[Editor’s note: This is the second in a two part series on bitcoin P2P lending by Stu Lustman of p2plendingexpert.com. Stu is a lifer in finance who has spent the last 10 years doing credit analysis and structuring transactions in the equipment finance industry. Almost 2 years ago, he started his blog on marketplace/peer to peer lending to share how a commercial credit professional would look at and analyze these loans. For the last 6 months, his loans have included lending in Bitcoin as well across 3 different platforms.]

Now that we have outlined what makes lending in Bitcoin different from lending in USD or any other fiat (government issued) currency lending, let’s look at the platforms themselves.

BTCJam

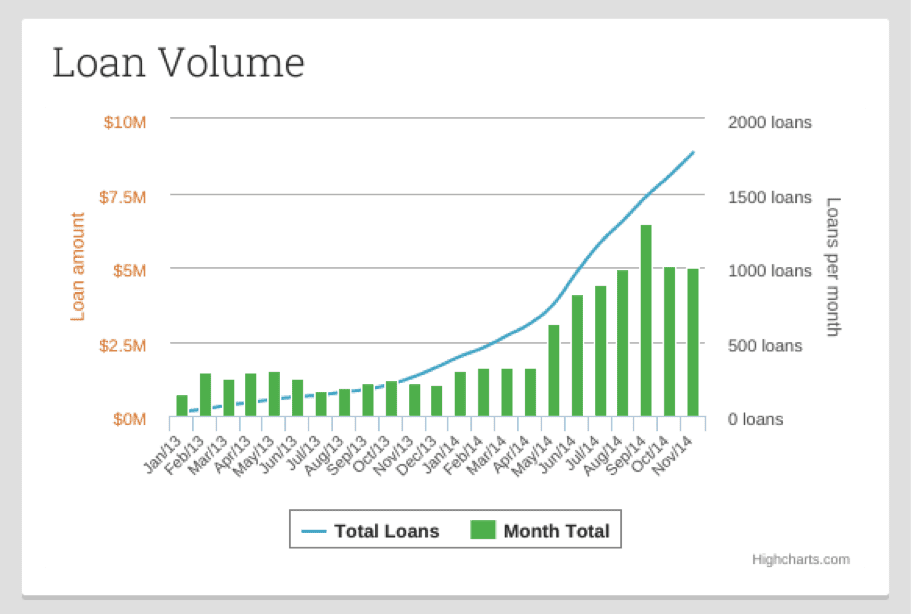

BTCJam (Jam) is the largest BTC based peer to peer lending platform. It does twice as much loan volume as the next largest platform. They are the largest and they are the best funded from Silicon Valley investors. Jam was founded by a Brazilian, Celso Pitta, who was looking for ways to increase the use and adoption of Bitcoin both in Brazil and here in the States. Here are some loan statistics, courtesy of the BTCJam website

As the chart shows, the growth has been recent and exponential. Loan volume tripled between April and August and has stayed at or above the August level of more than 1000 loans per month. This is bigtime growth but it can be hard to control growth that fast.

Jam offers 2 loan types: BTC and BitstampUSD loans. BitstampUSD is a loan that locks in the BTC/USD rate when they borrow. It has its advantages and disadvantages so choose wisely.

