[Editor’s Note: This is a guest post from New Jersey Guy, an active member of the Lend Academy Forum and investor on the Lending Club trading platform. He now lives in Florida and could invest on the Lending Club retail platform if he wanted, but he chooses not to – investing only through the trading platform still. In this, his second post, he gives some insight into one of the unique strategies he uses to invest. This article should not be considered investment advice – it is the personal opinion of the author of this guest post.]

Some of you are aware that I wrote the guest post “Foliofn Users at Lending Club Are Not Second Class Citizens”. Time flies, and that was now exactly one year ago! I took some criticisms over one of the strategies that I called the “Penny Note Strategy”. One forum member even referred to it as the “Toilet Note Strategy”. He could have been right, but I decided to follow through with it any way. I thought now would be a good time to report back to show you what has developed over the past 12 months.

Memory Refresher. What is the “Penny Note” strategy?

Simple. The Penny Note strategy is a very short-term strategy based on buying quality, seasoned notes with no more than 15 remaining payments. This can only be done off of FOLIOfn.

I think Simon Cunningham of Lendingmemo best explained it in this post. He described a loan as having “Three Seasons” with the first season (the first 10 months) as having the highest odds of default. The Final Season, as he describes “(are) months 18 and up, (which) has the most stable returns since the majority of loans that default would have done so.”

There is absolutely no research needed in picking these notes. The Lending Club profiles that we rely on when picking new issues are totally obsolete. Obviously, the borrower’s situation has most likely changed over the past 20 months making the profile worthless. Therefore, there are only 4 factors used when choosing these notes.

A.) Look for notes paying the highest yields. This will normally encompass grades B4 and lower. C’s and D’s are most abundant.

B.) Buy as many notes as you can at discount. Do not pay a markup! This is kind of important to help offset the 1% fee Lending Club charges. Otherwise, that 1% will negate what little interest you make when there are only a few payments remaining on the loan. That doesn’t mean to pass on a 17% YTM (Yield to Maturity) if the discount is 0%.

C.) The FICO Score. Look for a steady FICO with no major drops for at least 6 to 8 months.

D.) Payment History. The note must have on-time payments for at least the past 6-months. Forgive an occasional “Grace Period” prior to that. An actual “Late Payment” must be over 12-months old, and the borrower shouldn’t show a history of several late payments over the course of the loan. Also if there were late payments, check the collection log to see if the borrower took positive actions by communicating with Lending Club to rectify the situation. Odds are, they would do it again if a problem arises.

A good strategy for Newbies!

In September 2013, Peter Renton wrote a great article “How to invest $500 in P2P Lending”. Following up on that, you can take the same $500 and follow the strategy I’m about to show you. Or, do a $250 / $250 split. Or, better yet, take $1000, invest half in Peter’s strategy and the other half in mine. Peter will give you a very low-risk way to invest, but your lower yields will reflect that risk. My method will show you how to obtain higher returns without assuming much more risk than Peter’s method. In other words, you can take Peter’s projected 5.3% return and potentially increase it to between 8% and 10% by combining my strategy with his.

One of the biggest advantages for new people worried about making mistakes is that your risk is basically cut in half. You won’t be spending $25 per note, but rather $11 or $12 per note. So, you’ll have less money invested in the event a note turns totally south. Secondly, older notes return more principle than interest. Therefore, you’ll have a faster turn of your original money while still producing a higher rate of interest.

This does not mean that this method won’t work for seasoned investors. On the contrary, it could give you that slight return boost you’ve been looking for with a minimal amount of additional risk. Don’t replace your current strategy with this one, but rather make it a sideline. Create a separate folder for it and add 50 to 100 notes to it over the next 6 months. See what happens! Personally, I like to see around 400 active notes in my account. So when a bunch go Fully Paid, that’s when I’ll hunt new ones to replace them.

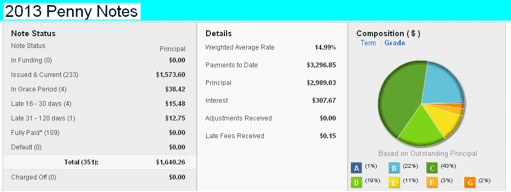

Okay. So I have 2 folders for these notes. One is for 2013, which I closed on December 30th. The second is for 2014, which I began on Jan. 1 and will continue to contribute to for the rest of the year. Here is what they look like:

The last note I added to the 2013 folder was done on Dec. 30th. The average age of this folder is now 33 months (according to Interest Radar). Unfortunately, I really didn’t get into this strategy until after I wrote my article last year. If memory serves me right, I only had something like 30 or 35 notes in this folder as of June 15th 2013. So, the majority of the notes were purchased the last 6 months of the year, and not spread out over 12 months. I anticipate this folder reaching its full maturity late 2015.

