Investors large and small are finding out about p2p lending. And they are committing new money like never before. As many of us know we will live in a much more competitive environment for investors than we did six or even three months ago.

So much so that both Lending Club and Prosper cannot keep loans on their platform for very long at all. Earlier today I logged on to Lending Club and there were only 85 loans available. At Prosper there were just 55 loans. The vast majority of these loans at both companies were for the lower interest loans. Investors looking for the higher yield loans have far fewer choices than before.

I first wrote about the changes for p2p investors back in March when there was a huge influx of institutional investors. Then in May I talked about how to adjust to the new p2p lending reality where loans are snapped up quickly. Since then, even more investors have joined the p2p lending party.

Retail Investors Are Still Investing Steadily at Lending Club

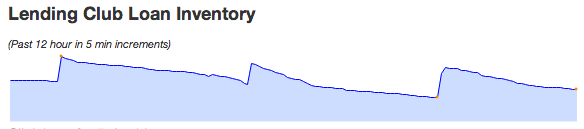

One of my favorite places to go that graphically illustrates this new demand is the Nickel Steamroller home page. Scroll down to the bottom of the page and you will see a graphic that looks like this (there is also one for Prosper).

The peaks are when Lending Club adds new loans at 6am, 10am, 2pm and 6pm PT every day (there are also small additions at 10pm and 2am). You can see how quickly investor demand comes in and fulfills the loans.

I have heard many complaints from individual investors who say they can no longer compete with large investors. And while it is true that many loans disappear within minutes or even seconds of being added to the platform, this is only happening to a very small percentage of loans. If most of the loans were being invested in immediately we would see an inverted “V” shape in the graphic above every time loans were added. But as you can see this is not happening.

What this tells me is that retail investors, as a whole, continue to find loans to invest in. Now, don’t get me wrong, if you have very specific filters then you may find it difficult to find loans but even today when there were just 85 loans available at Lending Club my Super Simple criteria found six loans.

I expect I will hear from investors who say that is all fine, but the loans that disappear in seconds are the best loans and we are left with lesser performing loans. That is quite possible, although we cannot know this for sure. Regardless, I believe that you can certainly earn an above average return even if you do miss out on a handful of the “best” loans.

High Yield Seekers at Prosper Need to be Quick

Now, over at Prosper it is a different story. If you are looking for the high yield loans then you are likely having some challenges the past few weeks. The vast majority of loans being added to the platform are AA, A and B grade loans. When I look at Nickel Steamroller’s detailed chart for Prosper in the last week most of the time there were less than 10 loans added each time for grades C and below. And these loans are typically fully invested within 20-30 minutes. So, if you can login at 9am and 5pm (Pacific) on weekdays and noon on weekends you will have the most luck.

Now, I am investing through the Prosper API and I am having no problem staying fully invested. But if I was having trouble putting my money to work then I would add B-grade loans into the mix. Some 3-year B-grade loans carry yields of above 15% and the 5-year loans can be over 17%. You can have a lot more choice at Prosper today it you add B-grade loans in to the mix.

Having said all that when I talk with Prosper management and they ask me what they can do better I say add more high high yield loans to the platform. This is what retail investors want.

So what do you think? Are you still able to stay fully invested? Or are you completely frustrated by the lack of loans that meet your criteria. I am always interested in your comments.