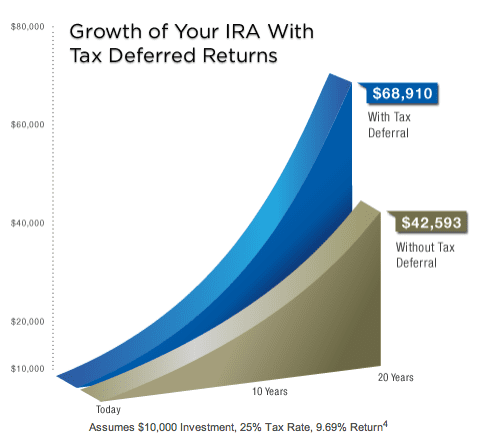

In the mid 1990’s I didn’t grasp the importance of the above graph (taken from Prosper’s IRA page). I was young and foolish when it came to thinking about retirement. I was the owner of a successful small business and I just didn’t think I needed a retirement plan. As I said I was young and foolish.

Luckily an ex-girlfriend convinced me of the error of my ways and I opened an IRA. In eighteen years that IRA has grown to almost $250,000 through the joy of compounding and making the maximum contribution every year. I recently did a Roth conversion on my IRA so now I know this money will be available tax-free once I reach retirement age.

This year I will be taking a large portion of this IRA and adding it to my investments in Lending Club and Prosper. I feel that there is no better way to grow your money tax free than in a high yielding investment like p2p lending. Taxes are a major drag on investment returns where interest is treated as ordinary income and I would like to avoid that tax burden as much as I can.

Lending Club IRA

I have had IRAs at Lending Club for several years now. I consolidated and rolled over my wife’s retirement accounts into Lending Club back in April 2010. In fact 100% of my wife’s retirement assets are in Lending Club and I am very comfortable with that. I also have a Roth IRA in my own name that I will be adding to substantially this year.

On Lending Club’s home page they claim that 95% of IRA account holders are earning 6% or more on their investments. No doubt most of these accounts are well diversified. You can open up an IRA at Lending Club with as little as $5,000 which means you can invest in 200 different loans. Just make sure you add another $5,000 to your account within 12 months to keep your balance above $10,000 to avoid the $100 fee.

Opening an IRA account at Lending Club is a little more complicated than just opening a regular taxable account. Lending Club uses a third party custodian, SDIRA Services, so you have to open an account with them as well as with Lending Club. But the initial hassle is well worth it as you don’t have to deal with taxes and your money grows tax free.

Prosper IRA

Prosper was not an option at the time I setup my IRAs at Lending Club, they introduced the Prosper IRA for the first time in January last year. I will be opening my first IRA at Prosper this year when I rollover part of my existing Roth IRA.

Prosper has a similar deal as Lending Club where you need a minimum of $5,000 to open an IRA account and you need to have a $10,000 balance within 12 months to avoid any fees. Prosper uses Sterling Trust as their custodian so you need to open an account with them as well as with Prosper to setup your IRA.

You Still Have Time to Contribute to an IRA for 2012

Investors have until April 15 to contribute to an IRA at Lending Club and Prosper. But don’t wait until the last day if you are opening a new account. It takes several days for your IRA to be setup and funded and you will miss the April 15th deadline if you wait too long.

You can also rollover any existing IRA (Roth, Traditional, SEP or SIMPLE) or 401(k) into Lending Club or Prosper. This is what I did with my wife’s retirement accounts – she had four different 401(k)’s and 403(b)’s from various different jobs and I rolled them all into an account an Lending Club.

I truly believe that if at all possible every investor should put some of their retirement money into p2p lending. Even if you are young don’t be foolish like I was and ignore your retirement. You will not only save a fortune on taxes and you will be able to fully enjoy the wonderful power of compound interest.

So now let’s hear from you. Do you have a retirement account at Lending Club or Prosper? If not why not? I am always interested to hear your comments.