Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

Organized crime groups are exploiting gaps in detection technology to orchestrate financial fraud on a massive level simultaneously across multiple businesses and geographies. The result? Actual fraud rates are multiple times higher than reported

Real-time payments systems have globally increased the threat of related fraud. Will FedNow follow the trend?

There are the five critical considerations to weigh before building a risk decisioning platform. This white paper offers a roadmap for evaluating third-party solutions.

Expert speakers from banks, credit unions, lending institutions, fintechs, and beyond engaged in spirited conversation inside our makeshift boxing ring.

·

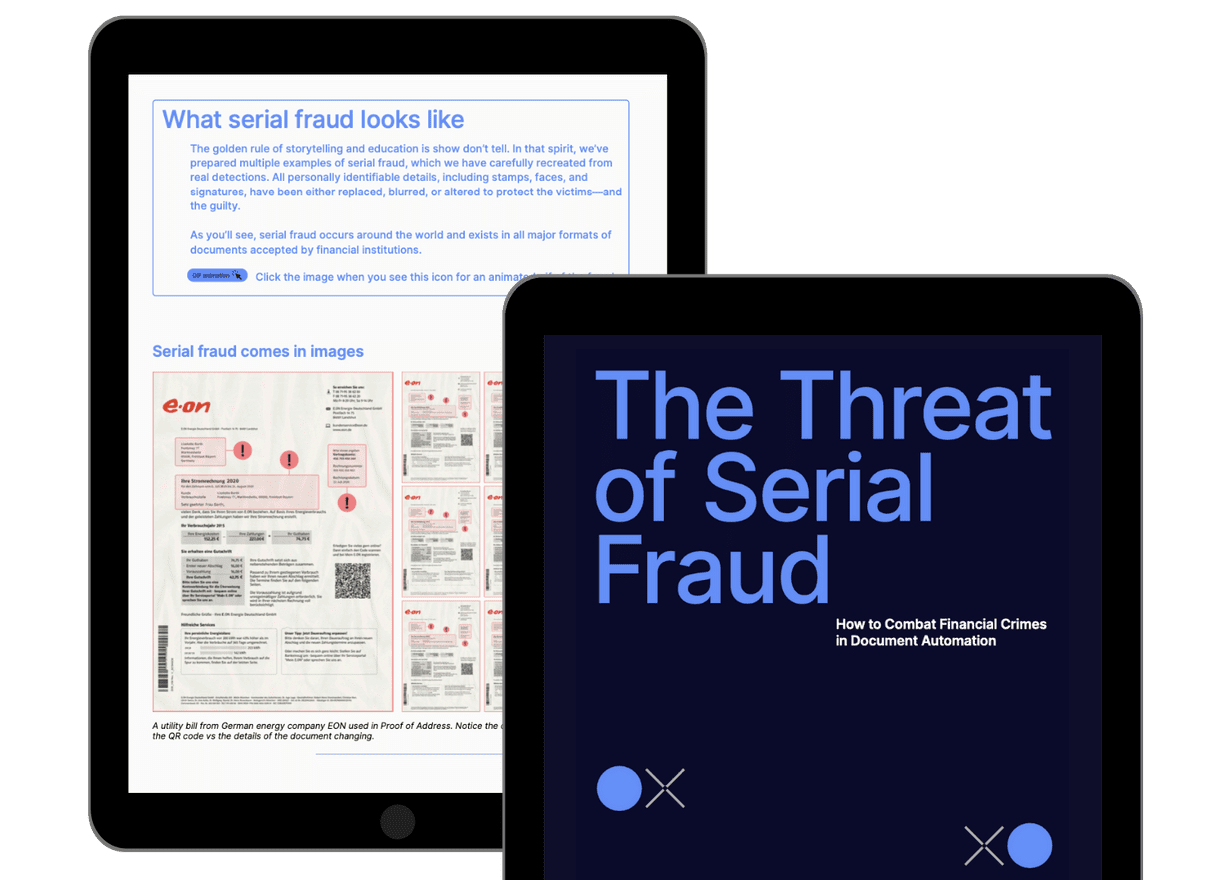

Serial fraud is becoming a major problem for financial institutions today as criminals use automation and scale like never before. This white paper provides actionable steps to combat serial fraud.

Experian's fraud prevention data network, in existence since 1991, will be available for use in North America later this year.

Sardine, a leader in the fraud prevention and compliance space has upped its game against widespread fraud.

While statistics vary year by year, there was a 79 percent increase in document fraud in 2022. Such a number doesn't come as a surprise to Inscribe fraud analyst Daragh McMeel. A rise in fraud rates often occurs when the economy travels an uncertain and difficult path.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

·

The iProov Threat Intelligence Report 2024 describes how technologies have accelerated the digital arms race between threat actors and those who stop them.