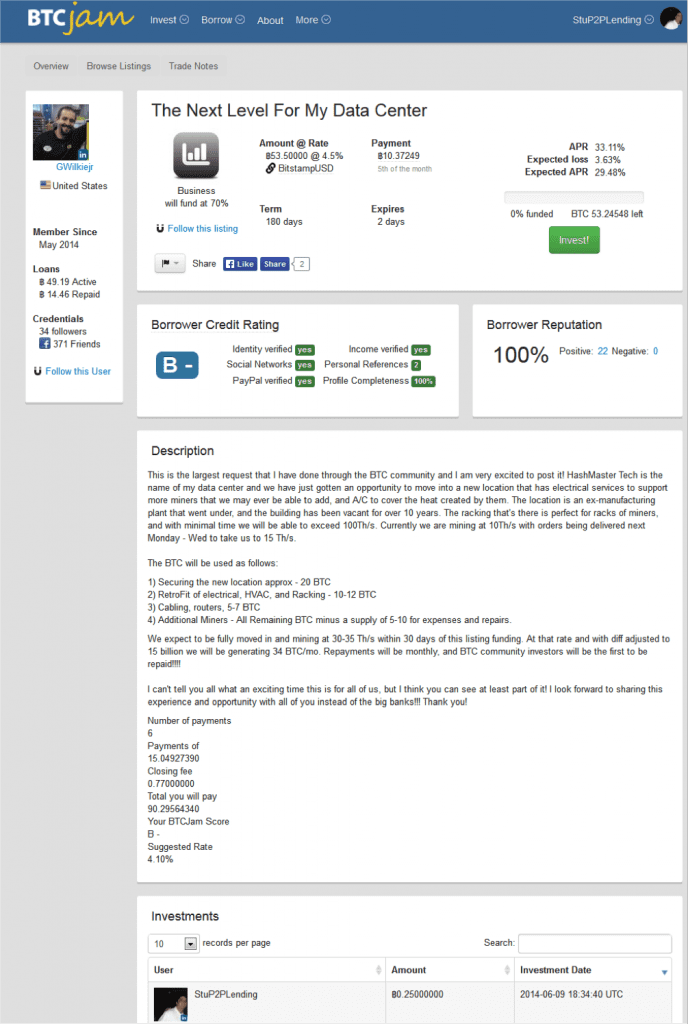

Let’s look at a loan listing that I invested in on Jam in my own account so we can see what it looks like and what information Jam provides. My handle on Jam is StuP2PLending. If you get an account there, you can follow me and see what I invest in there. Here is the listing.

As you can see there is quite a bit of information but one of the important things you should note here is that the 4.5% is MONTHLY. Yes, you read that right.

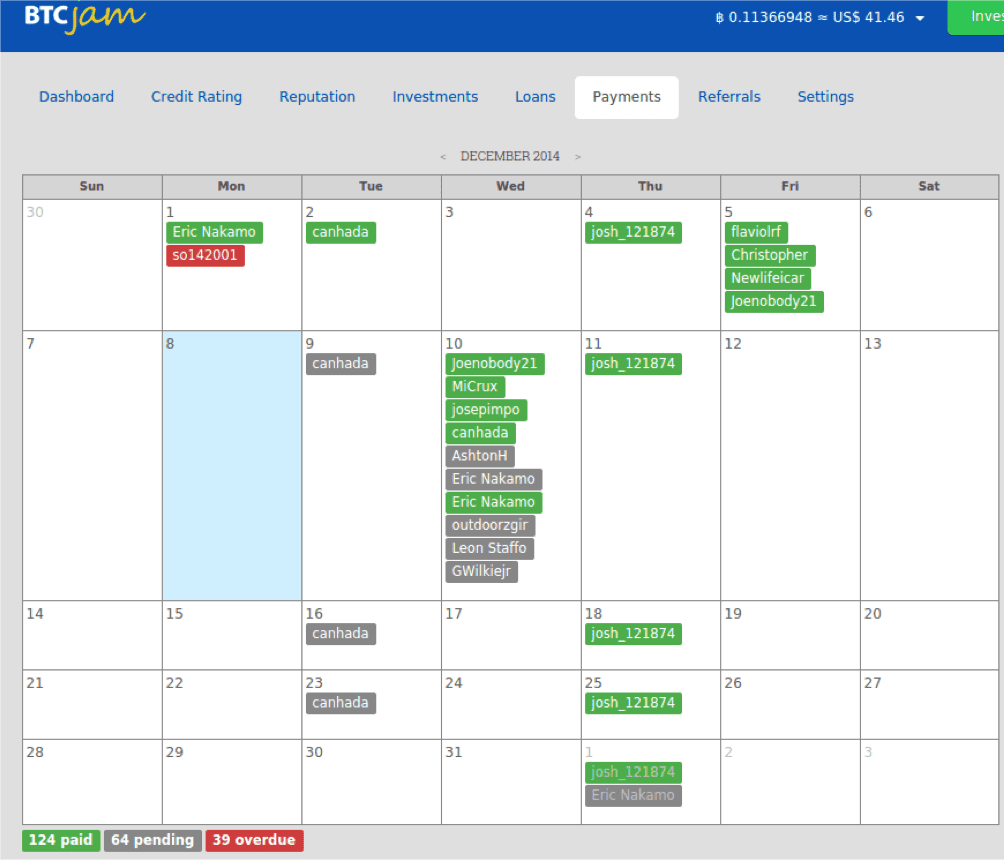

One of my favorite features on Jam is the Receivables/Payables page where you can see at a glance exactly who is scheduled to pay when and who has paid (in green) and who has not paid (in red). The only limiting factor on this feature is that payment amounts are not included. This is what it looks like:

