January 19, 2023, social media was awash with speculation on who could possibly be at the receiving end of the DoJ’s “major global crypto enforcement.”

Rumors circulated, individuals tweeting that perhaps it was one of the “Big Three” (Binance, Kraken, and Coinbase).

The somewhat anticlimactic answer was Bitzlato.

The little-known exchange has since been catapulted into the spotlight. Based in Hong Kong but operating globally, the DoJ has singled out the platform as a major facilitator for money laundering and fraud, particularly for Russian ransomware actors.

The Financial Crimes Enforcement Network (FinCEN) Treasury issued a notice that stated Bitzlato “has significant ties to and connections with Russia” and facilitated transactions with Russian darknets. This included the darknet Hydra, which was taken down in April 2022.

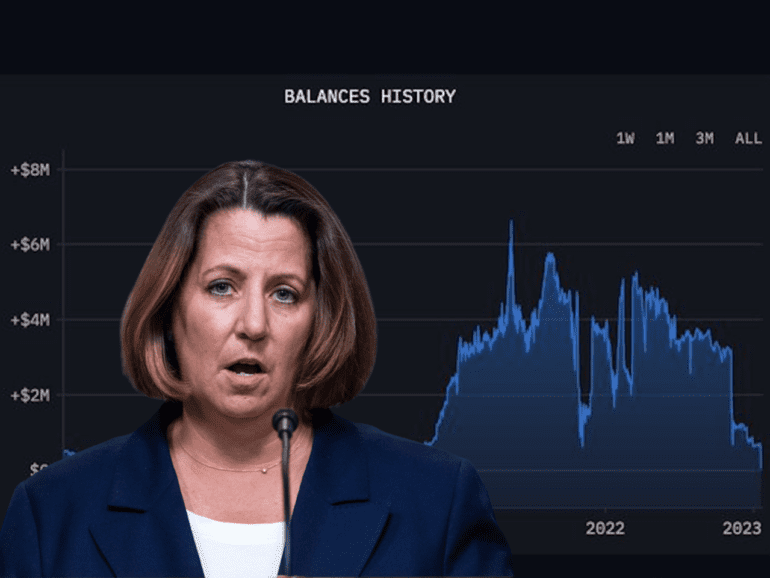

“Today, the Department of Justice dealt a significant blow to the crypto crime ecosystem,” said Deputy Attorney General Lisa Monaco in the press conference announcing the notice. “Today’s actions send the clear message: Whether you break our laws from China or Europe—or abuse our financial system from a tropical island—you can expect to answer for your crimes inside a United States courtroom.”

Bitzlato is said to have exchanged over $700 million with Hydra and received more than $15 million of ransomware proceeds.

Crypto Community Voices Confusion

The internet is not convinced.

Aside from insinuations that the only reason they were brought down was their connections with Russia, many feel the announcement included too much “bread and circus” to be taken at face value.

Twitter sleuths allege that at its peak, Bitzlato exchange wallets held $6 million and currently only hold $11 thousand, the equivalent of less than one bitcoin. They have cited data from Arkham intelligence for these claims, a data platform deriving information from publicly available, verified sources.

“Speculation over the target was quick to arrive, but no one really saw Bitzlato, a very little-known outfit, as the focus. It is far from a household crypto name,” said Timo Lehes, co-founder of Swarm Markets.

“Announcing big enforcement actions on TV as if they’ve just nailed the Dillinger Gang might make for good politics, but it isn’t an especially productive approach. Other regulators, such as BaFin in Germany, take a more forward-leaning approach to regulate the sector and don’t seem quite as keen on boastful ‘gotcha’ press conferences.”

Binance named as counterparty

Another nuance that has stirred speculation is the mention in FinCEN’s notice of Binance as one of the top three counterparties at the receiving end of transactions.

This information may be circumstantial, and it has been stated that Binance is cooperation with government officials. However, after Sam Bankman-Fried’s show of “cooperation” with regulators before FTX’s fall, suspicion is evident within the community.

According to Makarov & Shoar’s 2021 paper on blockchain analysis, Binance is also named as one of the three exchanges that most interacted with Hydra.

Binance currently makes up over 66% of the global market share of crypto transactions.

A Death Knell or a Diversion?

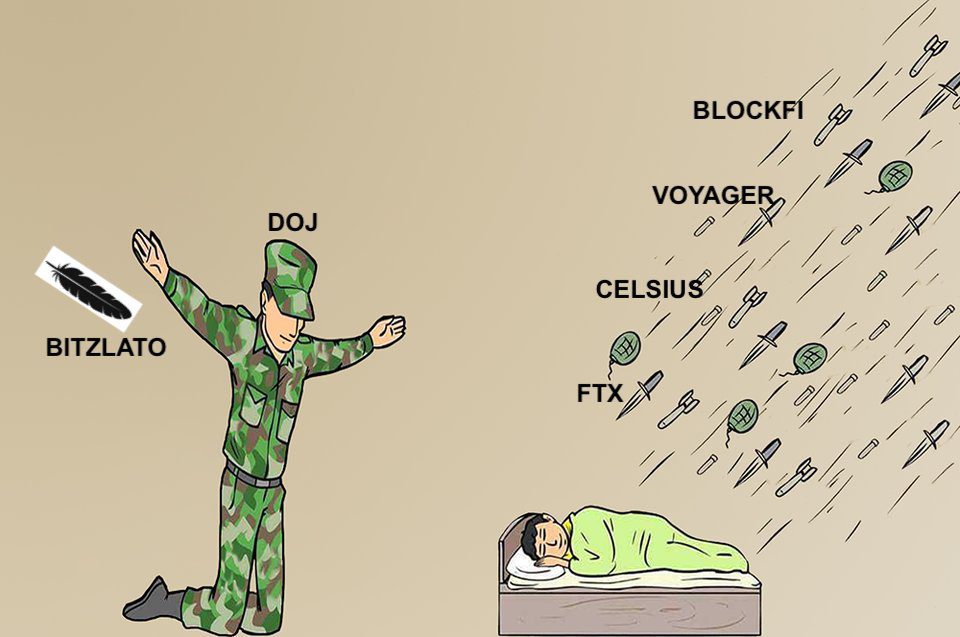

The DoJ’s failings to oust large instances of fraud within CeFi last year plays directly into the disappointment of the finance community.

Some regard the “major crypto enforcement” of Bitzlato as a thinly veiled attempt to both show action and push a broad agenda against DeFi. There is fear that this agenda will not consider the complexities and benefits of DeFi for the wider financial system, negatively influencing regulation and public perspective.

“We’re seeing some real contrasts emerge in these different approaches,” said Lehes. “The strong-arm tactics of the DoJ shows the stern attitude of regulators in the US to the crypto market right now and illustrates an obvious bifurcation in methods.”

“By all accounts, Bitzlato is small fry in the greater scheme of things in crypto, and the DoJ has failed to act on numerous bigger scandals in the past year.”

“While cracking down on illegal activity is to be lauded, this isn’t going to be how crypto becomes a normalized part of the financial ecosystem. That will come with measured regulatory frameworks and positive working relationships between regulators and crypto market innovators.”

RELATED: