Brazil and India are leading instant payment growth, with Pix and UPI accounting for over a third of total instant payments worldwide.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

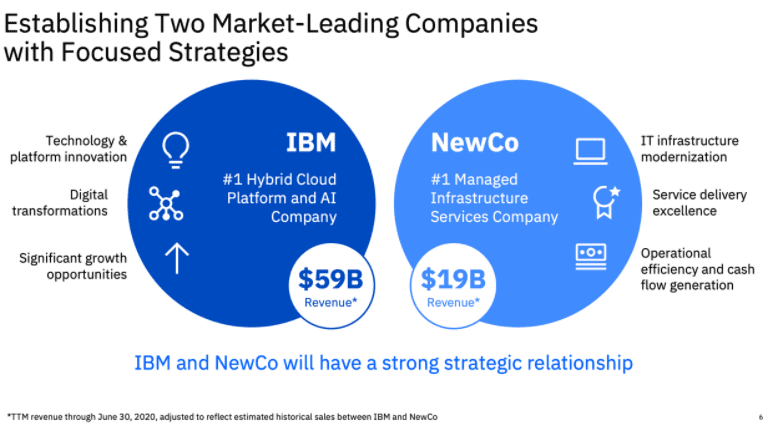

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

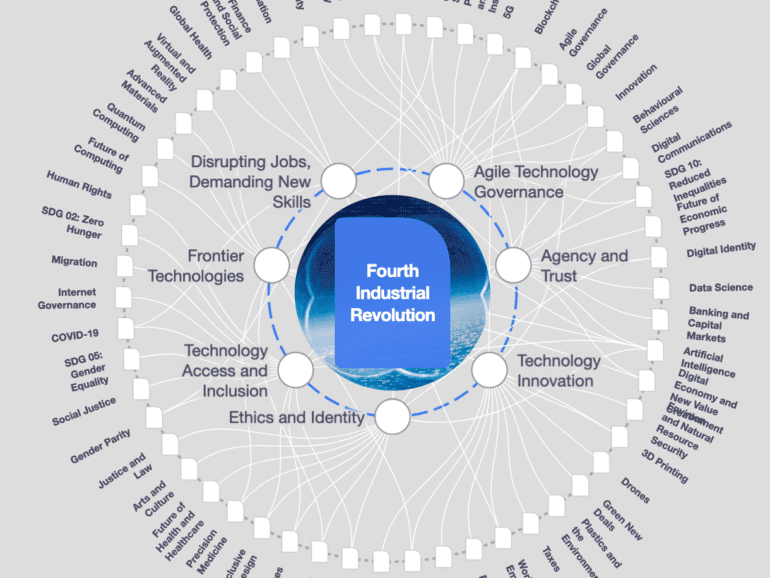

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

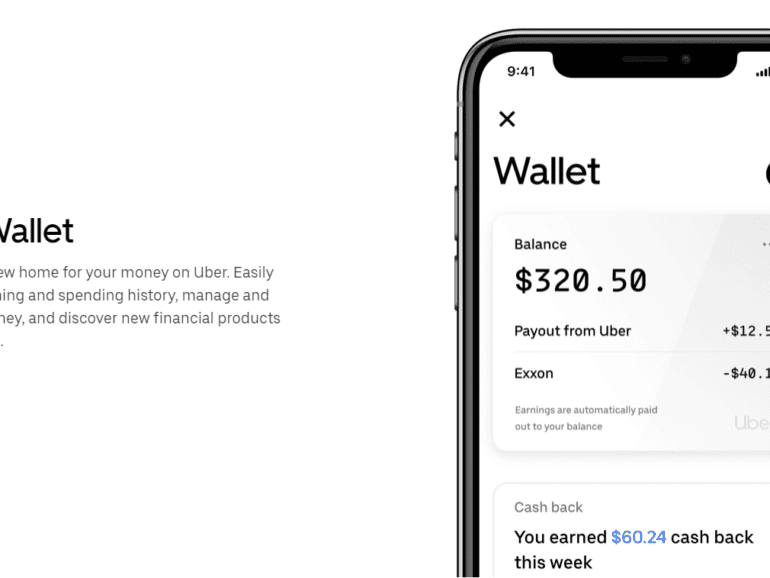

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!