My pay history here of 124 payments made and 39 overdue (at least 35 of which will not catch up and will go to default) makes my repayment history 76.07%. According to Jam, repay history is 85% although most of my research and feedback from other investors indicates that my 76.07% is better than the average investor on the platform.

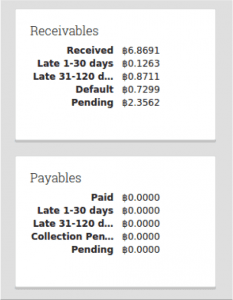

If you are more of a numbers guy or gal, then you can look at the Receivables/Payables page and see this:

Lastly, one feature that Jam offers that the others don’t is the ability to trade your notes if you want to sell off your portion of the loan you have invested in and you can do it right on their site and not on a separate market like FolioFN.

The early stage nature of this platform means that there will be errors and incomplete information in various areas but they are working to improve everyday and hopefully they will get to where Prosper & LC are today as high use/high trust lending platforms.

BitLendingClub

The next largest Bitcoin peer lending platform is BitLendingClub (BLC). BLC does about half of the volume that BTCJam does as of late 2014. While BLC has an office in Chicago, they are based in founder Kiril Gantchev’s hometown of Sofia, Bulgaria. With the help of CTO Yasen Yankov and right hand women Boryana and Monica, they are the most lender friendly and customer support oriented of the big 3 platforms. They have some similar features to BTCJam including the calendar page, member profiles, a different way that they do stamped/USD rate locked loans and links to trusted sites. What makes BLC different and a good place to lend?

Reverse Auction System

You get to bid the amount and the rate and the borrower can accept it or not.

Better Due Diligence

BLC has more due diligence roadblocks in place for those looking to scam some coin from honest investors. One roadblock is that borrowers with less than +100 reputation cannot automatically withdraw their coin borrowed from their account. It has to be done manually, by a person, with a reason given. Are there still defaulters and those who don’t intend to repay? Sure there are but this one additional roadblock makes lending on BLC much, much safer than the other 2 platforms.

They also do things like research and disclose to investors when there is suspicious activity in accounts like when a group of borrowers from one country with 5 different names and accounts all log in from the same one IP address. This and other red flags are looked into by BLC and their staff and importantly, are shared with investors so we investors can make better investment decisions on their platform.