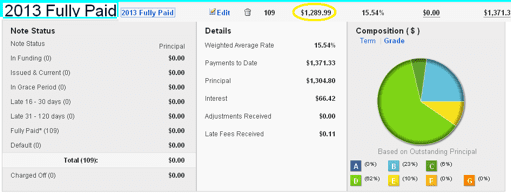

Now, here is the importance of buying at discount, even if just pennies. What I did was to take the 109 paid notes out of my 2013 Folder. You can see the total principle returned was $1,304. However, I paid $1290 for those notes, a difference of $14 in discounts. That pretty much negates the $14 in Lending Club fees I paid. Had I been a little bit more astute, I could come out further ahead. I’m paying more attention to discounts for 2014!

Again, I started contributing to my 2014 folder in January. According to Interest Radar, my average age is 27 months.

I’m guessing that the “Weighted Average Rate” might be a little deceiving. Lending Club states that the Weighted Average is “The average annual interest rate of the portfolio, weighted by the amount invested in each loan”. Does this take into consideration the extra money you make when buying notes at a discount? I don’t know. A 14.7%, C2 note will return a 19.8% YTM when purchased at a 3.9% discount. So what’s the weighted average? 14.7%? Or, 19.8%? Perhaps somebody can clarify. Regardless, the Weighted Average Rate is a fairly good indicator of where you stand.

You’ll also notice the Weighted Average rate for 2014 is higher than 2013. This is because 60-month notes have become old enough to now be put into the strategy. This actually began this past March, so it’s still new. We all know 60-month notes pay more interest. Currently, 60-month notes only make up 8% of my 2014 folder but I’m sure this will increase as more and more notes become available on Folio.

Now, anybody who has read my stuff in the past already knows that in general I’m a speculative trader. If you’re a D-G Grade retail investor, then your portfolio is pretty conservative by my standards. So far this year, my overall returns have been very disappointing. I’m only selling 1/3 the number of notes each month than 2013. Now, I’m not talking about these two folders, but rather my collection of speculative and low grade notes. Between April and May, I had 13 notes go bankrupt, and even more default. It just seems that my borrowers are finding it harder to pay than last year at this time.

No Defaults (Yet) With the Penny Note Strategy

So far, my Penny Note folders have not given me any problems. I have had no defaults. Just to be sure, I pulled up all my late notes to make sure there were no pending bankruptcies. None. As I expected, these folders just seem to run on their own with very little babysitting by me. Yes, I always seem to have a number of notes go into Grace Period. Nearly all of the time it’s due to Lending Club’s posting system and they generally clear up by themselves. Seasoned investors know what I’m talking about.

Also, I always seem to have notes in the 16-120 days late columns. Clearly, my system is not perfect, and I never expected it to be. People aren’t perfect. However, again, I will point out I have not had any defaults. As of this writing, all of my late notes are on “Payment Plans”. All have had recent contact with Lending Club, and none seem to be dodging their responsibility. These late notes always seem to correct themselves. But, when one note goes back to Current, it seems another falls down to take its place.

I’m not ignorant to the fact that defaults are inevitable. These are folders in which I am willing to eat a Charge-Off in order to measure my true results after the folders mature. In other words, I won’t pull a note and put it up for sale if I feel it’s heading for default. The whole idea is to let it sit there and see what happens. Besides, of the remaining notes still active, my average investment is only $7.87, so my losses would be minimal.

In conclusion, I cannot complain about my two Penny Note Folders. Besides hunting for notes, I have put very little time into them. As predicted, the notes seem to pretty much run on cruise control. If the trading market on Folio continues to slump, I’ll probably look to boost my active notes from 400 to 500, possibly more. By purchasing at small discounts, I’m hoping to realize real YTM’s in the high teens. Hopefully, this will help make up some of the money I don’t seem to be making on speculative-trading and end the year on a positive note.

[Update: There is a second part to this post that goes into more detail about the strategies – you can read it on Peer & Social Lending.]