products.

Retail leads, Customers follow

Martin went forward to ask Klenoff from Mastercard who should determine what type of lending product is best in the transaction.

Klenoff, an exec with years of experience developing both digital and physical payment products for one of the world’s largest payments processors, said the best products facilitate the consumer’s needs while keeping in mind the channels the consumer interacts with.

“Now, from a consumer standpoint, they’re not going in there right and thinking, “oh what loan product do I need for this transaction,” they’re going with a set of needs: “I need to renovate my kitchen, I need to buy appliances, It’s back to school season, and it’s really expensive because I have to outfit my three kids,” Klenoff said.

“When you’re thinking, as a provider, about the different loan products, also keeping in mind the different channels across which the consumer is going to interact are important, right. Those are different products that providers need to be thinking about servicing the range of consumer needs and the range of channels across which the consumers are going to interact.”

When to catch customers’ attention

The conversation moved to where exactly those offerings occur, as Turner from Barclays brought attention to the idea that point of sale financing has become essential for retailers in the past year.

“It should sit well alongside any other marketing activity that the retailer is doing: Where I see it why the retailer has point-of-sale finance in the first place is to drive incremental sales,” Turner said.

“And we’ve seen proof of that as early as possible within the journey. Having point-of-sale financing as close to the beginning of that journey is best for the customer because it gives them confidence in their ability to shop, better for the retailer because they’re able to share that kind of promotional activity.”

It’s all about including and encouraging customers to include products in their shopping journey, Turner said.

Features such as enabling customers to soft search their eligibility for financing boosts confidence.

For example, he said if shoppers have eight tabs open looking for a couch to buy, something as simple as a soft financing check will help shoppers focus, shut the other tabs, and invest in that option.

Turner is head of partnership and enablement with Barclays, an international UK-based bank that prides itself on supporting retailers and through 1.7 billion customer transactions at the point of sale.

He said to encourage retail partners, merchants to look for trust and regulatory understanding. Consumers are in the same boat, looking for trusted relationships with their favorite retailers that can be improved with positive bank partnerships.

Plenty of room for growth

Martin, drawing from his experience at Jifiti managing a significant point of sale tech provider for banks and retailers, pushed forward questions of scale.

BNPL is hot, but how can banks and retailers grow the option further? Finally, Klenoff elaborated on the topic of education: how banks, through their retail partners can help teach customers what options they have.

“So, while, buy now, pay later, point-of-sale financing is exploding, I think it’s also important to recognize that it’s still only roughly 2 percent of e-commerce volume today,” Klenoff said.

“It’s still very small which means that it’s not widely available everywhere, for all merchants and not all consumers are aware of it either. We’ve learned a lot over the last 15 years about how do you drive consumer adoption and usage, and a lot of it starts with education, both in the bank domain and in the merchant domain, it’s really all about kind of surround sound, getting consumers to understand how to use the product and then typically once they try it.”

It’s essential that consumers know even before they go shopping that they have these options, she said. Retailers and merchants can offer online or in-store ambassadors that guide customers through the process, as in-person sales returns.

Positive friction

While addressing the viewer questions (too many to answer), Martin brought up the regulation likely to come to the BNPL space.

He invited Turner, who has been long developing compliance toward UK regulation, to expand his idea of “more positive friction.”

“So, looking at positive friction as a concept: we’ve spent so long, making things easier and faster and slicker, and just about every journey that’s out there, you’re talking about how few clicks you can make and how few questions you can ask,” Turner said.

“And sometimes that’s to the detriment of firstly providing a good customer experience: if I were spending 15,000 pounds on a kitchen, I’d want to make sure that the person who I’m borrowing the money off is is saying ‘okay, we think you’re good for that Mr. Turner.’ I think we find that as accelerating so fast to the end of a journey that accesses to credit has become so easy, almost to the point of it being too easy.”

The concept is that though the feedback development loop has pushed transaction speed toward a slip-n-slide, you need to slow it down and make it plain and clear to the customer what they are getting into. So Barclays developed a simple solution, a system that lays out the product in an efficient, concise way.

“So we developed a system called sign anywhere, which presents the key facts of the loan documentation and the key facts of what the customer is getting themselves into really clearly in plain English, and then we put big blue buttons at the bottom that says I accept or I understand exactly what I’m getting myself into here,” Turner said.

“And through doing that through presenting that back to the customer slowing them down that key point in the journey, we can assess all sorts of things and make sure that customer does get a good outcome. They’re really pleased with our purchase because there’s nothing worse from a retailer’s perspective of that customer regretting the purchase that they came in, being so excited about.”