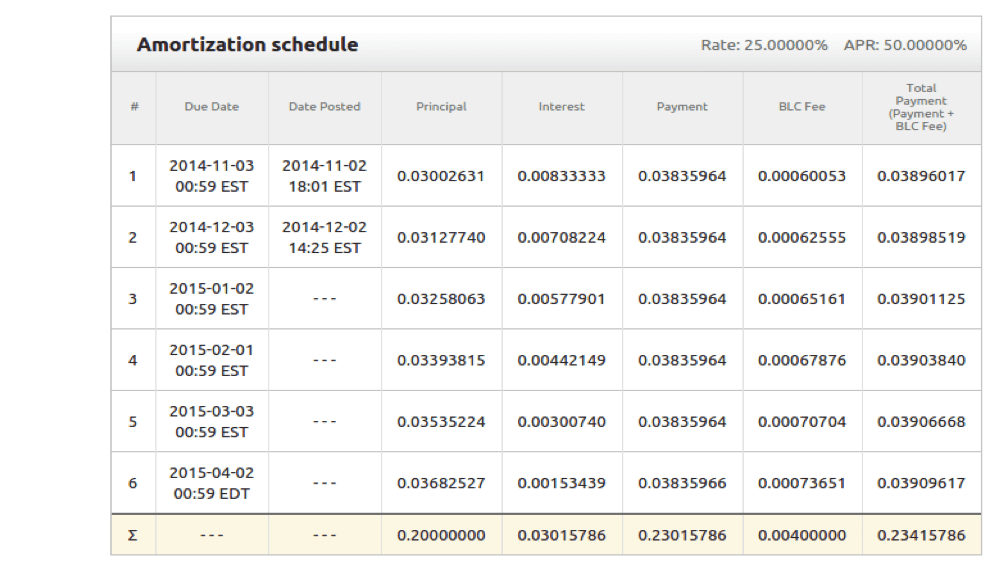

Built In Amortization Schedule

In a field where there are few investor tools, BLC has one that has potential to be a big help to investors. When you select the amount and interest rate that you are investing in a loan, BLC automatically shows an amortization schedule for that loan allowing us to see principal repaid, interest paid and how much is still owed in the even we get partial payment prior to a default. Here is what it looks like:

No Origination Fees

BLC does not charge a fee to originate the loan like Jam does. The fees that they do charge are collected with each loan payment. This means that defaulters are bad for them too as BLC earns less on that borrower when the borrower doesn’t pay. It’s a plus for investors that BLC’s revenue is aligned with our borrower payments coming in on time.

BLC has its own forum

One of my favorite features of BitLendingClub is the fact that they have their own forums that allow for interaction with borrowers, interaction between Kiril or Boryana and us investors, and investors to interact with each other. This is one of the things that I like most about using BLC. I like the idea that Kiril is accessible and support is fast and responsive. It makes me think they really care about me as an investor and my Bitcoins that are invested on their site.

As you can see, there are lots of things about BitLendingClub that I like. Like all of the other platforms, reporting, investor tools and site glitches from time to time occur here as well. These are the areas where BLC has to work if they want to become the #1 lending platform. They already have a very devoted following for the reasons discussed above and I expect this to continue into the future.

Bitbond

Bitbond was founded in Berlin by Radoslav Albrecht in July 2013. Like the other platforms, Bitbond (BB) received outside funding with a 200,000 Euro investment made in August 2014. Bitbond uses a reverse auction system as well with initial rate set by Bitbond’s credit scoring system. They are the smallest and the newest of the 3 platforms. So what are some things that make BitBond different?

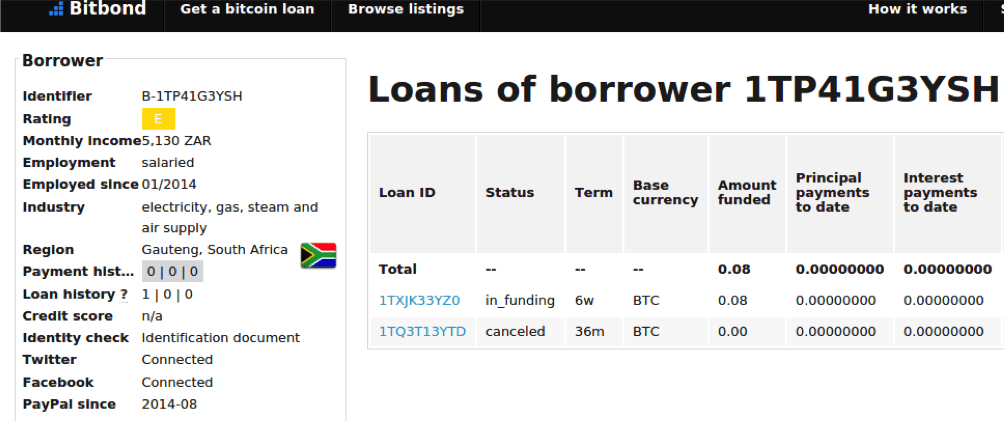

Blind Identifier on Profiles

The most perplexing of all of their features is taking the fact that we can know exactly who our borrower is, which is an advantage, and turns it back into a disadvantage by showing borrower information by placing a blind identifier on that profile. This identifier is an alphanumeric code of 11 letters and numbers together. This lack of borrower disclosure seems like it would lead to higher default rates than the other platforms and my question on that to BB investors (since I do not invest on it yet myself) seemed to confirm that to be true. Radoslav says the repayment rate is 87% based on the Q&A he did with me on my blog and that the info is available on his statistics page. Here is what one of the profiles with the blind identifier looks like.

Bitcoin Only Loans

According to Radoslav, they are working on Exchange rate locked loans but for now they only do Bitcoin only loans.

Lowest Fees

BB charges the lowest fees in the industry for loans up to 1 year. One year is the maximum term offered by BTCJam and BLC. Fees for these loans range from 0.5% up to 1%. These are origination fees.

Longest Term

Unlike Jam and BLC, BB offers by far the longest term offering 3 and 5 year loan terms. This is in an attempt to match what fiat money peer lending sites like Prosper and Lending Club offer.

Runs Personal Credit

For borrowers in some countries, personal credit reports are required and BB runs them. I like this feature and BB is the only one that does this.

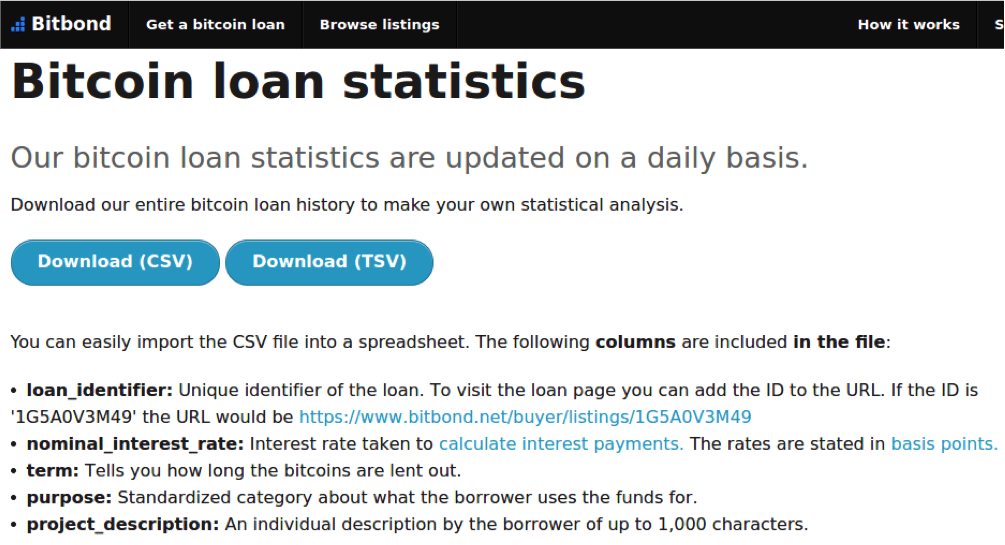

Availability of Statistics

Every loan BB has ever funded is available to download in a couple of formats including CSV. USD peer lending investors will love taking all this data and slicing and dicing it the way we do with Prosper and Lending Club. This is the stats page.

Collections: How all 3 platforms handle them

Due to the higher default rates, collections is a more involved piece of BTC marketplace lending than it is in the USD world. Let’s see how they all handle collections.

BTCJam uses a web based system called Net-Arb, which is an arbitration award system to give lenders the legal standing to go after their debtors. A couple small independent companies have been created to try to take these awards and collect on these debts but I don’t know of any attempts at this kind of collection that have been successful. Jam is cooperative but it has yet to lead to a collection that I am aware of.

BLC releases the personal and verified information after the required period of time (90 days after non-payment when it goes Default) so lenders can go after their debtors. They are cooperative but it rarely leads to collection.

BB either releases the personal information like BLC does or they sell the claim to a collection agency. This definitely seems more proactive.

In almost all cases with all 3 platforms, the chances of recovery are virtually zero.

Conclusion

Bitcoin marketplace lending is still in its infancy and like many young high growth industries is experiencing growing pains. Returns can be huge but so can volatility and defaults, especially if you are used to the stability of the USD peer lending world. This does not mean we should avoid Bitcoin based lending. In fact, we should embrace it but we should understand the risks that come with it. Lending in Bitcoin is different than lending in USD or EUR but these are differences we can take advantage of to achieve well above average market returns.